Get the free CERTIFICATE OF TAXPAID ALCOHOL - ttb treas

Show details

This document certifies that federal excise taxes have been paid on alcohol for specific uses, such as manufacturing flavoring extracts or medicinal preparations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of taxpaid alcohol

Edit your certificate of taxpaid alcohol form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of taxpaid alcohol form via URL. You can also download, print, or export forms to your preferred cloud storage service.

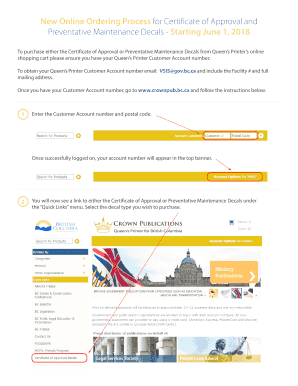

How to edit certificate of taxpaid alcohol online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit certificate of taxpaid alcohol. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of taxpaid alcohol

How to fill out CERTIFICATE OF TAXPAID ALCOHOL

01

Obtain the Certificate of Taxpaid Alcohol form from the appropriate tax authority.

02

Fill in the required identification details, including your name, business name, and address.

03

Enter the tax period for which you are reporting.

04

Provide detailed information about the alcohol products, including type, quantity, and value.

05

Calculate the total tax paid on the alcohol and enter this amount in the designated section.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the relevant tax authority.

Who needs CERTIFICATE OF TAXPAID ALCOHOL?

01

Businesses that manufacture or sell alcoholic beverages.

02

Importers and distributors of alcoholic products.

03

Individuals or entities applying for permits related to alcohol sales.

Fill

form

: Try Risk Free

People Also Ask about

Who bears the excise tax?

Excise and sales taxes are two different types of taxes. An excise tax is imposed on specific goods and is generally the responsibility of the merchant to pay to the government. The merchant, in turn, may or may not pass the tax on to the consumer by adding it to the price.

What does TTB mean in alcohol?

The Alcohol and Tobacco Tax and Trade Bureau (TTB) is a bureau under the Department of the Treasury .

How much money does the US government make on alcohol taxes?

In 2023, revenue from alcohol tax in the United States amounted to 9.5 billion U.S. dollars. The forecast predicts an increase in alcohol tax revenue up to 9.7 billion U.S. dollars by 2029. The total revenue of the U.S. government totaled to 4.44 trillion U.S. dollars in 2023.

What does TTB regulate for alcohol?

We are responsible for enforcing the laws regulating alcohol production, importation, and wholesale businesses; tobacco manufacturing and importing businesses; and alcohol labeling and advertising. Visit our About TTB page for more information about our mission and functions.

Who placed the excise tax on whiskey?

The first U.S. customs duties were already law when Hamilton took office. In his first report to Congress, in January 1790, he proposed to increase the duty on imported distilled spirits and to impose a new excise tax on domestic distilled spirits (i.e., whisky ).

Who is responsible for paying federal excise tax?

Excise taxes are independent of income taxes. Often, the retailer, manufacturer or importer must pay the excise tax to the IRS and file the Form 720. Some excise taxes are collected by a third party.

What is a tax stamp for alcohol?

A tax strip, or duty stamp, is a label affixed to a bottle of alcohol to show that the relevant customs duties and excise taxes have been paid to the government. Tax strips are created to be difficult to counterfeit and, like cash, often feature fine details and complex designs to deter forgers.

Who pays federal excise tax on alcohol?

The federal excise tax on alcoholic beverages is imposed at the manufacturer and importer level, based on the per unit production or importation of alcoholic beverages (e.g., distilled spirits, wine, and beer) for sale in the U.S. market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CERTIFICATE OF TAXPAID ALCOHOL?

A Certificate of Taxpaid Alcohol is an official document that certifies that all applicable taxes have been paid on alcoholic beverages.

Who is required to file CERTIFICATE OF TAXPAID ALCOHOL?

Manufacturers, importers, and wholesalers of alcoholic beverages are typically required to file a Certificate of Taxpaid Alcohol.

How to fill out CERTIFICATE OF TAXPAID ALCOHOL?

To fill out a Certificate of Taxpaid Alcohol, you need to provide details about the alcoholic beverages, including the type, quantity, and relevant tax information, followed by the signature of the responsible party.

What is the purpose of CERTIFICATE OF TAXPAID ALCOHOL?

The purpose of the Certificate of Taxpaid Alcohol is to ensure compliance with tax laws and to provide proof that all taxes on alcohol have been paid before distribution or sale.

What information must be reported on CERTIFICATE OF TAXPAID ALCOHOL?

The Certificate must report information such as the name and address of the seller, buyer details, description of the alcohol, quantities, tax amounts paid, and signatures.

Fill out your certificate of taxpaid alcohol online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Taxpaid Alcohol is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.