Get the free FinCEN Delays Implementation of Revised Suspicious Activity Report (SAR) Forms - sec

Show details

This document announces the delay in the implementation of revised Suspicious Activity Report (SAR) forms by FinCEN, instructing financial institutions to continue using current forms until further

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fincen delays implementation of

Edit your fincen delays implementation of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fincen delays implementation of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

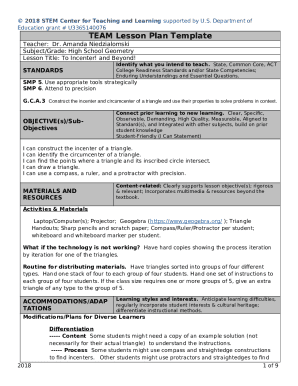

How to edit fincen delays implementation of online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fincen delays implementation of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fincen delays implementation of

How to fill out FinCEN Delays Implementation of Revised Suspicious Activity Report (SAR) Forms

01

Review the revised SAR forms and any accompanying documentation provided by FinCEN.

02

Ensure you are familiar with the key changes in the revised forms compared to the old ones.

03

Gather all necessary information required to complete the SAR, including details about the suspicious activity and involved parties.

04

Log in to the relevant filing platform used for submitting SARs.

05

Select the appropriate revised SAR form for your report.

06

Fill out the required fields accurately, providing detailed information as needed.

07

Double-check the information for completeness and accuracy before submission.

08

Submit the SAR electronically and keep a record of the submission confirmation.

Who needs FinCEN Delays Implementation of Revised Suspicious Activity Report (SAR) Forms?

01

Financial institutions such as banks and credit unions.

02

Money service businesses (MSBs).

03

Securities and futures industries.

04

Casinos and card clubs.

05

Any entity required to report suspicious activities under the Bank Secrecy Act.

Fill

form

: Try Risk Free

People Also Ask about

What is the timeline for SAR reporting?

An amended report must be filed on a previously-filed FinCEN SAR or prior SAR versions whenever new data about a reported suspicious activity is discovered and circumstances will not justify filing a continuing report (see General Instruction 4).

How many days at no time should the filing of a SAR be delayed longer than?

Filing Timelines – Banks are required to file a SAR within 30 calendar days after the date of initial detection of facts constituting a basis for filing. This deadline may be extended an additional 30 days up to a total of 60 calendar days if no suspect is identified.

When should a SAR be amended?

If this activity continues over a period of time, such information should be made known to law enforcement and the federal banking agencies. FinCEN's guidelines have suggested that banks should report continuing suspicious activity by filing a report at least every 90 calendar days.

What is the timeframe for continuing SAR?

A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious activity report.

What is the timeline for the SAR amendment?

Deadline for initial SAR filing: Day 30. End of 90 day review: Day 120. Deadline for continuing activity SAR with subject information: Day 150 (120 days from the date of the initial filing on Day 30). If the activity continues, this timeframe will result in three SARs filed over a 12-month period.

What are supporting documents for FinCEN SAR?

Supporting documentation includes relevant business records such as copies of instruments; copies of money transfer forms; receipts; sale, transaction or clearance records, and photographs, surveillance audio and/or video recording medium.

How long does it take to submit a SAR?

Calculating how long you have to respond to a SAR Organisations have one calendar month to respond to a SAR , starting from the day a SAR is submitted. If you receive a request on the last day of the month and the following month is shorter, a response must be made by the last day of the shorter month.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FinCEN Delays Implementation of Revised Suspicious Activity Report (SAR) Forms?

FinCEN has postponed the rollout of updated Suspicious Activity Report (SAR) forms to allow institutions additional time to adapt to the changes and ensure compliance with the new requirements.

Who is required to file FinCEN Delays Implementation of Revised Suspicious Activity Report (SAR) Forms?

All financial institutions, including banks, credit unions, and certain non-bank entities like money service businesses and casinos, are required to file Suspicious Activity Reports if they detect suspicious transactions.

How to fill out FinCEN Delays Implementation of Revised Suspicious Activity Report (SAR) Forms?

To fill out the revised SAR forms, institutions must provide detailed information regarding the suspicious activity, including the nature of the transaction, the parties involved, and any relevant contextual information that can assist in the investigation.

What is the purpose of FinCEN Delays Implementation of Revised Suspicious Activity Report (SAR) Forms?

The purpose of the revised SAR forms is to enhance the reporting process of suspicious activity, improve data collection, and provide law enforcement with more pertinent information to combat financial crimes.

What information must be reported on FinCEN Delays Implementation of Revised Suspicious Activity Report (SAR) Forms?

Required information includes the details of the suspicious transaction, identifying information of involved parties, the date and location of the activity, and a description of why the transaction is deemed suspicious.

Fill out your fincen delays implementation of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fincen Delays Implementation Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.