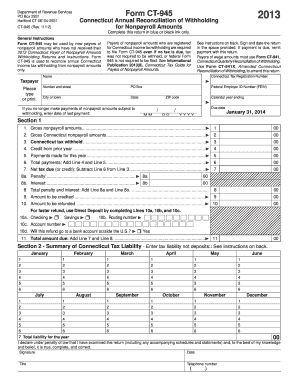

CT DRS CT-945 2012 free printable template

Show details

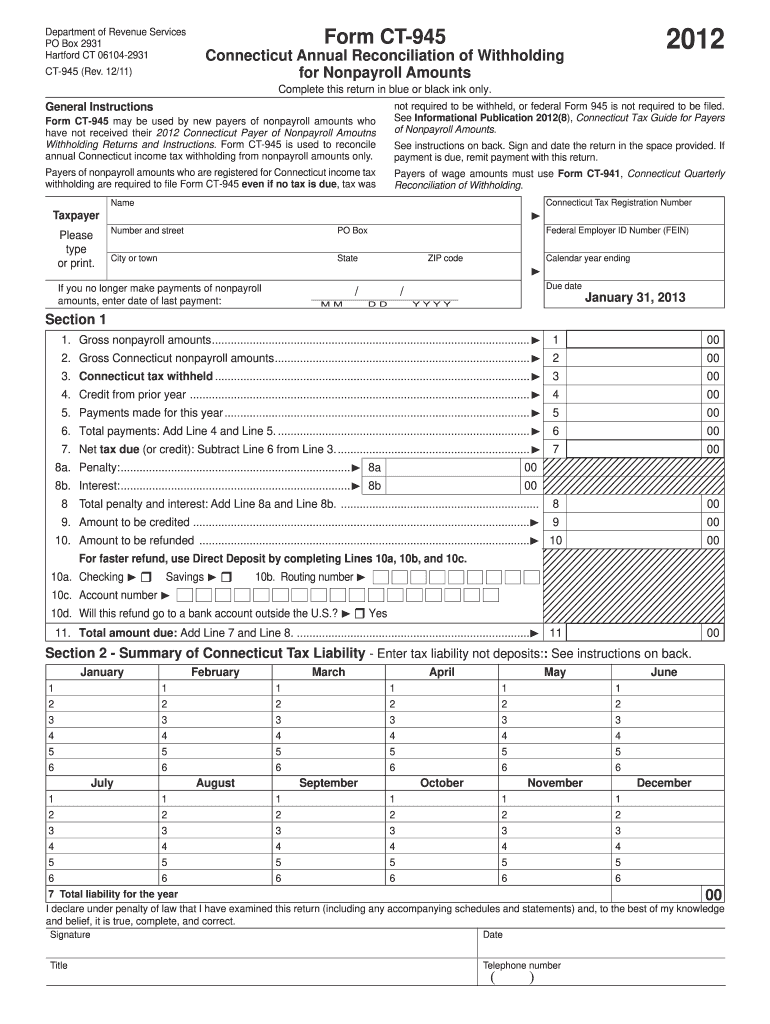

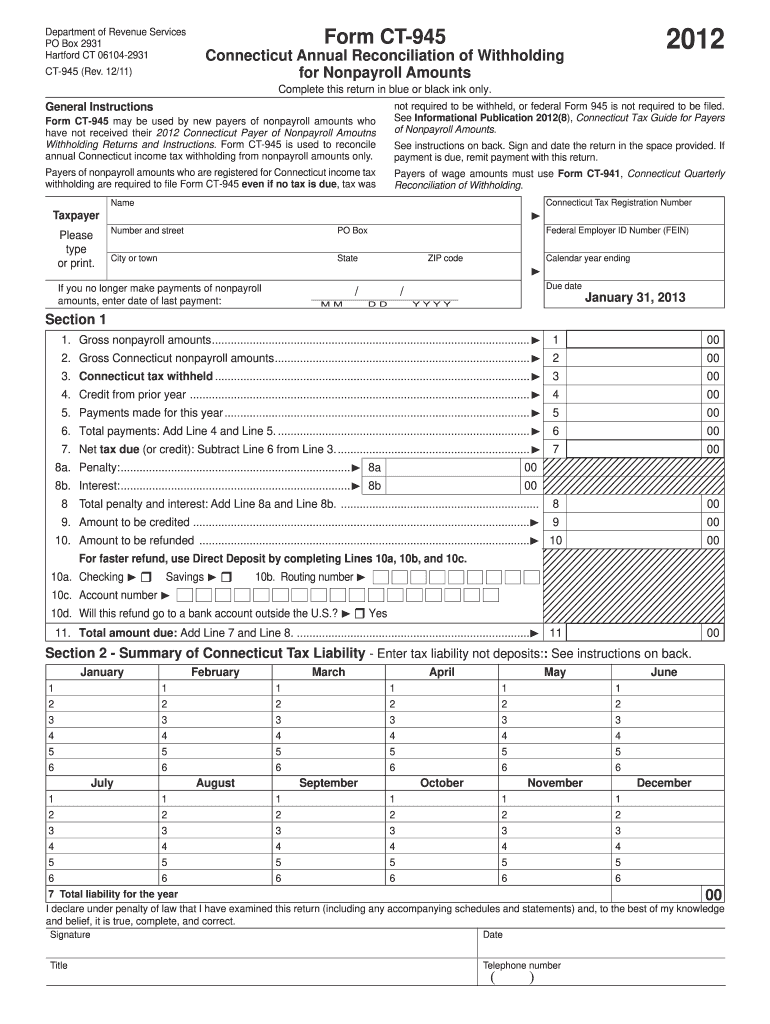

Signature Date Title Telephone number Form CT-945 Instructions Nonpayroll Amounts Subject to Connecticut Withholding Form CT-945 is due January 31 2013. See IP 2012 1. Amending Form CT-945 Use Form CT-941X Amended Connecticut Reconciliation of Withholding to amend or correct Form CT-945 or use the TSC at www. Add the Line 6 amounts and enter the total on Line 7. This should equal Form CT-945 Section 1 Line 3. Form CT-945 is used to reconcile annual Connecticut income tax withholding from...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form ct 945 2012

Edit your form ct 945 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ct 945 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form ct 945 2012 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form ct 945 2012. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-945 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ct 945 2012

How to fill out CT DRS CT-945

01

Begin by downloading the CT-945 form from the Connecticut Department of Revenue Services (DRS) website.

02

Fill out the taxpayer information section, including your name, address, and Social Security number or Employer Identification Number (EIN).

03

Complete the period covered section by indicating the tax year or period you are reporting.

04

Provide information on qualified contributions and the total amount contributed during the reporting period.

05

Calculate the credit amount by following the instructions provided on the form, ensuring all numbers are accurate.

06

Review the completed form for any errors or missing information.

07

Sign and date the form at the designated area.

08

Submit the form along with any required documentation to the Connecticut DRS by the specified deadline.

Who needs CT DRS CT-945?

01

Individuals or businesses that made qualified contributions to certain types of organizations and wish to claim a tax credit.

02

Taxpayers seeking a refund for overpayment of taxes can also benefit from filling out CT DRS CT-945.

Fill

form

: Try Risk Free

People Also Ask about

What is the CT tax withholding for 2023?

Connecticut's 2023 withholding methods are unchanged from 2022, the state Department of Revenue Services said Dec. 15. Tax rates used in the withholding methods continue to range from 3% to 6.99%. The department also released the 2023 Form CT-W4, Employee's Withholding Certificate.

