Get the free Proposed Rule Amendments to Securities Act Rule 163 - sec

Show details

This document proposes amendments to Rule 163(c) that would allow well-known seasoned issuers to authorize underwriters or dealers to communicate with potential investors about securities offerings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign proposed rule amendments to

Edit your proposed rule amendments to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proposed rule amendments to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing proposed rule amendments to online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit proposed rule amendments to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out proposed rule amendments to

How to fill out Proposed Rule Amendments to Securities Act Rule 163

01

Review the current requirements of the Securities Act Rule 163.

02

Gather necessary documentation and information required for the amendments.

03

Clearly outline the proposed changes you intend to implement.

04

Complete the amendment form provided by the regulatory authority.

05

Ensure all sections of the form are filled in accurately and completely.

06

Submit the proposal along with any required fees to the appropriate regulatory agency.

07

Monitor the status of your submission and respond to any requests for additional information.

Who needs Proposed Rule Amendments to Securities Act Rule 163?

01

Companies looking to issue securities while being exempt from certain registration requirements.

02

Investors seeking to understand the implications of the proposed amendments.

03

Regulatory bodies that oversee compliance with securities laws.

04

Legal professionals advising clients on securities regulations.

Fill

form

: Try Risk Free

People Also Ask about

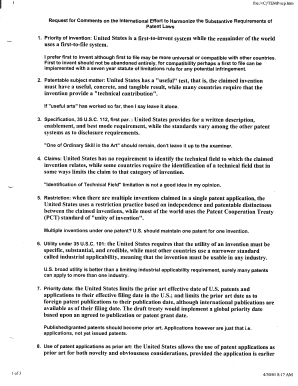

What is the SEC Rule 163?

Rule 163 under the Securities Act, in turn, permits well-known seasoned issuers (WKSIs) to make offers prior to filing a registration statement, but any related written communications must include a specified legend and must be promptly filed with the SEC upon the filing of the related registration statement, with

What is the rule 163B testing the waters?

AMENDMENTS TO THE SECURITIES AcT OF 1933-Title II of the Securities Exchange Act of 1934 1 amends the Securities Act of 1933. 2 These amendments make substantial concessions to the persistent and continuous clamor against the Securities Act.

What is the testing the waters rule 163B?

In 2019, the Securities and Exchange Commission (SEC) promulgated Securities Act Rule 163B to permit issuers to make offers to certain institutional investors, in what is termed “testing-the-waters.” The institutional investors must qualify as qualified institutional buyers (QIBs) or institutional accredited investors

What does testing of the waters mean?

Testing of the waters exemption – IPO issuers The exemption permits an IPO issuer, through an investment dealer, to determine interest in a potential IPO through limited confidential communication with accredited investors.

What does it mean when someone is testing the waters?

When we say we are ``testing the waters,'' we usually mean we are making a preliminary and limited exploration of a new idea or situation. Often, if the results are not what we expected, anticipated, or desired, we determine that the new course is not one to be followed. In other words, we turn back from the path.

What is the 163B rule?

Rule 163B requires that the solicited investor is, or is reasonably believed to be, a QIB or IAI. However, the rule does not specify steps an issuer or person acting on the issuer's behalf must take to establish that reasonable belief or otherwise require the issuer to verify investor status.

Has the Securities Act of 1933 been amended?

Rule 165 specifies that communication between an entity offering to exchange securities and investors (current or prospective), may only start from the point at which announcement of an impending deal hits the public domain until a registration statement of a concluded deal is filed with the Commission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Proposed Rule Amendments to Securities Act Rule 163?

Proposed Rule Amendments to Securities Act Rule 163 relate to the guidelines governing communications by issuers before a registered public offering. These amendments aim to enhance the clarity and efficiency of the regulatory framework.

Who is required to file Proposed Rule Amendments to Securities Act Rule 163?

Issuers planning to conduct a registered public offering of securities are typically required to file Proposed Rule Amendments to Securities Act Rule 163.

How to fill out Proposed Rule Amendments to Securities Act Rule 163?

To fill out Proposed Rule Amendments to Securities Act Rule 163, issuers must complete the necessary forms provided by the regulatory authority, ensuring that all relevant information and disclosures are accurately reported.

What is the purpose of Proposed Rule Amendments to Securities Act Rule 163?

The purpose of Proposed Rule Amendments to Securities Act Rule 163 is to modernize the regulatory framework for pre-offering communications, fostering better investor access to information and enhancing market efficiency.

What information must be reported on Proposed Rule Amendments to Securities Act Rule 163?

The information that must be reported includes details about the issuer, the types of securities being offered, and any material information relevant to the investment decision, in accordance with the regulations.

Fill out your proposed rule amendments to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proposed Rule Amendments To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.