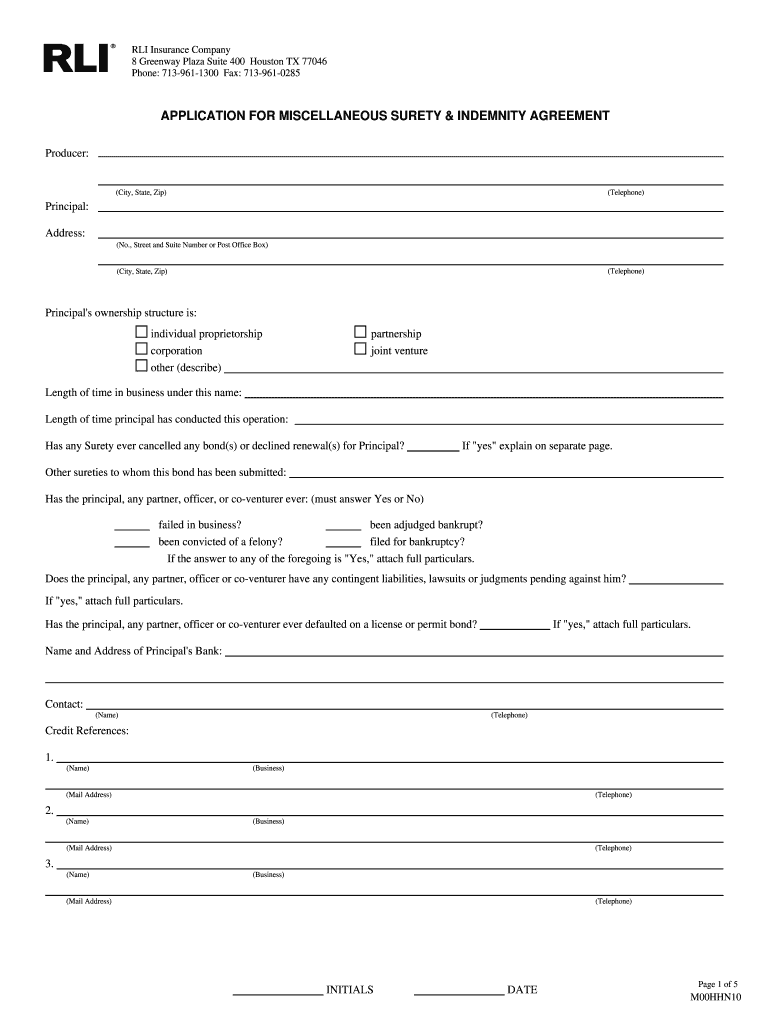

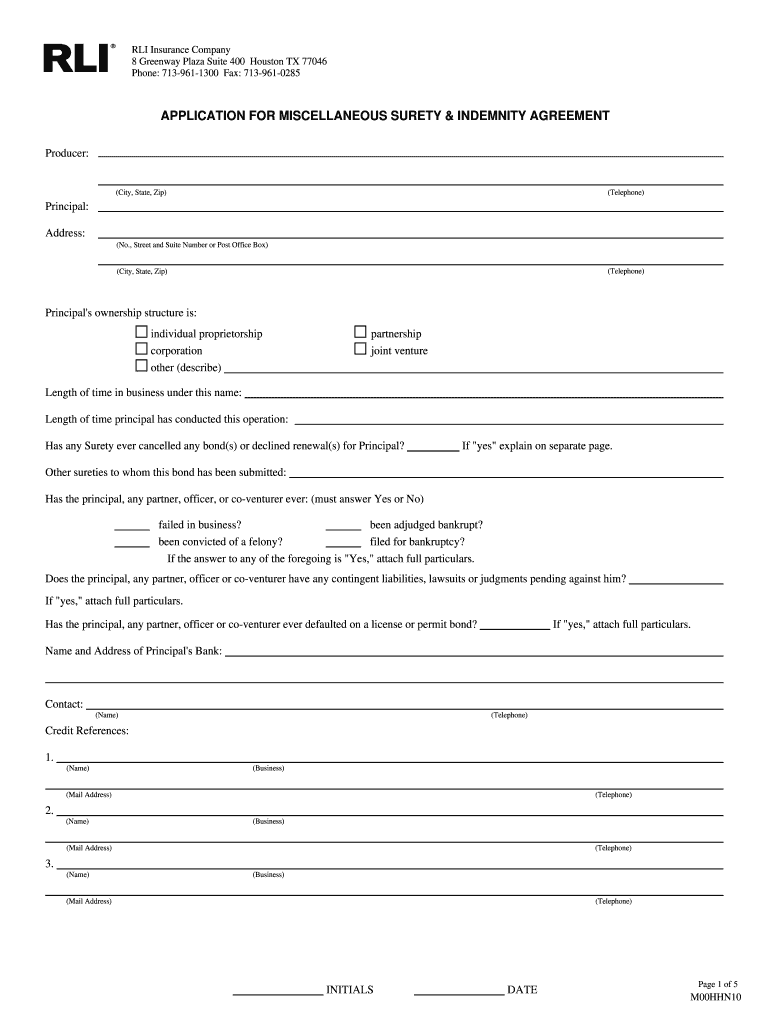

Get the free APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT

Show details

This document serves as an application form for a miscellaneous surety and indemnity agreement with RLI Insurance Company, outlining the responsibilities and agreements of the principal and indemnitors

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for miscellaneous surety

Edit your application for miscellaneous surety form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for miscellaneous surety form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for miscellaneous surety online

Follow the steps below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for miscellaneous surety. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for miscellaneous surety

How to fill out APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT

01

Begin by downloading the APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT form from the relevant authority's website or obtain a physical copy.

02

Fill out the applicant's information in the designated fields, including name, address, and contact details.

03

Provide a detailed description of the purpose for which the surety is needed.

04

Include any relevant identification numbers or licenses that may be required.

05

Indicate the amount of the surety bond being requested.

06

Review the terms and conditions of the agreement carefully.

07

Sign and date the application form in the designated area.

08

Submit the completed application form along with any required supporting documents and fees to the appropriate authority.

Who needs APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT?

01

Individuals or businesses seeking a surety bond for various purposes such as construction projects, contractual obligations, or regulatory compliance may need the APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out a surety bond application?

How to Fill Out a Surety Bond Form Bond Number. The bond number is the unique identification number assigned to your bond. Bond Premium. This is the cost of your bond, typically calculated as a percentage of your bond coverage. Principal Name. Surety Name. State of Incorporation. Obligee Name. Bond Amount. Bond Obligation.

What is the purpose of an indemnity bond?

An indemnity bond assures the holder of the bond, that they will be duly compensated in case of a possible loss. This bond is an agreement that protects the lender from loss if the borrower defaults on a legally binding loan.

What is an indemnity bond used for?

Indemnification refers to the act of “protecting against or keeping free from loss.” When party A agrees to indemnify party B, party A is agreeing to make party B whole again in the event that it suffers a loss. Practically speaking, indemnity provisions are used by parties in a contract to shift and manage risk.

