Get the free Employer's Adult Education Tax Credit - tax ri

Show details

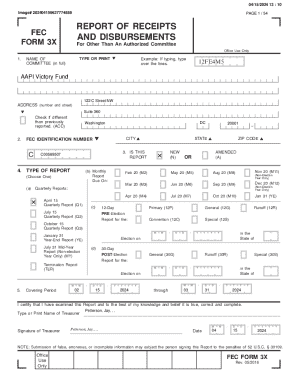

This document allows employers in Rhode Island to claim a tax credit for costs incurred for employee adult education programs. It outlines eligibility requirements, definitions, and the calculation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employers adult education tax

Edit your employers adult education tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employers adult education tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employers adult education tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit employers adult education tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employers adult education tax

How to fill out Employer's Adult Education Tax Credit

01

Collect the necessary documentation, including proof of the education provided and employee eligibility.

02

Complete the Employer's Adult Education Tax Credit application form accurately, ensuring all sections are filled out.

03

Calculate the total eligible expenses incurred for each qualifying employee's adult education.

04

Attach supporting documents such as receipts, invoices, and employee enrollment confirmations to the application.

05

Review the application for accuracy and completeness before submission.

06

Submit the application to the appropriate tax authority along with any required supplemental forms.

Who needs Employer's Adult Education Tax Credit?

01

Employers who provide adult education programs or training to their employees and wish to receive a tax credit for those expenses.

02

Businesses looking to enhance workforce skills through formal education, thereby benefiting from tax incentives.

Fill

form

: Try Risk Free

People Also Ask about

Is tuition taxable if the employer pays?

Under federal tax law, each year you can be reimbursed from your employer for up to $5,250 in tax-free tuition. This means that you don't need to report tuition reimbursement up to this limit on your federal income taxes, provided your company has a written policy that adheres to all federal tax guidelines.

Is my employer paying for my education taxable?

By law, tax-free benefits under an educational assistance program are limited to $5,250 per employee per year. Normally, assistance provided above that level is taxable as wages.

What is it called when your employer pays for your education?

Tuition reimbursement is a fringe benefit some employers offer to help their employees pay for college or continuing education costs. This added education can help you expand your knowledge and skills, making you a more valuable and versatile employee. It can also make you eligible for more raises and promotions.

Why do I not qualify for education tax credit?

The most likely reason you do not qualify for the American Opportunity Tax Credit is because you are between 18-24 and do not have a tax shown on line 11 of your 1040. In order to be eligible for the refundable portion of the tax credit that would be shown on line 17c, you would have to be over 24.

Who qualifies for the education tax credit?

You, your dependent or a third party pays qualified education expenses for higher education. An eligible student must be enrolled at an eligible educational institution. The eligible student is yourself, your spouse or a dependent you list on your tax return.

What is the tax credit for adult education?

The Lifetime Learning Tax Credit is worth 20% of your eligible education spending up to $10,000 per year. The maximum tax credit available is $2,000 if you spend $10,000 or more on qualified expenses and fall below the income limit that applies to your filing status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employer's Adult Education Tax Credit?

The Employer's Adult Education Tax Credit is a tax incentive designed to encourage employers to provide educational assistance to their employees, specifically for adult education programs that enhance skills and job performance.

Who is required to file Employer's Adult Education Tax Credit?

Employers who provide qualified educational assistance to their employees and want to claim the tax credit are required to file for the Employer's Adult Education Tax Credit.

How to fill out Employer's Adult Education Tax Credit?

To fill out the Employer's Adult Education Tax Credit form, employers need to provide information such as the number of eligible employees, the type of educational assistance provided, and the associated costs. It typically involves completing the designated IRS form and adhering to specific guidelines outlined by the IRS.

What is the purpose of Employer's Adult Education Tax Credit?

The purpose of the Employer's Adult Education Tax Credit is to promote workforce development and enhance employee skills by incentivizing employers to invest in the educational advancement of their employees.

What information must be reported on Employer's Adult Education Tax Credit?

Employers must report information such as the total amount of educational assistance provided, details about the educational programs offered, the number of employees receiving assistance, and any relevant cost information when applying for the tax credit.

Fill out your employers adult education tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employers Adult Education Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.