Get the free Surrender of Authority - Real Estate Investment Trust - sos state oh

Show details

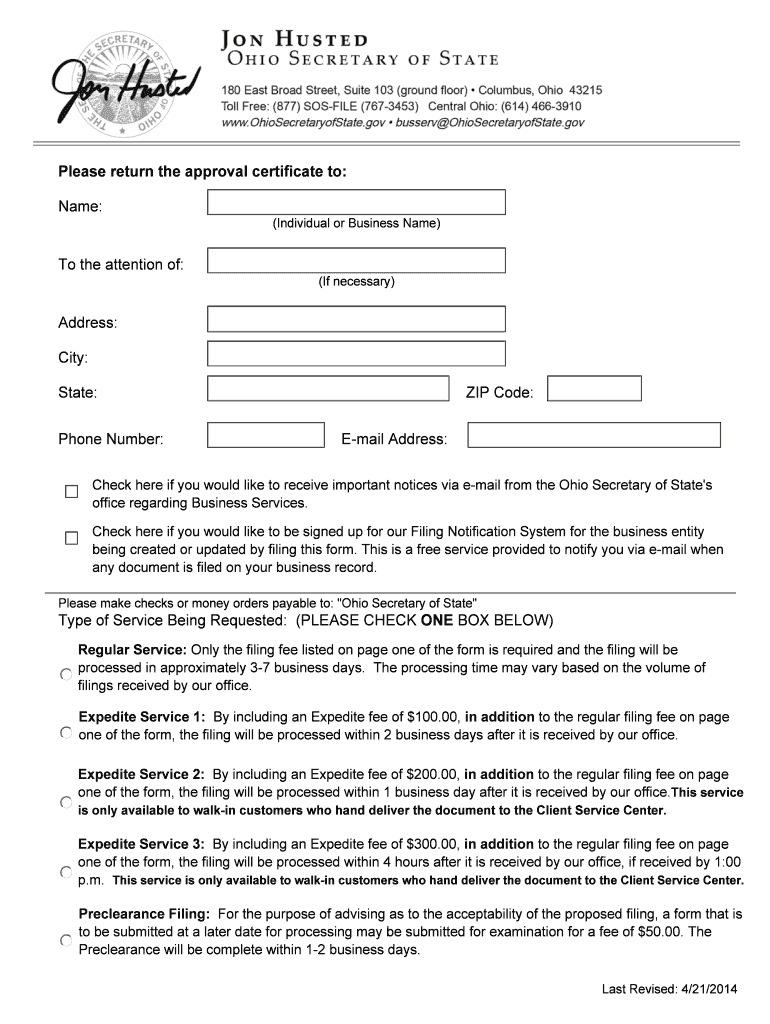

This document serves as a notice for a domestic or foreign real estate investment trust to surrender its authority to transact real estate business in Ohio, requiring the submission of a notarized

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surrender of authority

Edit your surrender of authority form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surrender of authority form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit surrender of authority online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit surrender of authority. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out surrender of authority

How to fill out Surrender of Authority - Real Estate Investment Trust

01

Obtain the Surrender of Authority form from the applicable regulatory authority or website.

02

Ensure you have the necessary information, including the name of the Real Estate Investment Trust (REIT) and the date of incorporation.

03

Fill out the identifying information of the REIT accurately on the form.

04

Provide the reason for the surrender of authority, detailing any pertinent circumstances or decisions.

05

Attach any required supporting documentation that may be needed to accompany the Surrender of Authority.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form, ensuring it is signed by an authorized representative of the REIT.

08

Submit the completed form to the appropriate regulatory body, along with any required fees.

Who needs Surrender of Authority - Real Estate Investment Trust?

01

Real Estate Investment Trusts (REITs) that are no longer operating or wish to cease their business.

02

REITs that have undergone significant restructuring or mergers and need to formalize the surrender.

03

Regulatory authorities that require documentation for compliance and record-keeping purposes.

Fill

form

: Try Risk Free

People Also Ask about

Where to mail form CA 568?

Section 2112 - Certificate of surrender (a) Subject to Section 2113, a foreign corporation which has qualified to transact intrastate business may surrender its right to engage in that business within this state by filing a certificate of surrender signed by a corporate officer or, in the case of a foreign association

How do I get consent from the New York State Tax Commission?

To obtain consent, call the New York State Tax Department Call Center at 518-485-2639. To apply with NYS Department of State, you must submit: an Application for Authority, the tax Commissioner's consent, and.

Where to mail CA certificate of surrender?

WHERE TO FILE: The Certificate of Surrender can be mailed to Secretary of State, Document Filing Support Unit, 1500 11th Street, 3rd Floor, Sacramento, CA 95814 or delivered in person to the Sacramento office. Certificates of Surrender are only filed in the Secretary of State's Sacramento office.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Surrender of Authority - Real Estate Investment Trust?

Surrender of Authority for a Real Estate Investment Trust (REIT) refers to the formal process by which a REIT relinquishes its authority to operate in a particular state or jurisdiction, often due to ceasing operations or changing its business structure.

Who is required to file Surrender of Authority - Real Estate Investment Trust?

Generally, any Real Estate Investment Trust that wishes to terminate its registration or authority to operate in a state must file the Surrender of Authority. This includes REITs that are no longer active or have decided to dissolve.

How to fill out Surrender of Authority - Real Estate Investment Trust?

Filling out the Surrender of Authority typically involves completing a specific form provided by the state where the REIT was registered. Required information often includes the name of the REIT, its registration number, the reason for surrender, and the signature of an authorized representative.

What is the purpose of Surrender of Authority - Real Estate Investment Trust?

The purpose of surrendering authority is to officially notify the state that the REIT is ceasing operations and no longer wishes to be recognized as a business entity within that jurisdiction, thereby avoiding unnecessary taxes and regulatory requirements.

What information must be reported on Surrender of Authority - Real Estate Investment Trust?

The information that typically must be reported includes the REIT's legal name, registration number, date of surrender, reason for surrender, and contact information for the REIT's representatives, along with any other state-specific requirements.

Fill out your surrender of authority online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surrender Of Authority is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.