Get the free Fixed Assets Accounting Manual - pdf usaid

Show details

This manual outlines the accounting procedures for record keeping of capital expenditures and fixed assets for the Power Distribution Wing of WAPDA, including asset valuation, depreciation, and retirement

We are not affiliated with any brand or entity on this form

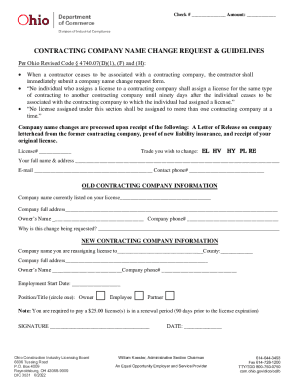

Get, Create, Make and Sign fixed assets accounting manual

Edit your fixed assets accounting manual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed assets accounting manual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed assets accounting manual online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fixed assets accounting manual. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed assets accounting manual

How to fill out Fixed Assets Accounting Manual

01

Gather all relevant documentation related to fixed assets.

02

Identify the types of fixed assets your organization owns.

03

Establish clear guidelines for asset acquisition and disposal.

04

Create a section for asset valuation methods and depreciation schedules.

05

Define responsibilities for asset management within the accounting team.

06

Include procedures for periodic asset inventory checks.

07

Outline reporting requirements and formats.

08

Incorporate policies for compliance with applicable laws and regulations.

Who needs Fixed Assets Accounting Manual?

01

Accounting departments of organizations managing fixed assets.

02

Finance managers overseeing asset management.

03

Auditors requiring clear records of asset transactions.

04

Compliance officers ensuring adherence to financial regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the GAAP fixed asset policy?

GAAP standards generally require fixed assets to be recorded at their historical cost, including all normal expenditures to bring the asset to a location and condition for its intended use. Acquisition costs include installation costs, assembly, freight, warehousing, insurance, taxes, etc.

What are the basics of fixed assets accounting?

A fixed asset, also known as a capital asset, is a tangible piece of property, plant, or equipment (PP&E;) that you own or manage with expectations that it'll continuously help generate income. An asset is fixed when it's an item that your business won't consume, sell, or convert to cash within the next calendar year.

What are the GAAP rules for fixed assets?

Under GAAP, fixed (tangible) assets have three primary characteristics: Acquired and held for use in operations, (e.g., not held for sale); Long-term in nature (greater than 1 year); and. Possess physical substance.

How do you write off a fixed asset in the journal entry?

To write off a fixed asset, you should: Debit Accumulated Depreciation for the life-to-date depreciation claimed on the asset. Credit Fixed Asset for the original cost of the asset. Debit Loss or credit Gain for the amount necessary to balance the journal entry.

What are the concepts of fixed assets?

Fixed assets are tangible, long-lived assets used by a company in its operations, such as machinery, factories, tools, furniture and computers. They are listed in the noncurrent asset section on a company's balance sheet because their useful lives extend beyond one year.

How to record fixed assets in accounting?

Some examples of fixed assets are land and land improvements; general infrastructure; buildings and building improvements; machinery and equipment; art, literature, and artifacts; software; and other intangible assets including right-to-use leased assets.

What is the accounting rule for fixed assets?

Fixed assets should be recorded at cost of acquisition. Cost includes all expenditures directly related to the acquisition or construction of and the preparations for its intended use. Such costs as freight, sales tax, transportation, and installation should be capitalized.

What are the 3 types of fixed assets?

Fixed assets are also known as capital assets and are denoted by the term Property, Plant and Equipment in the balance sheet.

What is the double entry for fixed assets?

The new asset is on the asset side of the accounting equation and is debited to fixed assets. The other entry of the double entry is to either reduce the bank account (with an immediate payment) or create an accounts payable liability, in either case a credit entry.

What is the journal entry for fixed assets in accounting?

The journal entry to record the sale of a fixed asset includes removing the book value of the fixed asset and its related accumulated amortization from the general ledger (and subledger), recording the cash (or cash equivalency) received, and then recognizing any gain or loss, if appropriate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fixed Assets Accounting Manual?

The Fixed Assets Accounting Manual is a documentation that outlines the policies, procedures, and guidelines for the management and accounting of fixed assets within an organization.

Who is required to file Fixed Assets Accounting Manual?

Organizations that own fixed assets are required to have a Fixed Assets Accounting Manual to ensure proper tracking, reporting, and compliance with accounting standards.

How to fill out Fixed Assets Accounting Manual?

To fill out the Fixed Assets Accounting Manual, organizations should gather information on fixed assets, including acquisition details, depreciation methods, asset categorizations, and necessary compliance regulations, and then document these in the manual format.

What is the purpose of Fixed Assets Accounting Manual?

The purpose of the Fixed Assets Accounting Manual is to provide a clear framework for tracking, managing, and reporting on fixed assets, ensuring compliance with accounting regulations, and aiding in financial transparency.

What information must be reported on Fixed Assets Accounting Manual?

The Fixed Assets Accounting Manual must report information such as asset descriptions, acquisition costs, useful lives, depreciation methods, disposal procedures, and relevant accounting policies.

Fill out your fixed assets accounting manual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Assets Accounting Manual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.