Get the free APPLICATION FOR SPECIAL ANNUITY PERMIT BY CHARITABLE, RELIGIOUS, MISSIONARY, EDUCATI...

Show details

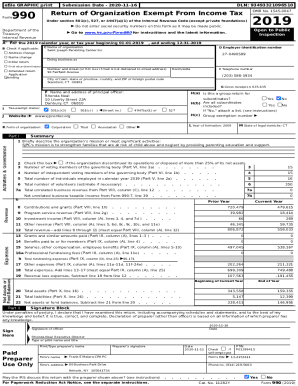

This document serves as an application to the New Jersey Department of Banking and Insurance for a special permit allowing charitable, religious, missionary, educational, or philanthropic organizations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for special annuity

Edit your application for special annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for special annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for special annuity online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for special annuity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for special annuity

How to fill out APPLICATION FOR SPECIAL ANNUITY PERMIT BY CHARITABLE, RELIGIOUS, MISSIONARY, EDUCATIONAL OR PHILANTHROPIC CORPORATIONS OR ASSOCIATIONS

01

Obtain the application form from the appropriate government department or website.

02

Fill in the basic information about your organization, including its name, address, and contact details.

03

Provide the purpose of the organization and how it qualifies as a charitable, religious, missionary, educational, or philanthropic entity.

04

Include details about the proposed annuity, such as the amount and duration.

05

Gather supporting documents, such as the organization's charter, tax-exempt status, and financial statements.

06

Sign the application form and include the date.

07

Submit the completed application along with the supporting documents to the designated office.

08

Pay any applicable fees for processing the application.

Who needs APPLICATION FOR SPECIAL ANNUITY PERMIT BY CHARITABLE, RELIGIOUS, MISSIONARY, EDUCATIONAL OR PHILANTHROPIC CORPORATIONS OR ASSOCIATIONS?

01

Organizations that operate as charitable, religious, missionary, educational, or philanthropic institutions and wish to offer annuities as part of their fundraising efforts.

Fill

form

: Try Risk Free

People Also Ask about

Is a charitable gift annuity a good idea?

Benefits of Establishing a Charitable Gift Annuity If funded with appreciated securities, no upfront capital gains tax is due. You can defer the payments until sometime in the future — such as when you reach retirement. You can be confident knowing Mayo Clinic will be a good steward of your gift.

What are the new charitable gift annuity rules?

You can exercise this option over a single calendar year and only once during your lifetime. There is an aggregate limit of $54,000 for 2025. The entire payment you receive from your charitable gift annuity will be subject to income tax. You can include your spouse as a recipient of the annuity payment.

How much does a charitable annuity pay?

Based on their ages, they will receive a payment rate of 6.0%, which means that they will receive $1,500 each year for the remainder of their lives. They're also eligible for a federal income tax charitable deduction of $8,792* when they itemize. *Based on a 5.2% charitable midterm federal rate.

How much does a $10,000 annuity pay per month?

Benefits of Establishing a Charitable Gift Annuity If funded with appreciated securities, no upfront capital gains tax is due. You can defer the payments until sometime in the future — such as when you reach retirement. You can be confident knowing Mayo Clinic will be a good steward of your gift.

How much does a $50,000 annuity pay per month?

An immediate annuity is when you receive payouts right after making your initial investment. Once you make your lump-sum payment, you'll get monthly payouts on your annuity. For a $200,000 immediate annuity, you could get anywhere between $1,000 and $1,300 a month, depending on your annuity factors and calculations.

How do you set up a charitable gift annuity?

First, you make a donation to a single charity. Then, the gift is set aside in a reserve account and invested. Based on your age(s) at the time of the gift, you receive a fixed monthly or quarterly payout (typically supported by the investment account) for the rest of your life.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR SPECIAL ANNUITY PERMIT BY CHARITABLE, RELIGIOUS, MISSIONARY, EDUCATIONAL OR PHILANTHROPIC CORPORATIONS OR ASSOCIATIONS?

The APPLICATION FOR SPECIAL ANNUITY PERMIT is a formal request submitted by charitable, religious, missionary, educational, or philanthropic organizations seeking authorization to issue annuity contracts under special conditions set by regulatory authorities.

Who is required to file APPLICATION FOR SPECIAL ANNUITY PERMIT BY CHARITABLE, RELIGIOUS, MISSIONARY, EDUCATIONAL OR PHILANTHROPIC CORPORATIONS OR ASSOCIATIONS?

Organizations categorized as charitable, religious, missionary, educational, or philanthropic that intend to offer annuity contracts must file this application.

How to fill out APPLICATION FOR SPECIAL ANNUITY PERMIT BY CHARITABLE, RELIGIOUS, MISSIONARY, EDUCATIONAL OR PHILANTHROPIC CORPORATIONS OR ASSOCIATIONS?

To fill out the application, organizations need to provide detailed information about their mission, financials, the structure of the organization, the proposed annuity products, and compliance with applicable laws and regulations.

What is the purpose of APPLICATION FOR SPECIAL ANNUITY PERMIT BY CHARITABLE, RELIGIOUS, MISSIONARY, EDUCATIONAL OR PHILANTHROPIC CORPORATIONS OR ASSOCIATIONS?

The purpose of this application is to ensure that organizations adhere to legal requirements when offering annuities and to protect the interests of the annuitants.

What information must be reported on APPLICATION FOR SPECIAL ANNUITY PERMIT BY CHARITABLE, RELIGIOUS, MISSIONARY, EDUCATIONAL OR PHILANTHROPIC CORPORATIONS OR ASSOCIATIONS?

The application must report the organization's name, address, mission, financial statements, details of proposed annuity products, and any other information required by the regulatory authority.

Fill out your application for special annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Special Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.