What is a CT 945 form?

Form CT-945 is used to reconcile annual Connecticut income tax withholding from nonpayroll amounts only.

What is the proper tax withholding form?

Form W-4, Employee's Withholding Certificate, is generally completed at the start of any new job. This form tells your employer how much federal income tax withholding to keep from each paycheck. This form is crucial in determining your balance due or refund each tax season.

What is CT 941 form?

Form CT-941 HHE is due April 15, 2022. Household employers registered to withhold Connecticut income tax from their household employee wages must file one Form CT-941 HHE for the entire calendar year even if no tax is due. See Informational Publication 2022(1), Connecticut Employer's Tax Guide, Circular CT.

What is the CT employee tax withholding form?

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form ct 945 2012?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the form ct 945 2012 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the form ct 945 2012 in Gmail?

Create your eSignature using pdfFiller and then eSign your form ct 945 2012 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit form ct 945 2012 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as form ct 945 2012. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is CT DRS CT-945?

CT DRS CT-945 is a tax form used in Connecticut for reporting certain types of income and withholding for employers.

Who is required to file CT DRS CT-945?

Employers who have withheld Connecticut income tax from their employees' wages are required to file CT DRS CT-945.

How to fill out CT DRS CT-945?

To fill out CT DRS CT-945, employers need to provide accurate information regarding the total amount of wages paid, tax withheld, and any other pertinent details as specified in the form instructions.

What is the purpose of CT DRS CT-945?

The purpose of CT DRS CT-945 is to report the withholding tax amounts for the Connecticut state income tax and to ensure compliance with state tax laws.

What information must be reported on CT DRS CT-945?

The information that must be reported on CT DRS CT-945 includes total wages paid, total tax withheld, as well as the employer's identification details and any adjustments if applicable.

Fill out your form ct 945 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ct 945 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.