TX SOS AW2-20 2011-2025 free printable template

Show details

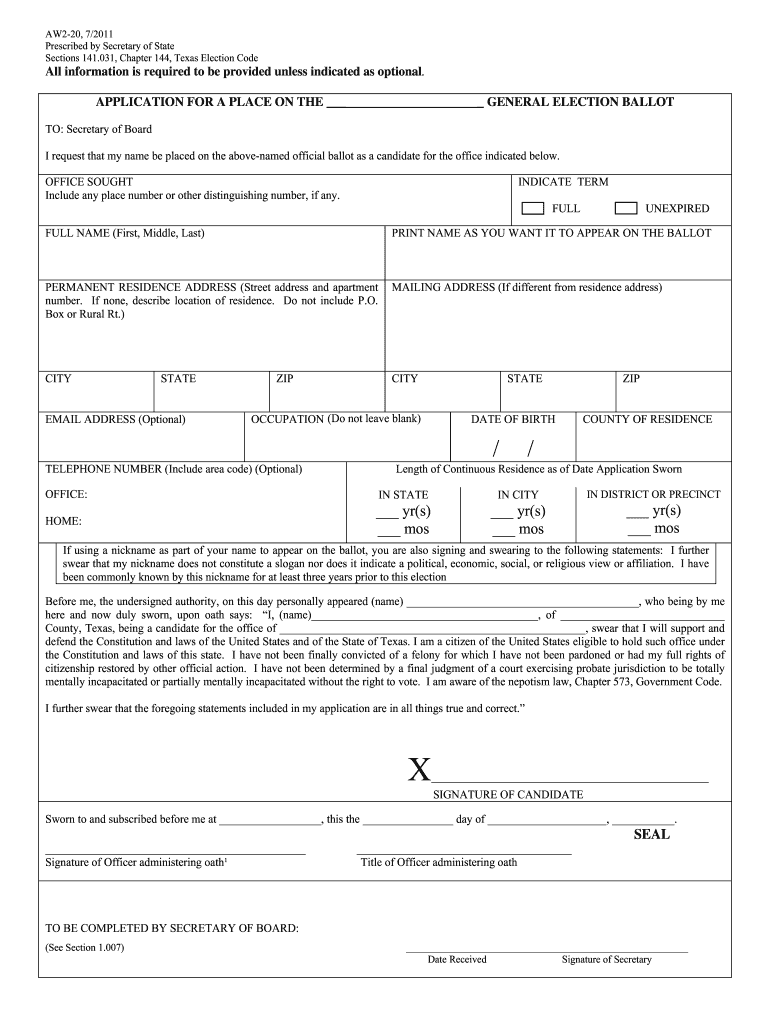

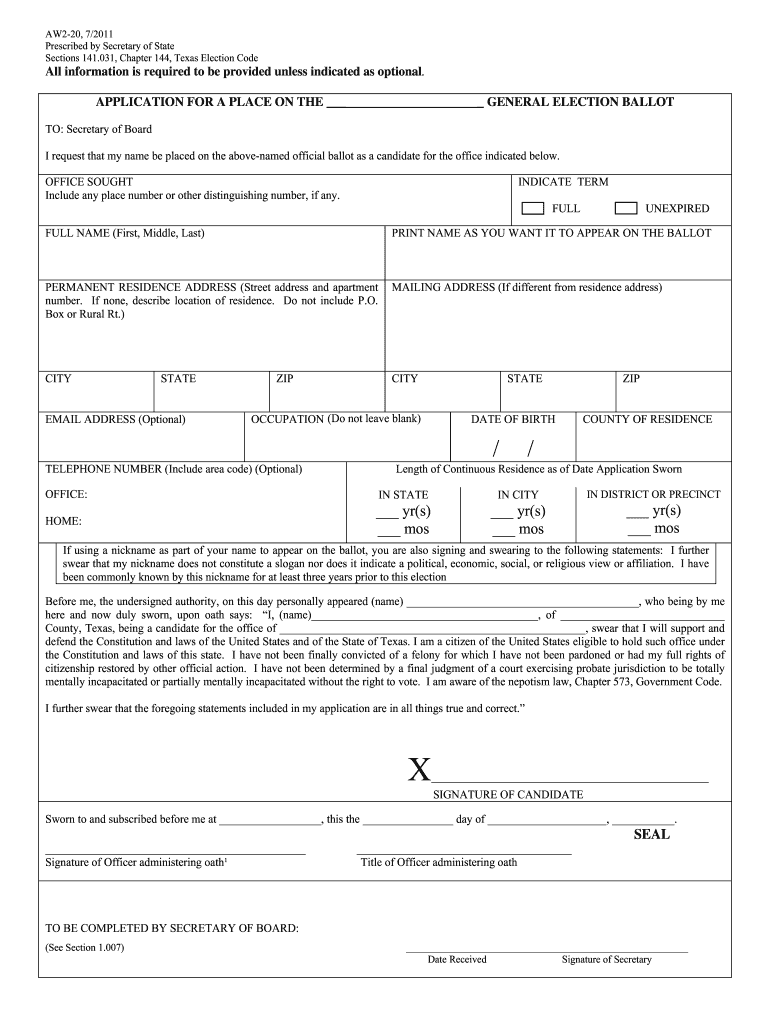

007 Date Received Signature of Secretary AW2-20 7/2011 INSTRUCTIONS The filing deadline is 5 00 p.m. 71 days prior to the election day if the election is held in May or November of an odd-numbered year except in cases where the law specifies the contrary. AW2-20 7/2011 Prescribed by Secretary of State Sections 141. 031 Chapter 144 Texas Election Code All information is required to be provided unless indicated as optional. APPLICATION FOR A PLACE ON THE GENERAL ELECTION BALLOT TO Secretary of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas aw2 20 secretary print form

Edit your texas aw2 20 edit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 aw2 20 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas aw2 20 state online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit texas aw2 state form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aw2 20 fill form

How to fill out aw2 20?

01

Begin by gathering all necessary personal information, such as your full name, address, and contact details.

02

Identify the specific sections of the form that require your attention. For example, you may need to fill out information regarding your employment history, income, and any deductions you qualify for.

03

Carefully read and follow the instructions provided with the form, ensuring that you understand each requirement before proceeding.

04

Complete each section of the form accurately and legibly, being mindful of any specific formatting or documentation requirements.

05

Double-check all entered information for any errors or omissions and make any necessary corrections.

06

Once you have reviewed and verified the accuracy of the filled-out form, sign and date it as required.

07

Make copies of the completed form for your records before submitting it according to the given instructions.

Who needs aw2 20?

01

Individuals who are employed and wish to accurately report their income and deductions to the relevant authorities.

02

Employers who are responsible for providing their employees with the necessary work-related tax documents.

03

Tax professionals or consultants who assist individuals or businesses in preparing and filing their tax returns accurately and timely.

Fill

aw2 20 pdf

: Try Risk Free

People Also Ask about

Can I print my own W-2 forms?

You can print Forms W-2 on plain 8-1/2" by 11" paper. When you print on plain paper, the employee's address is visible through a single-window, standard No. 10 business envelope (4-1/8" by 9-1/2", left-aligned window).

