Get the free IRS Offers Options When Tax Day is 'Pay' Day - irs

Show details

This document provides information and options for taxpayers on how to pay their taxes, including methods like electronic payment, credit card payments, and installment agreements for those who cannot

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs offers options when

Edit your irs offers options when form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs offers options when form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs offers options when online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs offers options when. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs offers options when

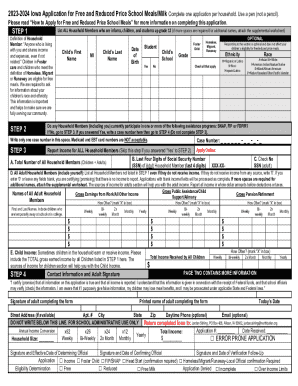

How to fill out IRS Offers Options When Tax Day is 'Pay' Day

01

Gather all necessary tax documents, including income statements and deductions.

02

Determine your overall tax liability and what you can afford to pay.

03

Research the different IRS Offer in Compromise options available to see which fits your situation.

04

Complete IRS Form 656, offering your settlement amount.

05

Submit the form along with Form 433-A (OIC) to provide details about your financial situation.

06

Pay the application fee or request a fee waiver if you qualify.

07

Wait for IRS to review your offer and respond with their decision.

Who needs IRS Offers Options When Tax Day is 'Pay' Day?

01

Individuals who are unable to pay their full tax liability due to financial hardship.

02

Taxpayers facing threats of collection actions from the IRS.

03

Those who believe that their tax debts can be settled for less than the full amount owed.

04

Individuals who have received IRS collection notices and want to negotiate a settlement.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you can't pay taxes on April 18?

An extension to file provides an additional six months with a new filing deadline of Oct. 16. Penalties and interest apply to taxes owed after April 18 and interest is charged on tax and penalties until the balance is paid in full.

What happens if you can't pay taxes by due date?

Penalty and Interest There is a 10 percent penalty for not filing your return and/or paying your full tax or fee payment on time. However, your total penalty will not exceed 10 percent of the amount of tax for the reporting period. An additional 10 percent penalty may apply, if you do not pay the tax by the due date.

What are the tax payment options for IRS?

Debit card, credit card or digital wallet For individuals and businesses. Processing fees apply. Not for payroll taxes.

How many days late can you pay your taxes?

If the return is more than 60 days late, the minimum late-filing penalty for returns due in 2025 is $510 or 100% of the tax owed, whichever is less. There's also a separate IRS penalty for paying your taxes late. This penalty is 0.5% per month on any unpaid taxes.

What are the options when you owe the IRS?

If you are an individual, you may qualify to apply online if: Long-term payment plan (installment agreement): You owe $50,000 or less in combined tax, penalties and interest, and filed all required returns. Short-term payment plan: You owe less than $100,000 in combined tax, penalties and interest.

What happens if you miss the April tax deadline?

The late filing penalty is 5% of the additional taxes owed amount for every month (or fraction thereof) your return is late, up to a maximum of 25%. If you file more than 60 days after the due date, the minimum penalty is $510 (for tax returns required to be filed in 2025) or 100% of your unpaid tax, whichever is less.

What if I can't pay my taxes by April 18th?

An extension to file provides an additional six months with a new filing deadline of Oct. 16. Penalties and interest apply to taxes owed after April 18 and interest is charged on tax and penalties until the balance is paid in full.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS Offers Options When Tax Day is 'Pay' Day?

IRS Offers Options When Tax Day is 'Pay' Day refers to various strategies provided by the IRS for taxpayers who owe taxes and may struggle to pay their tax liabilities on the due date. These options include payment plans, offers in compromise, and currently not collectible status.

Who is required to file IRS Offers Options When Tax Day is 'Pay' Day?

Taxpayers who owe federal income taxes and are unable to pay their balance in full by the tax deadline may qualify for IRS Offers Options. Individuals, businesses, and entities with outstanding tax debts can explore these options.

How to fill out IRS Offers Options When Tax Day is 'Pay' Day?

To fill out IRS Offers Options, taxpayers need to complete the relevant forms such as Form 656 (Offer in Compromise) and pay any associated fees. Additionally, they must provide financial information, including income, expenses, assets, and liabilities to support their offer.

What is the purpose of IRS Offers Options When Tax Day is 'Pay' Day?

The purpose of IRS Offers Options is to provide taxpayers with alternative solutions for settling their tax debts in a manageable way, ensuring compliance while minimizing financial burden. These options aim to help taxpayers avoid tax liens, levies, and other collection actions.

What information must be reported on IRS Offers Options When Tax Day is 'Pay' Day?

Taxpayers must report detailed financial information, which includes their total monthly income, monthly expenses, assets, liabilities, and any current financial hardship that justifies their inability to pay the full tax amount due.

Fill out your irs offers options when online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Offers Options When is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.