Get the free Application for Assumption Approval and/or Release from Personal Liability to the Go...

Show details

This document is used by veteran-borrowers to complete the process of selling their home by allowing the buyer to assume their VA guaranteed home loan, thereby releasing the veteran from personal

We are not affiliated with any brand or entity on this form

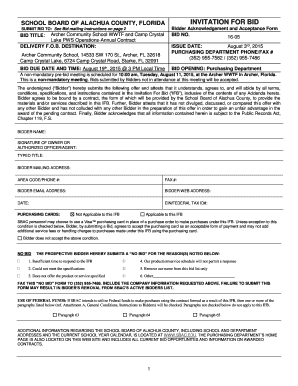

Get, Create, Make and Sign application for assumption approval

Edit your application for assumption approval form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for assumption approval form via URL. You can also download, print, or export forms to your preferred cloud storage service.

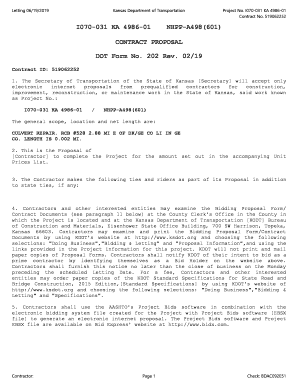

Editing application for assumption approval online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for assumption approval. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

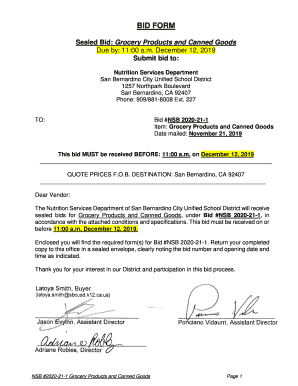

How to fill out application for assumption approval

How to fill out Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, VA Form 26–6381

01

Obtain VA Form 26-6381 from the VA website or through a local VA office.

02

Fill out the applicant's information in Section 1 including name, address, and phone number.

03

Complete Section 2 with information about the current loan, including the original loan amount and the VA case number.

04

In Section 3, provide information about the proposed assuming borrower, including their name and relationship to the applicant.

05

Section 4 requires the applicant's signature, certifying that all information is accurate.

06

Submit the completed form to the VA regional loan center serving the area where the property is located.

07

Check the status of the application after submission by following up with the VA regional loan center.

Who needs Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, VA Form 26–6381?

01

Homeowners who wish to transfer their VA-backed home loan to another eligible borrower.

02

Individuals assuming a VA-backed home loan who need formal approval to do so.

03

Lenders and financial institutions processing the assumption of a VA loan.

Fill

form

: Try Risk Free

People Also Ask about

Is assuming a VA loan a good idea?

Assigning a VA loan can be beneficial for both sellers and buyers in some situations. For sellers, it can help them sell their home faster and avoid foreclosure if they are struggling to make payments. For buyers, it can help them get a lower interest rate and avoid some of the costs of getting a new loan.

Under what conditions is a VA loan assumable?

Fun fact, you dont need to be a veteran to assume a VA loan. Anyone can.

How do you obtain a release of liability from the VA?

In order for VA to release you from liability, it will be necessary that your purchaser assume all of your liability to the Government, as well as to the loan holder, if this is other than VA.

What are the requirements to assume a VA loan?

Most government-backed loans, including all FHA loans, are assumable, as long as the lender approves the sale. However, additional rules apply: For loans originated on or after Dec. 15, 1989: If the buyer is creditworthy, the lender must approve a sale by assumption and transfer responsibility to the buyer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, VA Form 26–6381?

The Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, VA Form 26–6381, is a document used by veterans or servicemembers to seek approval for a third party to assume their VA home loan, while also requesting release from personal liability for the loan.

Who is required to file Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, VA Form 26–6381?

The veteran or servicemember who is the borrower on the VA home loan is required to file this application when they wish to transfer the loan to another individual and seek protection from future liability.

How to fill out Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, VA Form 26–6381?

To fill out the form, the borrower needs to provide their personal information, loan details, information about the proposed new borrower, and any relevant financial information required by the VA. It is important to follow the instructions carefully and ensure all sections are completed accurately.

What is the purpose of Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, VA Form 26–6381?

The purpose of this application is to allow a borrower to transfer their VA home loan to a new borrower, while also obtaining a release from personal liability for the loan, thus protecting the original borrower from future obligations related to the loan.

What information must be reported on Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan, VA Form 26–6381?

The form requires reporting of the borrower's personal information, the current loan account number, details about the new borrower, including their income and credit details, and any other financial information relevant to the loan assumption process.

Fill out your application for assumption approval online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Assumption Approval is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.