Get the free Federal Credit Union Loans, 1948

Show details

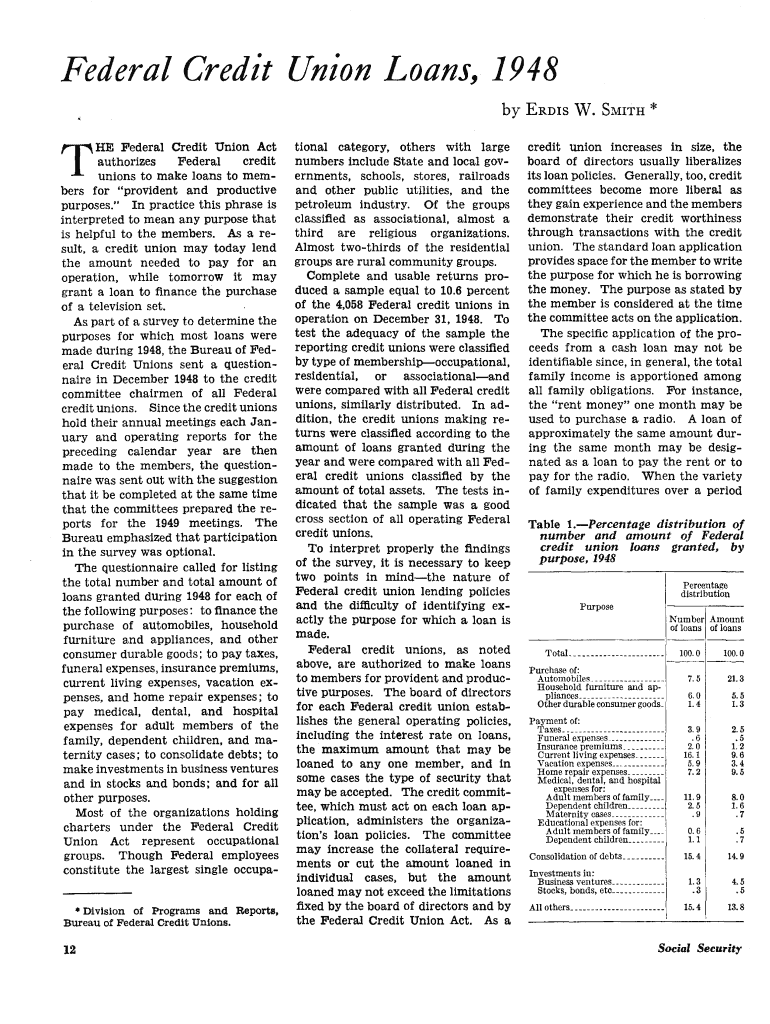

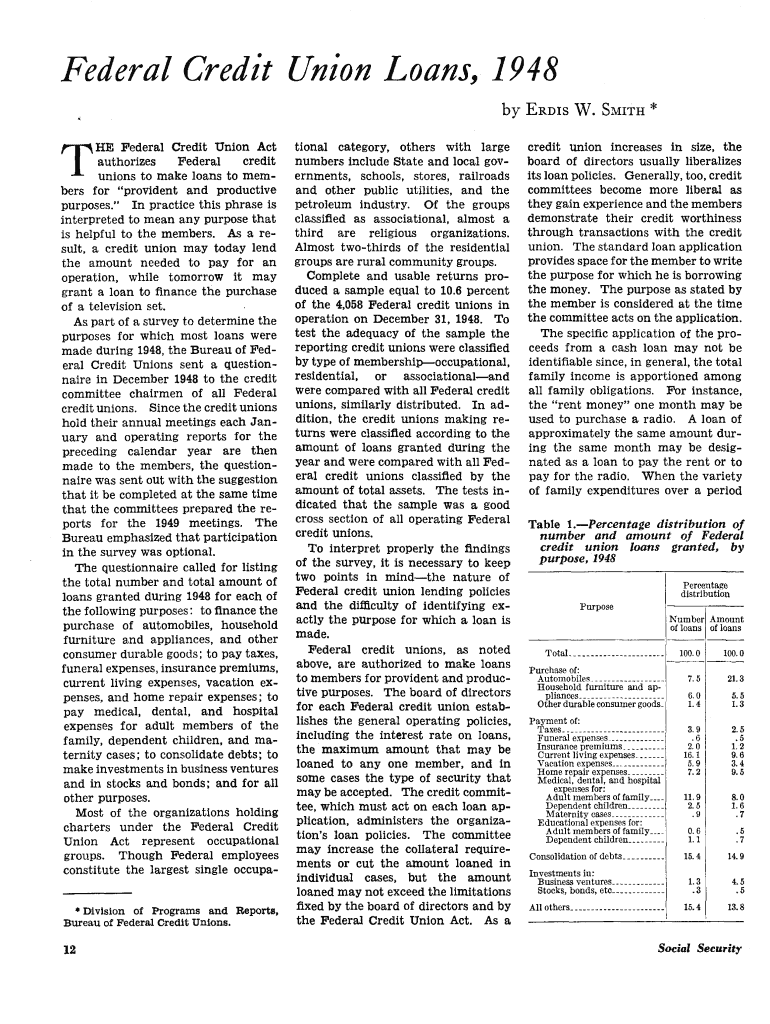

This document presents a survey conducted by the Bureau of Federal Credit Unions in 1948 to determine the purposes for which loans were made by federal credit unions, emphasizing member services for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal credit union loans

Edit your federal credit union loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal credit union loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal credit union loans online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit federal credit union loans. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal credit union loans

How to fill out Federal Credit Union Loans, 1948

01

Gather necessary personal and financial information, including income, employment history, and credit score.

02

Obtain and complete the Federal Credit Union loan application form provided by the credit union.

03

Provide documentation to support your application, such as pay stubs, tax returns, and identification.

04

Review the loan terms, including interest rates and repayment schedules, before finalizing your application.

05

Submit your completed application and documents to the Federal Credit Union for review.

06

Wait for the credit union's decision, which may involve a credit check and further verification.

07

If approved, carefully read and sign the loan agreement before receiving funds.

Who needs Federal Credit Union Loans, 1948?

01

Individuals or families seeking financing for major purchases, such as homes or vehicles.

02

Members of the Federal Credit Union looking for more favorable loan terms or interest rates compared to traditional banks.

03

Those with limited credit history or lower credit scores that may benefit from more flexible lending criteria.

04

Anyone in need of personal loans for debt consolidation, education expenses, or emergency funds.

Fill

form

: Try Risk Free

People Also Ask about

What are the three top credit unions?

Navy Federal Credit Union is the largest credit union by assets. It had $171 billion at the end of 2023. This amount is greater than the total assets of the next five largest credit unions combined. But even that dollar amount is much smaller compared to the largest bank holding companies.

What happened to credit unions during the Great Depression?

