Get the free RLI Insurance Company - Personal Umbrella Premiums

Show details

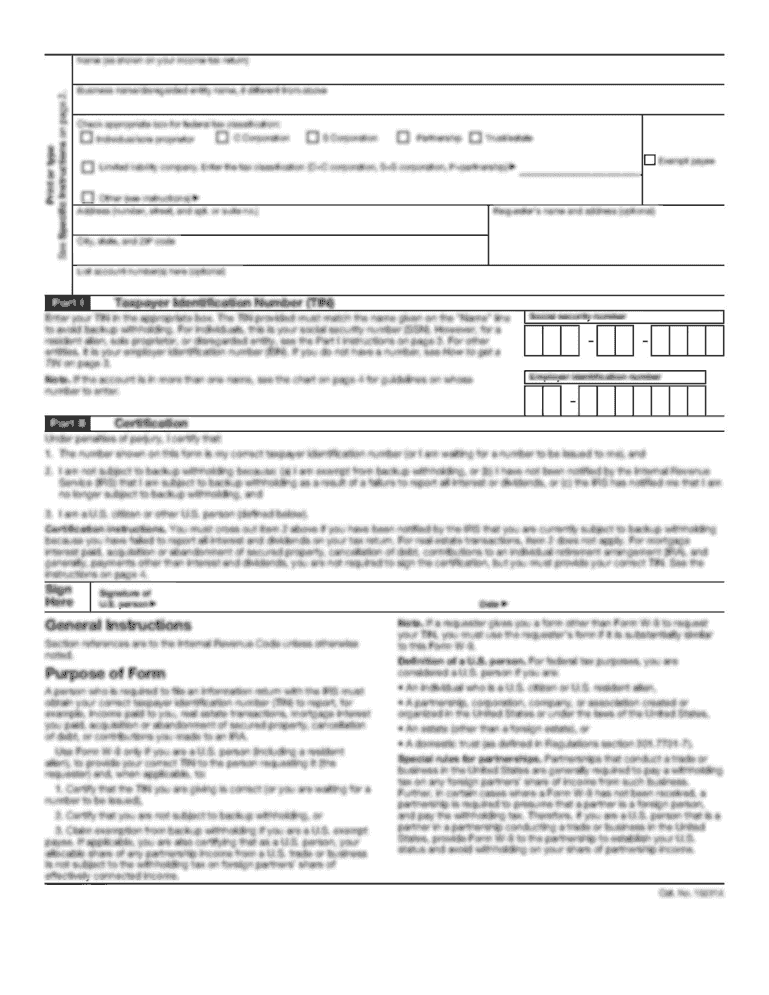

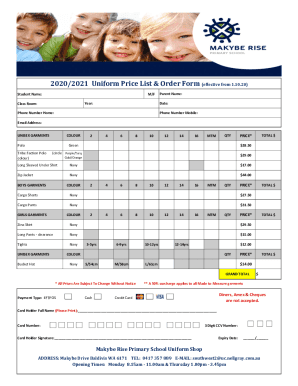

This document outlines the premium rates for personal umbrella insurance policies effective September 16, 2006, including classes, coverage options, and conditions related to youthful drivers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rli insurance company

Edit your rli insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rli insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rli insurance company online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rli insurance company. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rli insurance company

How to fill out RLI Insurance Company - Personal Umbrella Premiums

01

Gather your personal information, including your name, address, and contact details.

02

Collect information about your current insurance policies, such as auto and home insurance.

03

Determine the amount of coverage you need based on your assets and potential risks.

04

Visit the RLI Insurance Company website or contact an agent to access the Personal Umbrella Premiums application.

05

Fill out the application form with the required personal and insurance information.

06

Review the information for accuracy before submitting.

07

Submit the completed application and await confirmation or further instructions from RLI Insurance Company.

Who needs RLI Insurance Company - Personal Umbrella Premiums?

01

Individuals with significant assets who want to protect their wealth.

02

Homeowners and renters who desire additional liability coverage beyond their homeowners insurance.

03

Individuals with high-risk activities or professions that could lead to liability claims.

04

Families with dependents looking to secure their financial future in case of unforeseen events.

05

Anyone seeking peace of mind through added liability protection.

Fill

form

: Try Risk Free

People Also Ask about

How much does a personal umbrella policy cost?

RLI is an excellent insurance provider, boasting a favorable rating by both A.M. Best and the BBB; providing individuals and businesses with diverse coverage options to choose from; as well as collaborating with independent agents for customers' convenience.

Who has the best umbrella insurance policy?

Best umbrella insurance Best for customer satisfaction: Travelers. Best for bundling coverage: American Family. Best for high net worth families: Chubb. Best for military families: USAA.

Is RLI insurance reputable?

Despite catering to a select commercial niche, RLI Corp has achieved an impressive A+ rating from the Better Business Bureau (BBB), and no customer complaints have been filed in three years.

What does Dave Ramsey say about umbrella insurance?

Key Takeaways. Umbrella insurance is the defensive part of your wealth-building plan. Anyone with a net worth of $500,000 or more should have umbrella insurance. Your umbrella policy limit should be equal to or greater than your net worth.

What are the downsides of umbrella insurance?

Insurance exists for protection against catastrophe. Most people are never going to have a million or multi-million dollar claim. For a high net worth individual $300 or so per year for an umbrella policy is well worth it to protect their assets.

Is RLI a good umbrella insurance company?

Cons of Umbrella Insurance: Additional Premiums: An extra expense on top of existing insurance policies. High Underlying Limits Required: May require increasing liability limits on your primary policies. Potential Overinsurance: May be unnecessary for those with minimal assets.

What is RLI AM's best rating?

RLI's products are offered through its insurance subsidiaries RLI Insurance Company, Mt. Hawley Insurance Company and Contractors Bonding and Insurance Company. All of RLI's subsidiaries are rated A+ “Superior” by AM Best Company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RLI Insurance Company - Personal Umbrella Premiums?

RLI Insurance Company - Personal Umbrella Premiums are additional coverage options that provide liability protection beyond the limits of standard home and auto insurance policies. This type of insurance helps protect policyholders from significant financial loss in the event of serious claims or lawsuits.

Who is required to file RLI Insurance Company - Personal Umbrella Premiums?

Individuals or families who wish to enhance their liability coverage and protect their assets are typically required to file for RLI Insurance Company - Personal Umbrella Premiums. It is especially recommended for those with substantial assets or high-risk lifestyles.

How to fill out RLI Insurance Company - Personal Umbrella Premiums?

To fill out the RLI Insurance Company - Personal Umbrella Premiums application, policyholders need to provide personal information, details about their existing insurance policies, and information regarding their assets and liabilities. They should follow the instructions provided by the insurance company and ensure all information is accurate.

What is the purpose of RLI Insurance Company - Personal Umbrella Premiums?

The purpose of RLI Insurance Company - Personal Umbrella Premiums is to offer an extra layer of liability coverage that sits above existing home, auto, or watercraft insurance. This coverage helps safeguard against large liability claims and provides peace of mind to policyholders.

What information must be reported on RLI Insurance Company - Personal Umbrella Premiums?

The information that must be reported includes the policyholder's personal details, existing coverage limits of home and auto insurance, assets worth, and any previous claims history. Accurate reporting helps in determining the appropriate premium and coverage amount.

Fill out your rli insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rli Insurance Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.