Get the free Proposed Rule for Multifamily Accelerated Processing - gpo

Show details

This document outlines proposed regulations for the Multifamily Accelerated Processing (MAP) system, detailing lender approval, underwriter requirements, and guidelines for processing FHA multifamily

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign proposed rule for multifamily

Edit your proposed rule for multifamily form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proposed rule for multifamily form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit proposed rule for multifamily online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit proposed rule for multifamily. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

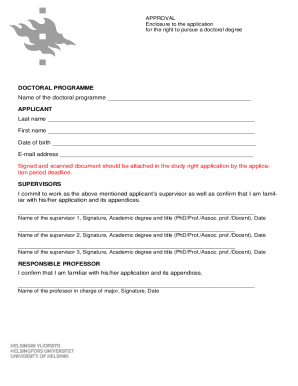

How to fill out proposed rule for multifamily

How to fill out Proposed Rule for Multifamily Accelerated Processing

01

Review the requirements for the Proposed Rule for Multifamily Accelerated Processing (MAP) from official HUD sources.

02

Gather necessary documentation including financial statements, building plans, and market analyses.

03

Complete the required forms, ensuring all sections are filled out accurately and completely.

04

Pay attention to any specific instructions pertaining to the submission format and accompanying documents.

05

Double-check all entries for accuracy to avoid processing delays.

06

Submit the proposed rule package to the designated HUD office as instructed.

Who needs Proposed Rule for Multifamily Accelerated Processing?

01

Developers and builders seeking financing for multifamily housing projects.

02

Lenders participating in the Multifamily Accelerated Processing program.

03

Investors interested in understanding the guidelines for multifamily property investments.

04

Housing authorities and organizations involved in affordable housing initiatives.

Fill

form

: Try Risk Free

People Also Ask about

Is it easier to get approved for a multifamily loan?

Multifamily vs. Residential multifamily is the easiest to finance and has the lowest barriers to entry. This is how most multifamily investors typically get started. Some will even owner-occupy one of the units in their first rental property as a way of securing the most attractive financing.

What is multifamily absorption?

A. ABSORPTION RATE. The proportion of newly completed units that are or have been leased, usually over a given period (such as 3 months). ABSORPTIONS. The net change in the total number of apartment homes leased.

What is multifamily accelerated processing?

MAP, or Multifamily Accelerated Processing, is a streamlined method and set of national standards for approved lenders to prepare, process, and submit loan applications for HUD multifamily financing. To be approved for MAP, all underwriters employed lender must attend a specialized HUD training session.

What is the map guide?

The MAP Guidebook is a comprehensive guide to the FHA Multifamily Loan Program and includes information on loan products, underwriting, and processing.

What credit score do you need for a multifamily loan?

To qualify for a credit union multifamily loan, borrowers must typically meet certain qualifications, including a minimum credit score of 620 or higher. However, there are loan options available for borrowers with lower credit scores.

What is creating a middle income housing option for 221 D 4?

Creating a Middle Income Housing option for 221(d)(4) 8, 2025, proposing new underwriting standards for Middle Income Housing, defined as units targeting 60% to 120% area median income (AMI). The underwriting guidelines would be instituted under the provision of the Multifamily Accelerated Processing (MAP) Guide.

What is the multifamily accelerated processing program?

MAP (Multifamily Accelerated Processing) is a streamlined method and set of national standards for approved lenders to prepare, process, and submit loan applications for HUD multifamily financing. To be approved for MAP, all underwriters employed lender must attend a specialized HUD training session.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Proposed Rule for Multifamily Accelerated Processing?

The Proposed Rule for Multifamily Accelerated Processing (MAP) is a framework established by the U.S. Department of Housing and Urban Development (HUD) aimed at expediting the approval process for multifamily housing projects to enhance efficiency in housing development.

Who is required to file Proposed Rule for Multifamily Accelerated Processing?

Entities seeking to obtain FHA insurance for multifamily housing projects, including developers, lenders, and borrowers, are required to file the Proposed Rule under the Multifamily Accelerated Processing guidelines.

How to fill out Proposed Rule for Multifamily Accelerated Processing?

To fill out the Proposed Rule for Multifamily Accelerated Processing, applicants must complete the necessary forms provided by HUD, ensuring all required documentation is included, and submit them to the appropriate HUD office for review.

What is the purpose of Proposed Rule for Multifamily Accelerated Processing?

The purpose of the Proposed Rule for Multifamily Accelerated Processing is to streamline the application and approval process for multifamily housing projects, thereby promoting affordable housing development and reducing the time needed for project completion.

What information must be reported on Proposed Rule for Multifamily Accelerated Processing?

The information that must be reported includes project details such as location, design plans, financing structure, environmental assessments, and compliance with zoning regulations, alongside any financial information requested by HUD.

Fill out your proposed rule for multifamily online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proposed Rule For Multifamily is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.