Get the free Privacy Impact Assessment for Remittance Strategy for Paper Check Conversion (RS-PCC...

Show details

This document provides a detailed Privacy Impact Assessment (PIA) for the IRS system that converts paper checks into electronic transactions, outlining its operation, data usage, compliance with privacy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign privacy impact assessment for

Edit your privacy impact assessment for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your privacy impact assessment for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit privacy impact assessment for online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit privacy impact assessment for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out privacy impact assessment for

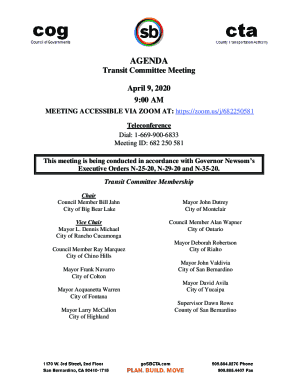

How to fill out Privacy Impact Assessment for Remittance Strategy for Paper Check Conversion (RS-PCC)

01

Identify the project purpose: Describe the Remittance Strategy for Paper Check Conversion (RS-PCC) and its objectives.

02

Assess the data collection: List the types of personal data that will be collected and their sources.

03

Evaluate data use: Explain how the personal data will be used within the RS-PCC process.

04

Identify risks: Analyze potential privacy risks to individuals associated with data collection and use.

05

Mitigation strategies: Outline measures that will be taken to mitigate identified risks.

06

Consult with stakeholders: Engage relevant stakeholders to gather input and feedback on the assessment.

07

Document and review: Compile all findings and ensure thorough documentation; conduct reviews to update as necessary.

08

Obtain approvals: Secure any necessary approvals from privacy or compliance teams.

Who needs Privacy Impact Assessment for Remittance Strategy for Paper Check Conversion (RS-PCC)?

01

Organizations implementing RS-PCC to ensure compliance with privacy regulations.

02

Data protection officers responsible for overseeing data privacy within their organization.

03

Legal teams who need to assess legal implications related to data privacy.

04

Stakeholders involved in the financial transaction process that will use RS-PCC.

Fill

form

: Try Risk Free

People Also Ask about

What does remittance mean in the IRS?

0:09 1:58 When a remittance appears on your tax transcript. It signifies that a payment has been made towardsMoreWhen a remittance appears on your tax transcript. It signifies that a payment has been made towards your tax liability. This payment can include amounts for income.

What does remittance mean on an IRS transcript?

0:21 1:49 Understanding remittance is crucial for taxpayers remittance indicates the amount of money sent toMoreUnderstanding remittance is crucial for taxpayers remittance indicates the amount of money sent to the Internal Revenue Service it represents payments made for various tax liabilities this includes

Does remittance mean refund?

Deriving from the term 'remit' (meaning “to send back”), remittance refers to a sum of money that is sent back or transferred to another party.

Does remittance mean payment has been made?

What is the meaning of Remittance? Payment remittance is a money exchange using a transfer. One party will send funds to another individual or entity, typically using electronic transfer or wire submission. Transactions of this kind are often done internationally and can be completed almost immediately.

What does received with remittance mean?

A remittance transfer is a money transfer sent electronically from the United States to another country by a remittance transfer provider. Common terms may include “international wires,” “international money transfers,” and “remittances.”

Does the IRS convert checks to electronic payments?

Authorization to Convert Your Check: If you provide us a check to make your payment, your check will be converted into an electronic fund transfer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Privacy Impact Assessment for Remittance Strategy for Paper Check Conversion (RS-PCC)?

The Privacy Impact Assessment for Remittance Strategy for Paper Check Conversion (RS-PCC) is a systematic process used to evaluate the potential impacts on individual privacy that could arise from the implementation of the Remittance Strategy for Paper Check Conversion. It helps organizations identify and mitigate privacy risks associated with the handling of personal data during the conversion of paper checks into electronic formats.

Who is required to file Privacy Impact Assessment for Remittance Strategy for Paper Check Conversion (RS-PCC)?

Organizations that implement or plan to implement the Remittance Strategy for Paper Check Conversion are required to file a Privacy Impact Assessment. This includes financial institutions, payment processors, and any entities that handle personal information during the check conversion process.

How to fill out Privacy Impact Assessment for Remittance Strategy for Paper Check Conversion (RS-PCC)?

To fill out the Privacy Impact Assessment for RS-PCC, organizations should gather relevant information regarding their data handling practices, identify potential privacy risks, outline measures taken to mitigate these risks, and describe the processes for data access and retention. Specific sections may include data collection methods, purpose of data use, and security measures in place to protect the data.

What is the purpose of Privacy Impact Assessment for Remittance Strategy for Paper Check Conversion (RS-PCC)?

The purpose of the Privacy Impact Assessment for RS-PCC is to ensure that organizations assess their compliance with privacy laws and regulations, identify possible risks to personal data, enhance transparency regarding data handling practices, and promote accountability in protecting individuals' privacy rights.

What information must be reported on Privacy Impact Assessment for Remittance Strategy for Paper Check Conversion (RS-PCC)?

The information that must be reported includes details on the types of personal data being collected, the sources of this data, the reasons for its collection, data retention periods, security measures implemented, potential risks to privacy, and how data subjects can exercise their rights concerning their personal data.

Fill out your privacy impact assessment for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Privacy Impact Assessment For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.