Get the free Annual Report E-Filing Refund Policy - soswy state wy

Show details

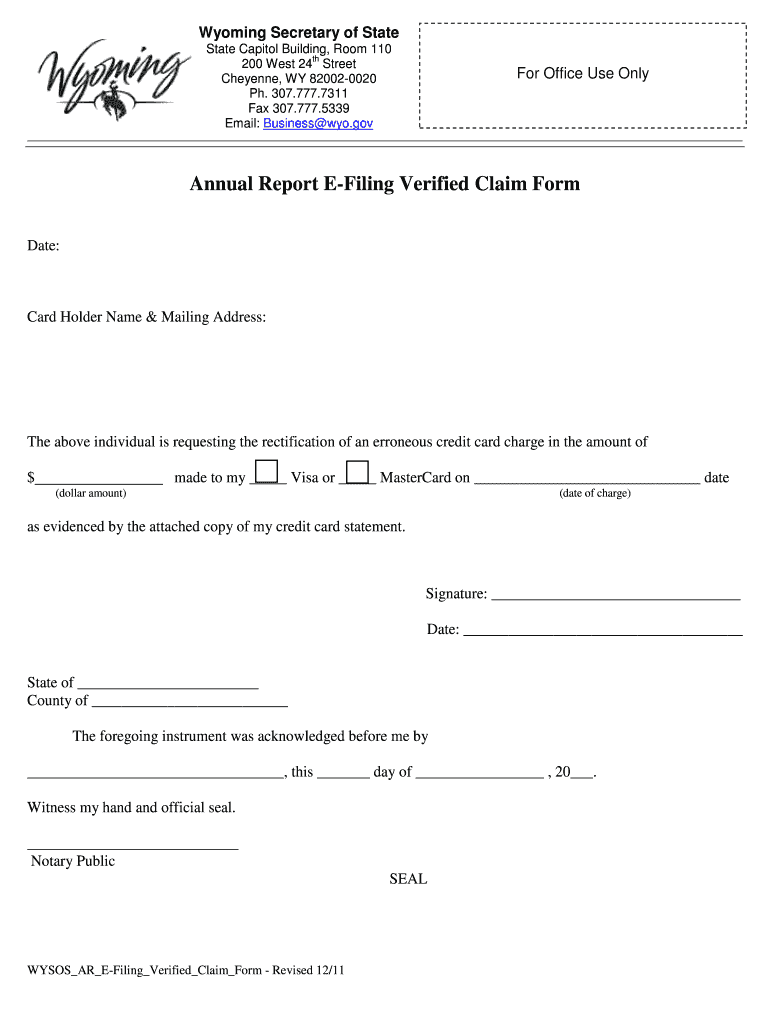

This document outlines the refund policy for erroneous credit card charges on the electronic filing of annual reports with the Wyoming Secretary of State’s Office.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual report e-filing refund

Edit your annual report e-filing refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual report e-filing refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual report e-filing refund online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual report e-filing refund. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

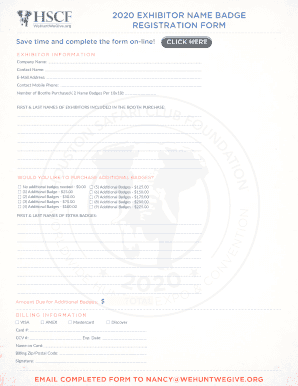

How to fill out annual report e-filing refund

How to fill out Annual Report E-Filing Refund Policy

01

Gather all necessary financial documents for the reporting year.

02

Access the Annual Report E-Filing portal on the official website.

03

Enter your business information, including name, address, and registration number.

04

Provide financial data as required, including revenue, expenses, and assets.

05

Review and confirm your entries for accuracy.

06

Locate the Refund Policy section within the filing interface.

07

Select your preferred refund method (e.g., direct deposit or check).

08

Submit the completed report and retain a copy for your records.

Who needs Annual Report E-Filing Refund Policy?

01

All businesses required to file an Annual Report with their respective regulatory authority.

02

Companies that are seeking to apply for a refund of fees paid in excess or under different circumstances.

03

Business owners who want to ensure compliance with state reporting requirements.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for IRS e-file suitability?

This suitability check may involve: a credit check; a tax compliance check; a criminal background check; and a check for prior non-compliance with IRS e-file requirements. If your application is approved, the IRS will send you an acceptance letter with your Electronic Filing Identification Number (EFIN).

What are the exceptions to the 3 year refund rule?

There are exceptions to the three- or two-year statute of limitation. The statute may be suspended during periods in which individual taxpayers are unable to manage their financial affairs due to physical or mental impairments. This is known as being financially disabled.

Are tax preparers required to file electronically?

If you are a specified tax return preparer, you are required to e-file the covered returns you prepare and file. There are certain exceptions. (See FAQ 12). In those situations, you should attach Form 8948, Preparer Explanation for Not Filing Electronically PDF, to those paper returns.

What are the IRS record keeping requirements for tax preparers?

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later if you file a claim for credit or refund after you file your return.

What are the new efile requirements?

Beginning Jan. 1, 2024, taxpayers who file more than 10 W-2s and 1099s (in aggregate) for the year are now required to electronically file all forms. Previously, the threshold was 250 returns.

Do taxpayers get their refunds fastest when they file electronically?

The fastest way for taxpayers to get their refund is to file electronically and choose direct deposit. Taxpayers who file a paper return can also choose direct deposit, but it will take longer to process the return and get a refund.

Is an annual report the same as a tax return?

Filing your state income tax return does not take care of your annual report requirement. State annual reports and state income tax returns are different things. Even if one has already been filed, the other still needs to be filed. You still need to file an annual report, even if you've never received a notice.

What are the IRS e file requirements for tax preparers?

E-file requirement for tax return preparers: The law requires tax return preparers and firms who reasonably expect to file 11 or more covered returns in calendar year 2013 and thereafter, to e-file the returns they prepare and file. For 2013, covered returns are Forms 1040, 1040-A, 1040-EZ, and 1041.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Report E-Filing Refund Policy?

The Annual Report E-Filing Refund Policy outlines the conditions under which a filing fee may be refunded to companies that submit their annual reports electronically but encounter issues such as duplicate filings or overpayments.

Who is required to file Annual Report E-Filing Refund Policy?

Any business entity required to submit an annual report electronically as mandated by state or federal regulations is subject to this policy.

How to fill out Annual Report E-Filing Refund Policy?

To fill out the Annual Report E-Filing Refund Policy, entities must complete the specified refund request form, provide necessary documentation including proof of payment, and submit the form to the appropriate regulatory authority.

What is the purpose of Annual Report E-Filing Refund Policy?

The purpose of the Annual Report E-Filing Refund Policy is to ensure fairness in the filing process by allowing businesses to recover fees in cases of error, thus promoting compliance and supporting business operations.

What information must be reported on Annual Report E-Filing Refund Policy?

Entities must report their business name, identification number, payment details, the nature of the refund request, and any documentation supporting the claim for a refund.

Fill out your annual report e-filing refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Report E-Filing Refund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.