NJ A-5088-TC 2011 free printable template

Show details

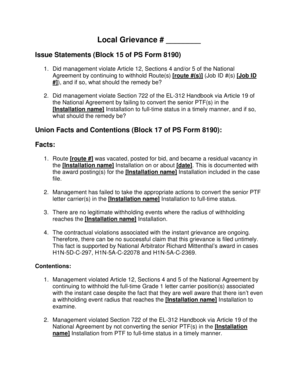

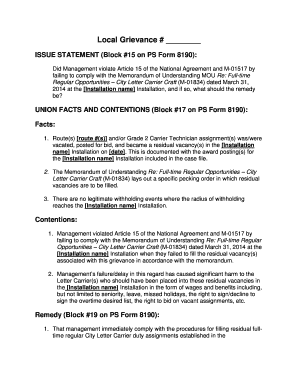

To the Director of the Division of Taxation, Department of the Treasury, State of New Jersey: ... Have any of the assets of the corporation been sold or transferred during the current or prior taxable

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ A-5088-TC

Edit your NJ A-5088-TC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ A-5088-TC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ A-5088-TC online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NJ A-5088-TC. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ A-5088-TC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ A-5088-TC

How to fill out NJ A-5088-TC

01

Obtain Form NJ A-5088-TC from the New Jersey Division of Taxation website or your local tax office.

02

Read the instructions that accompany the form to understand the specific eligibility requirements.

03

Complete your personal information at the top of the form including your name, address, and Social Security number.

04

Fill out the section regarding your household income, ensuring that all sources of income are accurately reported.

05

Provide the details for any dependents you are claiming, including their names and Social Security numbers.

06

Calculate any deductions or credits you are eligible for as specified in the instructions.

07

Review your completed form for accuracy and completeness.

08

Sign and date the form at the designated area.

09

Submit the form to the appropriate New Jersey tax authority by the deadline listed in the instructions.

Who needs NJ A-5088-TC?

01

Individuals and families who believe they qualify for tax credits or deductions related to property taxes in New Jersey.

02

Residents of New Jersey who have adjust gross income within the limits specified by the state.

03

Homeowners or renters seeking reimbursement for property taxes paid or credits based on their income.

Instructions and Help about NJ A-5088-TC

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a tax compliance?

You will be able to get the TCC in less than 3 minutes of application.

How long does it take to get a SARS certificate?

24-Hours is the fastest timeframe for a Tax Clearance Pin Certificate in South Africa. You can get a SARS-issued Tax Clearance Pin Certificate within 24 hours by using our Tax Clearance Pin Certificate service.

How long does it take to get an IRS tax clearance certificate?

ing to the IRS, it takes 4 to 6 months to obtain the clearance letter if the return is accepted without any errors or special circumstances. However, the time is much closer to 6 to 9 months.

What is the meaning of tax clearance certificate?

A Tax Clearance Certificate is confirmation from Revenue that an applicant's tax affairs are in order. Revenue may issue a Tax Clearance Certificate to a customer who has tax arrears where the arrears are covered by an instalment arrangement. How to apply for a Tax Clearance Certificate.

How long does it take to get a tax clearance certificate from SARS?

24-Hours is the fastest timeframe for a Tax Clearance Pin Certificate in South Africa. You can get a SARS-issued Tax Clearance Pin Certificate within 24 hours by using our Tax Clearance Pin Certificate service.

How do I get my SARS tax clearance certificate online?

How to access your “MY COMPLIANCE PROFILE” (MCP) via SARS eFiling Step 1: Logon to eFiling. Logon to eFiling by using your login name and password. Step 2: Activate the Tax Compliance Status service. Step 3: View your “My Compliance Profile”

Can you get tax clearance online?

Note: Alternatively you can request a Tax Compliance Status (TCS) for a specific purpose (e.g. Tender) online via eFiling.

Where can I get a tax clearance?

The eTC service allows you to apply for a Tax Clearance Certificate online. A Tax Clearance Certificate is confirmation from Revenue that your tax affairs are in order at the date of issue.

How do I get a tax certificate in New Jersey?

To register, file a Business Registration Application (Form NJ-REG) online with the Division of Revenue and Enterprise Services. Once registered, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Certificate of Authority (to be able to collect Sales Tax).

How do I obtain my tax clearance certificate?

A tax clearance certificate can be obtained by an individual or a company. A tax clearance certificate is issued in arrears over a course of three years. You need to have rendered your tax returns to the relevant authority over the course of three years to be eligible for a tax clearance certificate in Nigeria.

Can I download a tax clearance certificate online?

You can also request a Tax Clearance Certificate online on the SARS E-Filing website.

Why do I need a tax clearance?

A Tax Clearance Certificate is essentially a piece of official documentation that your business can get from SARS as proof that you have no outstanding Tax at SARS. Having a Tax Clearance Certificate in South Africa means your business is in good standing with SARS.

What is a tax clearance certificate?

The definition of a Tax Clearance Certificate A Tax Clearance Certificate is essentially a piece of official documentation that your business can get from SARS as proof that you have no outstanding Tax at SARS.

How do I get a tax clearance certificate in NJ?

Individuals require a paper application The Application for Business Assistance Tax Clearance must be completed, signed by the applicant, and submitted to the Division of Taxation, at the address listed on the application. Payment must be made by check or money order.

How long does it take to get a tax clearance certificate?

24-Hours is the fastest timeframe for a Tax Clearance Pin Certificate in South Africa. You can get a SARS-issued Tax Clearance Pin Certificate within 24 hours by using our Tax Clearance Pin Certificate service.

What documents are needed for tax clearance certificate?

The following documents is required when applying for a Tax Clearance Certificate for your company an income tax reference number for the company, the director or also known as the public officer of the company must have a certified copy of his/her ID or a valid passport if the applicant is a foreign, a signed SARS

How do I get an IRS tax clearance certificate?

Obtain a permit by filing the applicable Form 2063, U.S. Departing Alien Income Tax Statement or Form 1040-C, U.S. Departing Alien Income Tax Return with your local IRS office (by appointment only) before you leave the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NJ A-5088-TC online?

pdfFiller has made it easy to fill out and sign NJ A-5088-TC. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit NJ A-5088-TC in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing NJ A-5088-TC and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the NJ A-5088-TC electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your NJ A-5088-TC and you'll be done in minutes.

What is NJ A-5088-TC?

NJ A-5088-TC is a tax form used in New Jersey for reporting certain information related to tax credits and incentives, particularly for businesses.

Who is required to file NJ A-5088-TC?

Businesses claiming specific tax credits or incentives in New Jersey are required to file NJ A-5088-TC.

How to fill out NJ A-5088-TC?

To fill out NJ A-5088-TC, obtain the form from the New Jersey Division of Taxation website, complete each section accurately, providing necessary information regarding tax credits claimed.

What is the purpose of NJ A-5088-TC?

The purpose of NJ A-5088-TC is to facilitate the reporting and processing of tax credits and incentives awarded to businesses in New Jersey.

What information must be reported on NJ A-5088-TC?

The form requires reporting details such as the type of tax credit, the amount claimed, and any relevant business information.

Fill out your NJ A-5088-TC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ A-5088-TC is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.