Get the free 2009-128 - occ

Show details

This document outlines an agreement between Eaton National Bank and the Comptroller of the Currency to ensure safe and sound banking practices, particularly focused on loan management and compliance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009-128 - occ

Edit your 2009-128 - occ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009-128 - occ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009-128 - occ online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2009-128 - occ. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009-128 - occ

How to fill out 2009-128

01

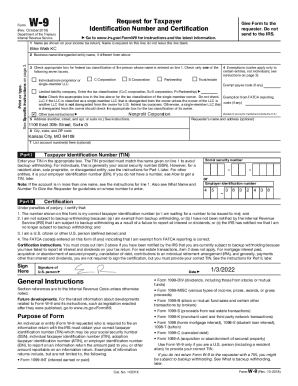

Obtain the 2009-128 form from the IRS website or your local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Review the instructions for each section carefully to understand what information is required.

04

Complete the income section, reporting all sources of income as specified in the instructions.

05

Fill out the deductions section, providing any applicable information such as mortgage interest, medical expenses, etc.

06

Calculate your total tax owed or refund based on the filled in information.

07

Sign and date the form at the bottom before submitting it to the IRS.

08

Keep a copy of the completed form for your records.

Who needs 2009-128?

01

Individuals and families who need to file their income taxes for the year 2009.

02

Taxpayers seeking to claim deductions or credits related to their income.

03

Anyone who has received a notice from the IRS requiring them to fill out form 2009-128.

Fill

form

: Try Risk Free

People Also Ask about

What is the Regulation No 1107 2009 on plant protection products?

This Regulation lays down rules for the authorization of plant protection products in commercial form and for their placing on the market, use and control within the European Union.

What is the sustainability of pesticides?

Pesticides, People, and the Environment The toxic properties of pesticides, so cen- tral to their commercial value and use, pose a grave threat to sustainability. Many pesticides that were once widely used, such as DDT and aldrin, are now banned because of their harmful effects on people and the environment.

What is the Commission proposal for the sustainable use of pesticides?

The proposal sets legally binding targets at EU level to reduce by 50 % the use and the risk of chemical pesticides as well as the use of the more hazardous pesticides by 2030, in line with the EU's 'farm to fork' strategy.

What is the sustainable use directive?

The Sustainable Use of Pesticides Directive (SUD) establishes a framework for European Community action to achieve the sustainable use of pesticides by setting minimum rules to reduce the risks to human health and the environment that are associated with pesticide use.

What is the use of plant protection products?

4.1 Plant protection products, referred to here as pesticides, are chemicals used for controlling agricultural pests and diseases; these include herbicides ( control) fungicides and insecticides.

What is the Commission proposal for the sustainable use of pesticides?

The proposal sets legally binding targets at EU level to reduce by 50 % the use and the risk of chemical pesticides as well as the use of the more hazardous pesticides by 2030, in line with the EU's 'farm to fork' strategy.

What is the sustainable use of plant protection products regulation?

Officially the proposal was called Regulation on the Sustainable Use of Plant Protection Products. It includesd EU wide targets to reduce the use and risk of chemical pesticides by 50% in 2030. This is line with the EU's Farm to Fork and Biodiversity strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009-128?

2009-128 is a specific form or document used for tax or regulatory purposes, typically associated with reporting certain financial information or compliance with specific laws.

Who is required to file 2009-128?

Individuals or entities that meet certain criteria established by the governing body or tax authority are required to file 2009-128, usually those involved in specific transactions or activities that necessitate this report.

How to fill out 2009-128?

To fill out 2009-128, you need to enter the required information accurately, including details such as personal or business identification, financial data, and any other information mandated by the instructions associated with the form.

What is the purpose of 2009-128?

The purpose of 2009-128 is to ensure compliance with tax regulations or to report necessary information regarding financial transactions to the relevant authorities.

What information must be reported on 2009-128?

The information that must be reported on 2009-128 typically includes identifying information, financial data, the nature of transactions, and any other required disclosures as per the form's guidelines.

Fill out your 2009-128 - occ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009-128 - Occ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

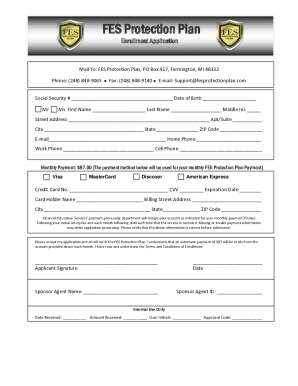

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.