What is the reason for an indemnity agreement?

Additionally, indemnity bonds are required in legal scenarios, such as for securing bail, protecting against claims in insurance contracts, or ensuring the repayment of loans. They may also be needed in cases involving business partnerships, government tenders, or compliance with regulatory requirements.

What is the indemnity bond required for?

Do You Get the Money Back for an Indemnity Bond? No — the surety covers the cost of a claim upfront, but you must pay them back under the indemnity agreement terms. Indemnity bond premiums are also non-refundable once you file your official bond.

What is a surety indemnity agreement?

What is an indemnity agreement for surety? Generally speaking, the indemnity provision in the agreement grants the surety the broad legal right to recover from the indemnitor whatever it pays on the principal's behalf under the related bonds, as well as those amounts for which it remains liable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT?

The APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT is a legal document that allows an individual or business to apply for a surety bond and indemnity coverage. This application outlines the terms and conditions under which the surety and indemnity will be provided.

Who is required to file APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT?

Individuals or businesses seeking a surety bond or indemnity insurance for various undertakings, such as construction projects, licensing, or contract agreements, are required to file the APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT.

How to fill out APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT?

To fill out the APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT, applicants should provide accurate and complete information, including personal details, business information, the nature of the undertaking, financial statements, and any required certifications or signatures.

What is the purpose of APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT?

The purpose of the APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT is to initiate the process of obtaining a surety bond and indemnity protection, ensuring that the applicant complies with legal obligations and understands the financial responsibilities involved.

What information must be reported on APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT?

The APPLICATION FOR MISCELLANEOUS SURETY & INDEMNITY AGREEMENT typically requires detailed information including the applicant's identification details, business structure, credit history, financial statements, specific project details, and any prior claims or defaults.

Fill out your application for miscellaneous surety online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Miscellaneous Surety is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.