Get the free Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Righ...

Show details

This document proposes new rules regarding medical malpractice insurance policies in New Jersey, including optional provisions for insureds to consent to settlements and associated premium reductions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medical malpractice insurance general

Edit your medical malpractice insurance general form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medical malpractice insurance general form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing medical malpractice insurance general online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit medical malpractice insurance general. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

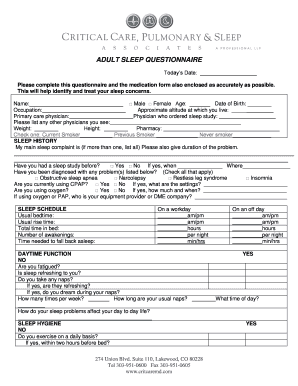

How to fill out medical malpractice insurance general

How to fill out Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Right to Settle

01

Read the policy document carefully to understand the general provisions.

02

Gather all necessary information about your medical practice, including type, location, and services offered.

03

Complete the application form, ensuring to provide accurate and thorough details.

04

Review the optional policy provisions, focusing on the 'Right to Settle' clause.

05

Decide if you want the option to have a say in settlement decisions, as outlined in the policy.

06

Consult with your insurance agent or a legal advisor for clarification on any complex terms or conditions.

07

Submit the application along with any required documentation and premiums.

Who needs Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Right to Settle?

01

Healthcare professionals including doctors, nurses, and therapists.

02

Medical practices and institutions providing patient care.

03

Any entity or individual engaged in medical services or treatments.

04

Legal professionals representing healthcare providers.

05

Anyone seeking to protect against claims of negligence or malpractice.

Fill

form

: Try Risk Free

People Also Ask about

What are the two types of medical malpractice insurance?

There are two types of professional liability coverage available to PAs: occurrence and claims-made. Occurrence policies cover incidents that happen during the policy period without regard to when the claims are reported. Occurrence coverage provides protection for each policy period indefinitely.

Can an insurance company settle a claim without my consent?

This means that the insurance company can choose to pay claims against your (even if you do not wish to do so). They don't have to ask you first. One of the few exceptions to this is medical malpractice where doctors sometimes have policies that require the doctor to consent before settling.

What is a consent to settle provision?

Having a consent-to-settle clause gives you the choice to decide whether to settle a claim or not—otherwise the medical insurance company will make that decision for you. Discuss your situation with your agent and your trusted advisors to make the best decision as to whether to settle.

What is the right to reject provision in insurance?

The short answer is yes, you absolutely have the right to refuse an offer from an insurance company. However, you must understand when and why you might want to do so, and why you should consult a car accident lawyer, to protect your interests and ensure you receive fair compensation for your injuries and damages.

What are the two main types of health insurance?

What are Some Types of Health Care Coverage? Health care coverage is often grouped into two general categories: private and public.

What are the two types of malpractice insurance for NPS?

There are two types of nurse practitioner malpractice insurance coverage: occurrence and claims-made policies.

Should I get claims made or occurrence malpractice insurance?

The choice of which policy may be dictated by your market. In some areas and in some specialties, claims made is the only policy type available. If you have the choice between the two, you choose occurrence if you want to pay now for unlimited coverage, or claims made, if you want to pay later for unlimited coverage.

What are the 2 types of medical malpractice insurance?

There are two types of professional liability coverage available to PAs: occurrence and claims-made. Occurrence policies cover incidents that happen during the policy period without regard to when the claims are reported. Occurrence coverage provides protection for each policy period indefinitely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Right to Settle?

Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Right to Settle is a clause in medical malpractice insurance policies that gives the insurer the authority to settle claims on behalf of the insured without needing approval beforehand. This provision helps in managing claims efficiently and can help mitigate costs for both parties.

Who is required to file Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Right to Settle?

Healthcare providers, including physicians, nurses, and hospitals, typically must file for Medical Malpractice Insurance that includes the General Provisions; Optional Policy Provision – Right to Settle, to ensure adequate coverage against potential claims.

How to fill out Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Right to Settle?

To fill out the Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Right to Settle, an applicant should provide accurate details regarding their professional practice, prior malpractice claims, and consent to the terms outlined in the policy, ensuring all information is up-to-date.

What is the purpose of Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Right to Settle?

The purpose of this provision is to grant insurers the ability to efficiently resolve claims without requiring the insured's approval, allowing for quicker settlements and potentially reducing legal costs and negative impacts on the insured's reputation.

What information must be reported on Medical Malpractice Insurance – General Provisions; Optional Policy Provision – Right to Settle?

The information that must be reported typically includes the insured's professional history, details of any past claims or incidents, current practice details, and any changes in practice that may affect coverage needs.

Fill out your medical malpractice insurance general online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medical Malpractice Insurance General is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.