Get the free 2012 Borrowers’ Application Form - duq

Show details

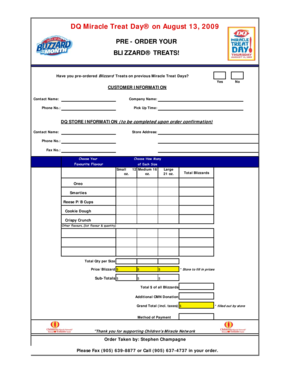

This form is for borrowers to apply for library membership at the Allegheny County Law Library. It includes sections for personal information, type of organization, billing details, and payment information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 borrowers application form

Edit your 2012 borrowers application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 borrowers application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 borrowers application form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2012 borrowers application form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 borrowers application form

How to fill out 2012 Borrowers’ Application Form

01

Begin by downloading the 2012 Borrowers’ Application Form from the relevant website or financial institution.

02

Fill in your personal information, including your name, address, and contact details in the designated fields.

03

Provide your social security number or taxpayer identification number.

04

Indicate your employment information, including employer name, address, and position.

05

Detail your financial information, including income, assets, and liabilities.

06

If applicable, include information about any co-borrowers.

07

Review the completed form for accuracy and completeness.

08

Sign and date the application form where indicated.

09

Submit the form to the appropriate lender or institution, either by mail or electronically.

Who needs 2012 Borrowers’ Application Form?

01

Individuals seeking a mortgage or loan for purchasing a home.

02

Borrowers looking for refinancing options on existing loans.

03

Applicants for financial assistance programs related to housing.

Fill

form

: Try Risk Free

People Also Ask about

What is going on with the Art Institute loan forgiveness?

On May 1, 2024, the Biden-Harris administration announced the automatic $6.1 billion in Art Institutes student loan forgiveness for students with federal loans who attended the schools between January 1, 2004 and October 16, 2017. Private student loans are not eligible for this federal forgiveness or discharge.

What should I write on my borrower defense application?

What must be included in the application? A description of the harm you suffered because of the school's statements, acts, or omissions. ED recommends you provide as much as detail as possible in the sections below about the statement, act, or omission that you believe qualifies you for a Borrower Defense to Repayment.

Can I get my money back from Ashford University?

Ashford University Discharge This group discharge will provide relief to borrowers harmed by Ashford's actions, including borrowers who have not yet applied for borrower defense. Borrowers do not need to take any action to receive their discharge.

How do you win a borrower defense claim?

There are six different grounds for a borrower defense discharge under the 2023 Borrower Defense Regulation: Substantial Misrepresentation. Substantial Omission of Fact. Breach of Contract. Aggressive and Deceptive Recruitment. Judgment. Prior Secretarial Action.

What are the reasons for borrower defense?

You might qualify for federal loan forgiveness under this program if you believe your school defrauded you in the following ways: Intentionally misled you about your education program. Caused you harm as a result to a degree that warrants full discharge of your loans.

Why can't I consolidate my student loans?

To consolidate a loan, it must be in repayment or in its grace period. Generally, you can't consolidate an existing consolidation loan unless you include an additional eligible loan in the consolidation.

What to say on borrowers defense application?

This is your opportunity to share the ways in which the school misled you. You want to include as much detail possible in your answers, including as much information as you can remember about who made promises to you and where and when they made those promises.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012 Borrowers’ Application Form?

The 2012 Borrowers' Application Form is a standardized document used by borrowers to apply for loans and provide necessary personal, financial, and loan-related information to lenders.

Who is required to file 2012 Borrowers’ Application Form?

Individuals or entities seeking to secure a loan from a financial institution, including personal loans, mortgages, or business loans, are required to file the 2012 Borrowers' Application Form.

How to fill out 2012 Borrowers’ Application Form?

To fill out the 2012 Borrowers' Application Form, applicants must provide accurate personal details, financial information, details about the loan request, and any required documentation as specified by the lending institution.

What is the purpose of 2012 Borrowers’ Application Form?

The purpose of the 2012 Borrowers' Application Form is to gather essential information from borrowers to help lenders assess creditworthiness and make informed lending decisions.

What information must be reported on 2012 Borrowers’ Application Form?

The information that must be reported on the 2012 Borrowers' Application Form includes borrower identification details, income level, employment status, credit history, loan amount requested, and purpose of the loan.

Fill out your 2012 borrowers application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Borrowers Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.