Get the free Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices - occ

Show details

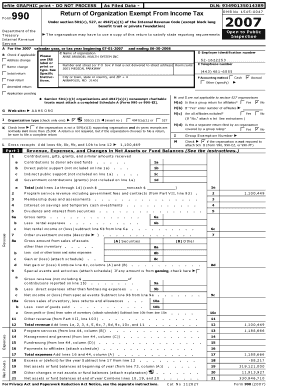

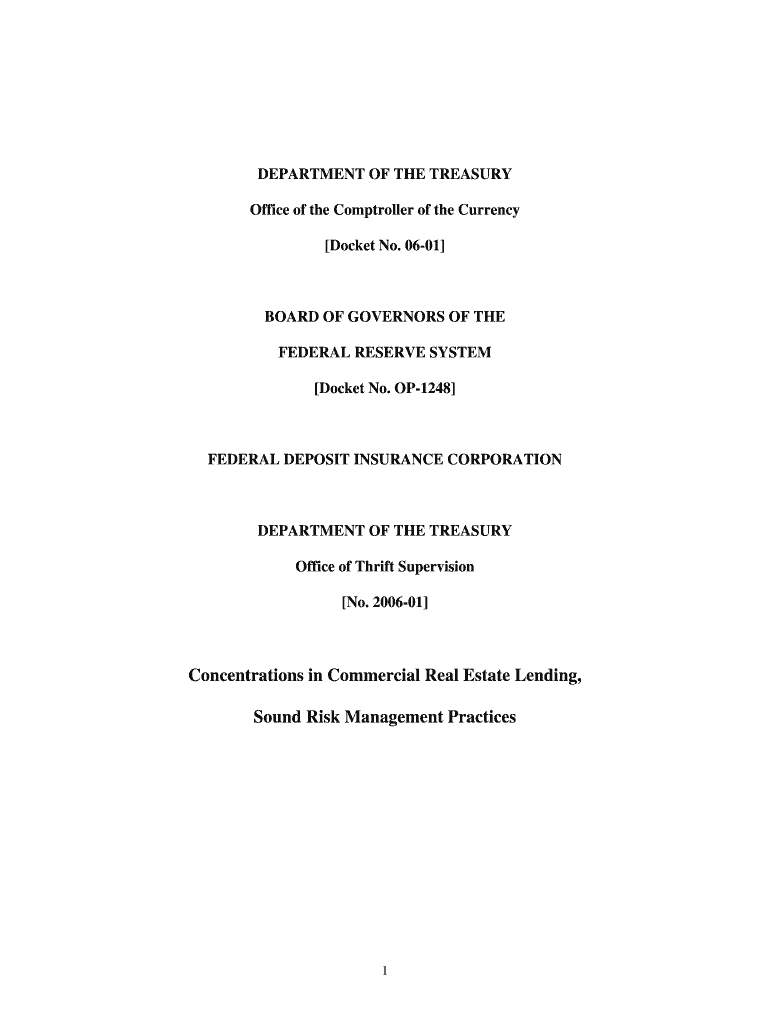

This document proposes guidance on sound risk management practices for institutions with high concentrations in commercial real estate lending, addressing concerns of vulnerability to market cycles

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign concentrations in commercial real

Edit your concentrations in commercial real form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your concentrations in commercial real form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit concentrations in commercial real online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit concentrations in commercial real. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out concentrations in commercial real

How to fill out Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices

01

Identify the type of commercial real estate properties your institution is involved in.

02

Gather data on current exposures in various categories such as office, retail, industrial, and multi-family housing.

03

Analyze the concentration levels in each property category to ensure they align with lending policies.

04

Review historical performance data for each property type to evaluate risk.

05

Establish limits for acceptable concentrations based on risk tolerance and strategic objectives.

06

Implement a monitoring system to track concentrations on an ongoing basis.

07

Regularly update policies and procedures to reflect changes in the market or portfolio.

Who needs Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices?

01

Commercial banks engaged in real estate lending.

02

Risk management departments in financial institutions.

03

Regulatory bodies overseeing commercial lending practices.

04

Investors seeking to understand risk exposures.

05

Executives involved in strategic decision-making related to lending.

Fill

form

: Try Risk Free

People Also Ask about

What is the 100-300 rule in banking?

Large Loan Concentrations Large loan concentration risk represents the collective risk/exposure a group of large loans presents. This is normally measured based on an institution's top ten loan commitments.

What is the 10 20 bank rule?

Understanding the 10/20 Non-Bank Rule The rule is triggered when raising more than CHF 500k through CLAs under either of the following conditions: more than 10 CLA investors with identical conditions, or. more than 20 CLA investors, even if the conditions vary.

When a bank has a 20% reserve requirement if the bank receives a deposit for $1000 What is the total amount of loans that can be created from the $1000?

Let's assume that banks hold on to 20% of all deposits. This means that a customer deposit of $1,000 will allow a bank to loan out $800.

What is the 5 25 rule in banking?

The 5:25 scheme allows banks to extend long-term loans of 20-25 years to match the cash flow of projects, while refinancing them every 5 or 7 years. This expected to match the cash flows ing to the repayment schedule and making long-term infrastructure projects viable.

What is a concentration limit for a bank?

Home Mortgage Disclosure Act/Regulation C.

What is the $3000 rule for banks?

for cash of $3,000-$10,000, inclusive, to the same customer in a day, it must keep a record. more to the same customer in a day, regardless of the method of payment, it must keep a record. a record. The Bank Secrecy Act (BSA) was enacted by Congress in 1970 to fight money laundering and other financial crimes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices?

Concentrations in Commercial Real Estate Lending refer to the risk that a financial institution faces when it has a large amount of its loans in a specific sector, such as commercial real estate. Sound risk management practices involve evaluating, monitoring, and controlling these concentrations to minimize potential financial losses.

Who is required to file Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices?

Financial institutions that engage in commercial real estate lending activities, such as banks and credit unions, are required to file reports and adhere to sound risk management practices regarding concentrations in their loan portfolios.

How to fill out Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices?

To fill out the report on Concentrations in Commercial Real Estate Lending, institutions should gather relevant data on their commercial real estate loans, including details on loan amounts, property types, geographic locations, and borrower information. This data should then be summarized in the required format specified by regulatory authorities.

What is the purpose of Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices?

The purpose of Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices is to identify and mitigate risks associated with having large exposures in commercial real estate. This helps ensure financial stability, protects the institution's capital, and supports overall economic health.

What information must be reported on Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices?

Reports must include information on the total amounts of commercial real estate loans, the distributions of these loans by property type and geography, details on borrower profiles, and any relevant performance metrics that indicate risk exposure.

Fill out your concentrations in commercial real online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Concentrations In Commercial Real is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.