Get the free Instructions for Schedule C (Form 1065) - irs

Show details

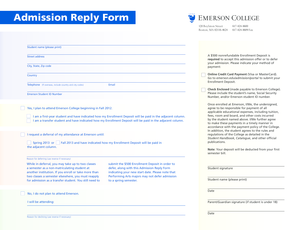

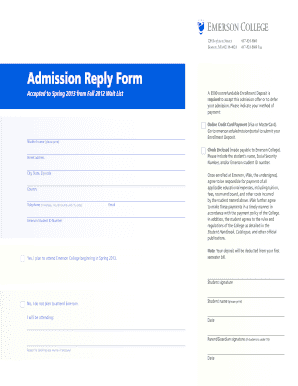

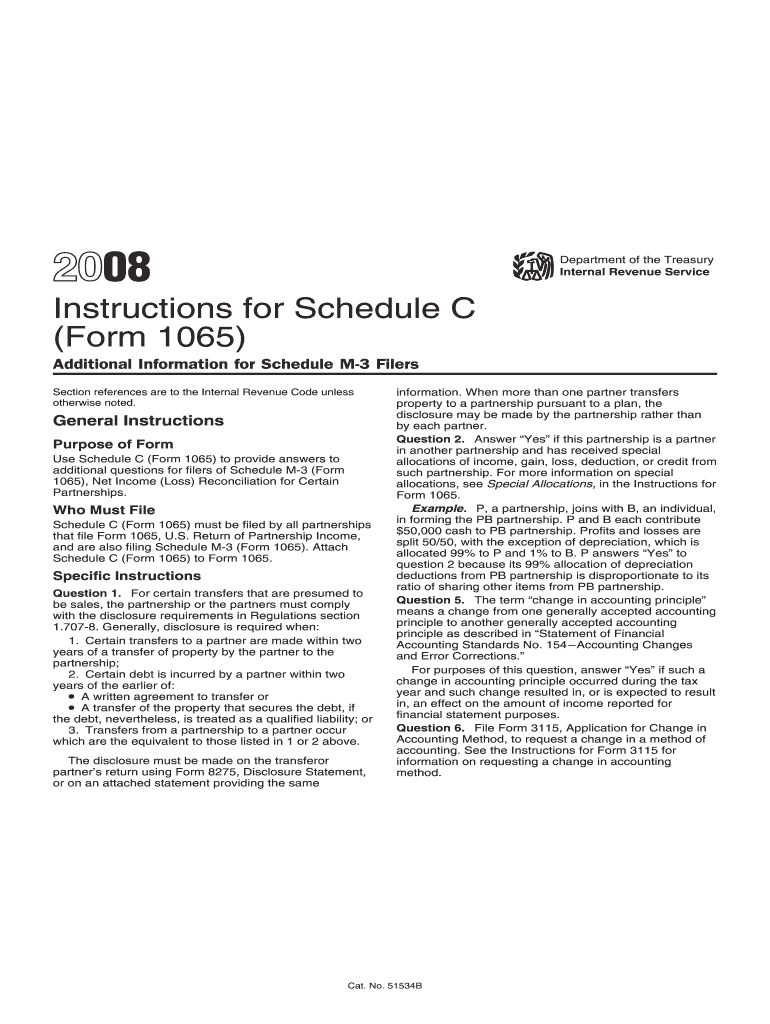

This document provides instructions for filling out Schedule C (Form 1065), which is used by partnerships to provide additional information when filing Form 1065 and Schedule M-3.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instructions for schedule c

Edit your instructions for schedule c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for schedule c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing instructions for schedule c online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit instructions for schedule c. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instructions for schedule c

How to fill out Instructions for Schedule C (Form 1065)

01

Gather all necessary financial documents, including income statements and expense receipts.

02

Download the Schedule C (Form 1065) from the IRS website or obtain a paper copy.

03

Fill out your business information at the top of the form, including the name and address of your business.

04

Enter your gross receipts or sales on line 1 of the form.

05

Deduct any cost of goods sold on line 2, if applicable.

06

List other business expenses in the appropriate sections, such as vehicle expenses, rent, utilities, etc.

07

Calculate the net profit or loss by subtracting total expenses from gross income.

08

Complete the sections for specific deductions available, such as interest expenses or depreciation.

09

Review the completed form for accuracy before submission.

10

Submit the completed Schedule C (Form 1065) along with your partnership's tax return.

Who needs Instructions for Schedule C (Form 1065)?

01

Partnerships that need to report income, gains, losses, deductions, and credits from their businesses.

02

Businesses that are classified as partnerships and need to comply with IRS regulations.

03

Taxpayers who are members of a partnership and need to report their share of business income on their tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Can I fill out my own schedule C?

You can download all versions of a Schedule C on the IRS website. You can also use online tax preparation software to access a Schedule C and complete your tax return.

What expenses are 100% tax deductible?

Small businesses can fully deduct the cost of advertising, employee wages, office supplies and equipment, business travel, and professional services like legal or accounting fees. Business insurance premiums, work-related education expenses, and bank fees are also typically 100% deductible.

What qualifies as expenses on a schedule C?

Some examples include copyrights, business licenses, domain name fees, property taxes, federal and state taxes, etc. Travel and Meals - Amounts paid for meals and travel in relation to your business.

What is counted as an expense?

An expense is a cost that a business incurs in running its operations. Expenses include wages, maintenance, rent, and depreciation. Expenses are deducted from revenue to arrive at profits. Businesses are allowed to deduct certain expenses to help alleviate their tax burden.

What is the $2500 expense rule?

Adopting the de minimis safe harbor provides several advantages: Simplified tax recordkeeping: Property owners can immediately deduct expenses for purchases like appliances or minor upgrades if they cost $2,500 or less per item. This ease of documentation aids in maintaining straightforward tax records.

What is the Schedule C for 1065?

Schedule C (Form 1065) provides essential information for partnerships to report financial activities. This form includes guidelines for reporting transfers and accounting changes. It is crucial for ensuring compliance with IRS regulations.

What supplies are expenses Schedule C?

How are supplies and materials typically reported on a Schedule C? All materials that are directly involved in the production of your products will be reported on your Schedule C under Part III - Cost of Goods Sold.

What information do I need to file form 1065?

Form 1065 instructions Profit and loss statement. Balance sheet. Deductible expenses and total gross receipts. Basic information about the partnership and the partners. Cost of goods sold (if your business sells physical goods). W-2 and W-3 forms. Form 114. Form 720.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Instructions for Schedule C (Form 1065)?

Instructions for Schedule C (Form 1065) provide guidelines on how to report income, deductions, and other financial information related to a partnership's business activities for tax purposes.

Who is required to file Instructions for Schedule C (Form 1065)?

Partnerships that are required to file Form 1065 for reporting their income and expenses are required to follow the Instructions for Schedule C (Form 1065).

How to fill out Instructions for Schedule C (Form 1065)?

To fill out Instructions for Schedule C (Form 1065), taxpayers must gather financial information about the partnership's income and expenses, complete the sections of the form as directed by the instructions, and ensure accurate reporting of business activities.

What is the purpose of Instructions for Schedule C (Form 1065)?

The purpose of Instructions for Schedule C (Form 1065) is to assist partnerships in accurately completing their tax return and ensure compliance with federal tax laws regarding partnership income and deductions.

What information must be reported on Instructions for Schedule C (Form 1065)?

Information that must be reported includes gross receipts, cost of goods sold, deductions for business expenses, and net profit or loss from the business activities of the partnership.

Fill out your instructions for schedule c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Schedule C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.