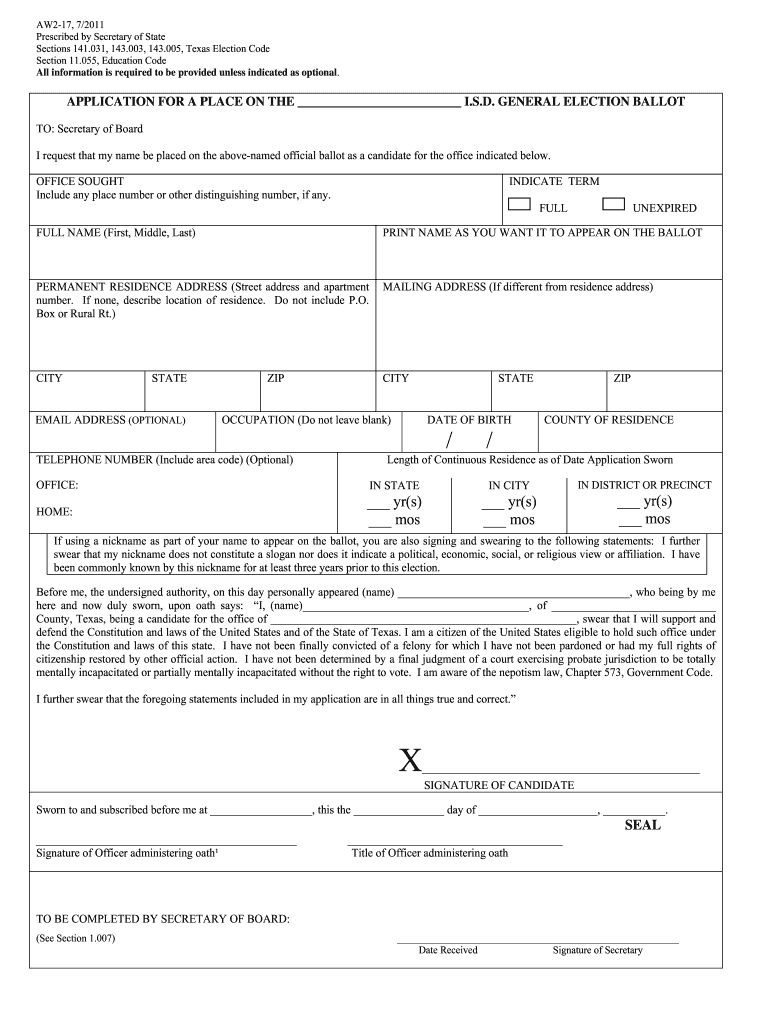

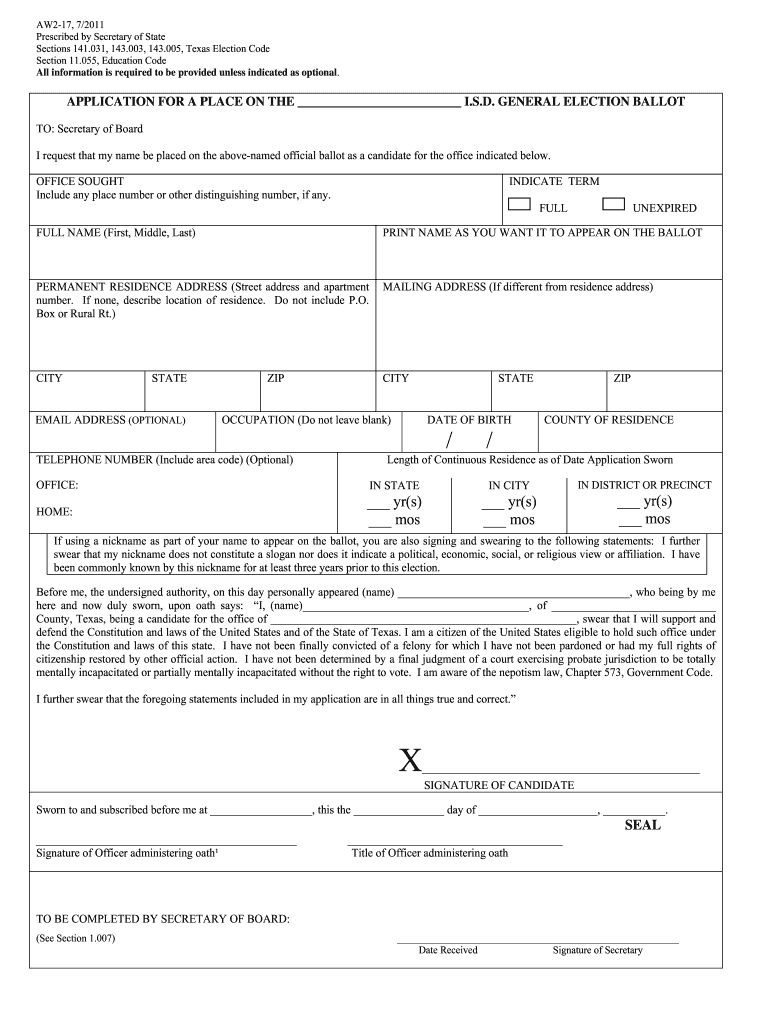

Get the free sos aw2 17 application pdf

Get, Create, Make and Sign tx sos aw2 17 download form

How to edit aw2 15 form 7 2011 fillable form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sos aw2 17 application

How to fill out sos aw2 17 application?

Who needs sos aw2 17 application?

Video instructions and help with filling out and completing sos aw2 17 application pdf

Instructions and Help about sos aw2 17 application

Laws dot-com legal forms guide wage and tax statement form w2 an employer is required to complete a wage and tax statement form labeled the w-2 for every employee this document records how much an employee has earned and how much of their income has already been set aside for various taxes and funds multiple copies of this form exist for different purposes an employer can obtain this form from the IRS website or a local office an employee will receive this document from their employer step 1 in box an employer should enter their employees social security number step 2 in boxes B and C the employer should enter their employer identification number name and address step 3 box D is for the control number the number assigned to each individual employees return step 4 box e records the employee's name and address step 5 box one records employee total earnings step six boxes three five and seven record how much of earnings are eligible for Social Security and Medicare garnishment boxes two four and six record how much of wages were withheld for federal tax Social Security and Medicare payments step seven box eight records any tips an employer thinks have been reported step eight box ten records expenses for dependent care or the cost of such services provided by an employer step nine box eleven and twelve may not apply consult official IRS instructions step ten box thirteen will indicate if an employee is statutory that his wages withheld for Social Security and Medicare but not federal income tax was enrolled in a retirement plan or received sick pay step 11 boxes 15 through 20 record taxes withheld for state and local taxes as well as the name and the location of the business step 12 complete all five copies of this form submit copy one to the state or local tax department keep copy D for employee records mail the other three copies to an employee no later than January 31st to watch more videos please make sure to visit laws com

People Also Ask about

How do I amend my LLC in Alabama?

How do I change my address with an LLC in Alabama?

How do I reserve a business name in Alabama?

What is a certificate of existence Alabama?

What is a certificate of formation in Texas?

How do I change my registered agent address in Alabama?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sos aw2 17 application?

How do I complete sos aw2 17 application on an iOS device?

Can I edit sos aw2 17 application on an Android device?

What is sos aw2 17 application?

Who is required to file sos aw2 17 application?

How to fill out sos aw2 17 application?

What is the purpose of sos aw2 17 application?

What information must be reported on sos aw2 17 application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.