Get the free SBA Eligibility Questionnaire for Standard 7(a) Guaranty - archive sba

Show details

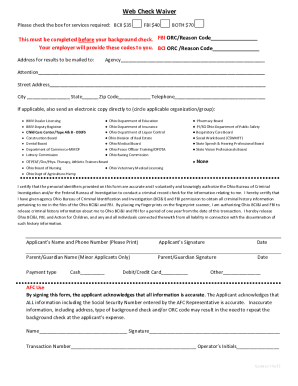

This questionnaire assists lenders in determining eligibility for SBA's standard 7(a) loans, addressing aspects like type of business, citizenship, use of proceeds, and eligibility standards.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba eligibility questionnaire for

Edit your sba eligibility questionnaire for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba eligibility questionnaire for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba eligibility questionnaire for online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sba eligibility questionnaire for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba eligibility questionnaire for

How to fill out SBA Eligibility Questionnaire for Standard 7(a) Guaranty

01

Begin by gathering necessary business documentation, including tax returns and financial statements.

02

Fill out the business information section, including the legal name, address, and ownership structure.

03

Provide details about the business’s purpose and the use of the loan funds.

04

Answer questions regarding the business’s size to determine if it meets SBA size standards.

05

Disclose any affiliations with other businesses that might affect eligibility.

06

Complete the ownership section by listing all owners and their respective ownership percentages.

07

Provide information on the personal background and financial history of owners.

08

Submit the questionnaire and any required attachments to the lender.

Who needs SBA Eligibility Questionnaire for Standard 7(a) Guaranty?

01

Small businesses seeking financing through the SBA Standard 7(a) loan program.

02

Entrepreneurs looking to ensure they meet eligibility criteria for SBA loans.

03

Lenders assessing whether applicants qualify for SBA-backed loans.

Fill

form

: Try Risk Free

People Also Ask about

What are the 7 eligibility requirements for a 7A loan?

To be eligible for 7(a) loan assistance, businesses must: Be an operating business. Operate for profit. Be located in the U.S. Be small under SBA Size Requirements. Not be a type of ineligible business. Not be able to obtain the desired credit on reasonable terms from non-Federal, non-State, and non-local government sources.

How hard is it to get an SBA 7a loan?

When a personal guarantee is used, the applicant includes their Social Security Number (SSN) for a hard credit inquiry as well as details about the individual's personal income. This information is in addition to the company's employer identification number (EIN) and financial statements.

What is required for a personal guarantee?

Personal Guarantees Individuals owning at least 20% of a borrower entity must provide an unlimited personal guaranty on SBA loans. For 7(a) loans, Lenders have the option of using the SBA Form 148 or their own equivalent guaranty form.

What are the requirements for SBA 7a personal guarantee?

How can you avoid signing a personal guarantee? Separate your business legal structure. Establishing your business as a separate legal entity is likely the first step in avoiding a personal guarantee. Establish business credit. Offer other high-value collateral.

How hard is it to get approved for an SBA 7A loan?

What Disqualifies You From Getting an SBA Loan? The three primary disqualifiers for an SBA loan include a poor credit history, insufficient collateral or equity investment, and lack of a solid business plan. These factors can signal to lenders a high risk of default, making loan approval less likely.

What are the requirements for SBA 7 a personal guarantee?

Personal Guarantees Individuals owning at least 20% of a borrower entity must provide an unlimited personal guaranty on SBA loans. For 7(a) loans, Lenders have the option of using the SBA Form 148 or their own equivalent guaranty form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SBA Eligibility Questionnaire for Standard 7(a) Guaranty?

The SBA Eligibility Questionnaire for Standard 7(a) Guaranty is a form used by the Small Business Administration (SBA) to assess the eligibility of businesses applying for a 7(a) loan guarantee. It collects information about the business and its owners to ensure compliance with SBA criteria.

Who is required to file SBA Eligibility Questionnaire for Standard 7(a) Guaranty?

Any small business seeking a 7(a) loan guaranteed by the SBA is required to file the SBA Eligibility Questionnaire to demonstrate that they meet the necessary eligibility requirements set forth by the SBA.

How to fill out SBA Eligibility Questionnaire for Standard 7(a) Guaranty?

To fill out the SBA Eligibility Questionnaire for Standard 7(a) Guaranty, businesses should provide accurate and complete information about their operations, ownership, and financial circumstances. This typically includes details on business structure, revenue, number of employees, and personal history of the owners, ensuring all sections of the form are addressed.

What is the purpose of SBA Eligibility Questionnaire for Standard 7(a) Guaranty?

The purpose of the SBA Eligibility Questionnaire for Standard 7(a) Guaranty is to evaluate whether a business qualifies for the 7(a) loan program, which provides access to financing for small businesses that may not be eligible for traditional loans.

What information must be reported on SBA Eligibility Questionnaire for Standard 7(a) Guaranty?

The information reported on the SBA Eligibility Questionnaire for Standard 7(a) Guaranty typically includes business details such as legal structure, ownership percentage, financial details including revenue and profit margins, and personal information about the owners, including credit history and background.

Fill out your sba eligibility questionnaire for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Eligibility Questionnaire For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.