Get the free Federal Register Notice of Antidumping Duty Administrative Review - gpo

Show details

This document announces the decision of the U.S. Court of International Trade regarding the administrative review of antidumping duties on certain steel products from India, including updated weighted-average

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal register notice of

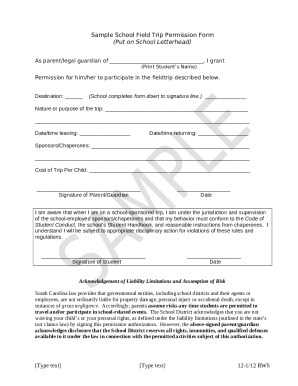

Edit your federal register notice of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal register notice of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

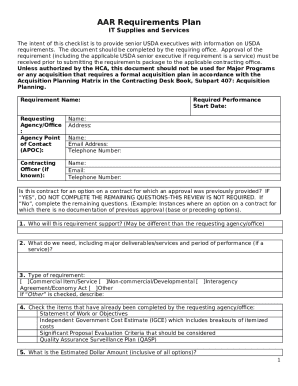

Editing federal register notice of online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit federal register notice of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

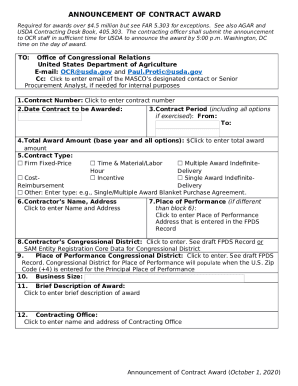

How to fill out federal register notice of

How to fill out Federal Register Notice of Antidumping Duty Administrative Review

01

Gather necessary information including the company's name and address.

02

Specify the relevant case number and product description.

03

Indicate the period of review.

04

Provide a detailed summary of the exporter's sales and cost of production data.

05

Include any additional documentation required to support claims.

06

Submit the completed form by the specified deadline through the appropriate channels.

Who needs Federal Register Notice of Antidumping Duty Administrative Review?

01

Importers and exporters involved in trade of goods subject to antidumping duties.

02

Businesses seeking a review of antidumping duties imposed on their products.

03

Legal representatives or consultants assisting companies in the trade industry.

Fill

form

: Try Risk Free

People Also Ask about

What is the timeline for anti-dumping?

The statute requires that Commerce will issue a preliminary decision 140 days after initiation in an AD investigation, and 65 days after initiation in a CVD investigation. These deadlines may be extended under certain circumstances.

What is the duration of definitive duty in the imposition of anti-dumping measures?

"The duration of the definitive anti-dumping duty shall not exceed five (5) years from the date of its imposition (or from the date of the most recent review if that review has covered both dumping and injury) unless the Commission has determined in a review initiated before that date on their own initiative or upon a

How long do anti-dumping duties last?

Anti-dumping measures must expire five years after the date of imposition, unless an investigation shows that ending the measure would lead to injury.

How long do antidumping duties last?

Provisional measures expire (i.e., duties will no longer be collected by CBP) after they have been in place for 120 days. For AD cases, this period may be extended up to 180 days. Suspension of liquidation and duty collection by CBP will resume if Commerce publishes an AD/CVD order.

What is the time limit for anti-dumping duty?

The provisional anti-dumping duty is recommended in a period of 60-70 days and levied in a period of about 3 months from the date of initiation of the proceedings.

What is the anti-dumping tax in the US?

Anti-dumping duties are typically levied when a foreign company is selling an item significantly below the price at which it is being produced. While the intention of anti-dumping duties is to save domestic jobs, these tariffs can also lead to higher prices for domestic consumers.

Which agency is responsible for the General Administration of Dumping Antidumping and Countervailing Duty Laws?

When the Department of Commerce finds that imported merchandise was sold in the U.S. at an unfairly low or subsidized price, to level the playing field for U.S. companies injured by these unfair trade practices, CBP is responsible for collecting the Antidumping and Countervailing Duties (AD/CVD) in a timely manner.

What are the US antidumping and countervailing duty laws?

Antidumping (AD) and Countervailing Duties (CVD) address unfair trade practices by providing relief to U.S. industries and workers that are "materially injured," or threatened with injury, due to imports of like products sold in the U.S. market at less than fair value (AD), or subsidized by a foreign government or

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Federal Register Notice of Antidumping Duty Administrative Review?

The Federal Register Notice of Antidumping Duty Administrative Review is a public announcement issued by the U.S. Department of Commerce that provides details on the initiation of reviews of antidumping duty orders on imported goods. It outlines the timeframe and procedures for the review process of previously established antidumping duties.

Who is required to file Federal Register Notice of Antidumping Duty Administrative Review?

Typically, producers, exporters, and importers of the goods subject to the antidumping duty order are required to file the Federal Register Notice of Antidumping Duty Administrative Review. Additionally, any interested parties with a stake in the outcome may also participate in the filing.

How to fill out Federal Register Notice of Antidumping Duty Administrative Review?

To fill out the Federal Register Notice of Antidumping Duty Administrative Review, participants must provide specific details including company information, product descriptions, and data related to the sales and pricing of the products in question. It is advisable to consult the guidelines provided by the Department of Commerce for exact instructions.

What is the purpose of Federal Register Notice of Antidumping Duty Administrative Review?

The purpose of the Federal Register Notice of Antidumping Duty Administrative Review is to inform stakeholders and the public regarding the initiation of the review process. It aims to allow interested parties to provide input and ensure fair assessment of the antidumping duties in accordance with U.S. trade laws.

What information must be reported on Federal Register Notice of Antidumping Duty Administrative Review?

Information that must be reported includes the names and contact information of the involved parties, the specific merchandise affected, details about the pricing and sales information relevant to the review period, and any supporting documentation or arguments in favor of or against the continuation of antidumping duties.

Fill out your federal register notice of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Register Notice Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.