Get the free SURETY BOND DISCOUNT BUYING ORGANIZATION - sos ca

Show details

This document serves as a surety bond for discount buying organizations in compliance with California Civil Code Section 1812.100 et seq., ensuring financial responsibilities and legal obligations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond discount buying

Edit your surety bond discount buying form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond discount buying form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit surety bond discount buying online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit surety bond discount buying. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out surety bond discount buying

How to fill out SURETY BOND DISCOUNT BUYING ORGANIZATION

01

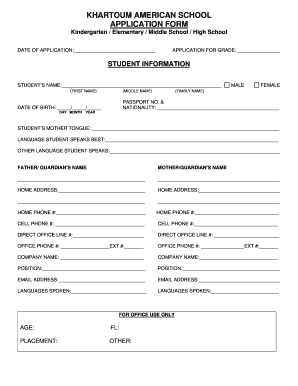

Obtain the SURETY BOND DISCOUNT BUYING ORGANIZATION application form.

02

Read the instructions carefully.

03

Fill in your personal information, including name, address, and contact details.

04

Provide your organization’s legal name and structure (e.g., LLC, Corporation).

05

Specify the type of bonds you plan to purchase under this organization.

06

Include any required financial documentation to support your application.

07

Review the completed application for accuracy.

08

Submit the application along with any necessary fees to the designated authority.

Who needs SURETY BOND DISCOUNT BUYING ORGANIZATION?

01

Businesses or individuals looking to purchase surety bonds at a discounted rate.

02

Organizations that frequently require bonding for projects or contracts.

03

Professionals seeking to reduce bonding costs through a collective purchasing agreement.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of a surety bond?

Disadvantages of Commercial Surety Bonds Cost: While commercial surety bonds are generally more affordable than other financial guarantees, they still come with a cost. Businesses must pay a premium to obtain a surety bond, which can vary depending on the bond amount and the company's financial stability.

How much does a 40000 surety bond cost?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Bad Credit (599 and below) $40,000 $400 - $1,200 $2,000 - $4,000 $50,000 $500 - $1,500 $2,500 - $5,000 $75,000 $750 - $2,250 $3,750 - $7,5007 more rows

How much does a $10 000 surety bond cost?

The cost of a surety bond is calculated as a small percentage of the total bond coverage amount — typically 0.5–10%. This means a $10,000 bond policy may cost between $50 and $1,000. For applicants with strong credit, most bond rates are 0.5–4% of the bond amount.

How much does a $50,000 surety bond cost?

$50,000 surety bonds typically cost 0.5–10% of the bond amount, or $250–$5,000.

How to calculate a surety bond?

The cost of a surety bond is calculated as a small percentage of the total bond coverage amount — typically 0.5–10%. This means a $10,000 bond policy may cost between $50 and $1,000. For applicants with strong credit, most bond rates are 0.5–4% of the bond amount.

How much does a $35000 surety bond cost?

In the case of a $35,000 surety bond, that means paying between $350 and $1,050. Get a quick estimate of your bond cost with our Surety Bond Cost Calculator below or apply online for free to receive an exact quote.

How much does a $40,000 surety bond cost?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Average Credit (600-675) $40,000 Surety Bond $400 - $1,200 $1,200 - $2,000 $50,000 Surety Bond $500 - $1,500 $1,500 - $2,500 $75,000 Surety Bond $750 - $2,250 $2,250 - $3,7509 more rows

Who is the best surety bond company?

Best Surety Bond Companies Overall The Hartford. Best Overall. Get Quote. From Tivly. Jet Surety. Best for Small Businesses. Get Quote. Call: (855) 296-2663. Travelers. Runner-Up; Best for Small Contractors. Liberty Mutual. Best for Bad Credit. Get Quote. From Tivly. Zurich. Best for Large Contractors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SURETY BOND DISCOUNT BUYING ORGANIZATION?

A Surety Bond Discount Buying Organization is a collective entity or association that facilitates the purchase of surety bonds at discounted rates, helping its members save on bonding costs.

Who is required to file SURETY BOND DISCOUNT BUYING ORGANIZATION?

Organizations that represent multiple individuals or businesses seeking to obtain surety bonds at a discounted rate are typically required to file as a Surety Bond Discount Buying Organization.

How to fill out SURETY BOND DISCOUNT BUYING ORGANIZATION?

To fill out a Surety Bond Discount Buying Organization form, one must provide relevant organizational details, member information, bonding needs, and any applicable documentation indicating the purpose of the organization.

What is the purpose of SURETY BOND DISCOUNT BUYING ORGANIZATION?

The purpose of a Surety Bond Discount Buying Organization is to provide a platform for members to purchase surety bonds at reduced rates, increasing affordability and access to bonding services.

What information must be reported on SURETY BOND DISCOUNT BUYING ORGANIZATION?

Information that must be reported usually includes the organization's name, member details, bonding requirements, financial statements, and any agreements made with surety companies.

Fill out your surety bond discount buying online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond Discount Buying is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.