What if my employer did not report my wages to Social Security?

If the employer fails to provide SSA with corrected reports or information that shows the wage reports filed with SSA are correct, SSA will ask IRS to investigate the employer's wage and tax reports to resolve the discrepancy and to assess any appropriate reporting penalties.

Can you print your own W-2 forms?

You can print Forms W-2 on plain 8-1/2" by 11" paper. When you print on plain paper, the employee's address is visible through a single-window, standard No. 10 business envelope (4-1/8" by 9-1/2", left-aligned window).

How can I get a copy of my W-2 online?

In the event you lose your Form W–2, or require a duplicate copy you can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one from the State Controller's Office.

Can you print W-2 on plain paper to IRS?

Only chemically backed paper is acceptable for Form W-2 (Copy A).

What if my employer did not report my wages to social security?

If the employer fails to provide SSA with corrected reports or information that shows the wage reports filed with SSA are correct, SSA will ask IRS to investigate the employer's wage and tax reports to resolve the discrepancy and to assess any appropriate reporting penalties.

How do I fill out a new w4 form?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TX SOS AW2-20 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your TX SOS AW2-20 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get TX SOS AW2-20?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the TX SOS AW2-20 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my TX SOS AW2-20 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your TX SOS AW2-20 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is aw2 20?

AW2 20 refers to a specific form used for reporting certain information related to employment taxes.

Who is required to file aw2 20?

Employers who have paid wages to employees and are required to withhold taxes are required to file AW2 20 forms.

How to fill out aw2 20?

AW2 20 forms can be filled out by providing the necessary information about wages paid, taxes withheld, and other required details as specified by the form.

What is the purpose of aw2 20?

The purpose of AW2 20 is to report wage and tax information to the relevant tax authorities.

What information must be reported on aw2 20?

AW2 20 forms require the reporting of employee wages, tips, and other compensation, along with details of taxes withheld.

Fill out your TX SOS AW2-20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX SOS aw2-20 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.