In response to the Great Depression, new credit unions were being formed to fill the void left by shuttered banks. The U.S. Credit Union National Association (CUNA) and CUNA Mutual Insurance Society initiated a new national Credit Union Day celebration in 1948.

What happened in 1934 for credit unions?

THIRTY years ago, on June 26, 1934, President Franklin Delano Roosevelt signed the Federal Credit Union Act, authorizing the 'formation of federally chartered credit unions in the IJnited States.

What was America's first credit union?

America First Credit Union was founded on March 16, 1939. It was established at Fort Douglas in Salt Lake City, Utah after 59 members of the National Federation of Federal Employees, Local No. 650, instituted the Fort Douglas Civilian Employees Credit Union.

What did the Federal Credit Union Act do?

By establishing a federal credit union system, the Federal Credit Union Act of 1934 legitimated the developing credit union movement in the United States. It encouraged savings and made credit more available to people of limited means, providing American consumers with greater spending power.

What is America's largest credit union?

Future Treasury Secretary Alexander Hamilton founds the Bank of New York, the oldest continuously operating bank in the United States—operating today as Mellon.

What is the oldest credit union in the United States?

1909. April 6, 1909 – St. Mary's Cooperative Credit Association, the first U.S. credit union, opens in Manchester, New Hampshire, with assistance from Alphonse Desjardins. Massachusetts Bank Commissioner Pierre Jay and wealthy Boston merchant Edward A.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Federal Credit Union Loans, 1948?

Federal Credit Union Loans, 1948 refers to a set of regulations and guidelines governing the lending practices of federally chartered credit unions in the United States, established to promote the financial well-being of their members.

Who is required to file Federal Credit Union Loans, 1948?

Federally chartered credit unions are required to comply with and file reports related to Federal Credit Union Loans, 1948 to ensure transparency and adherence to federal regulations.

How to fill out Federal Credit Union Loans, 1948?

To fill out Federal Credit Union Loans, 1948, credit unions must complete the necessary forms provided by the National Credit Union Administration (NCUA), detailing loan terms, member information, and compliance with the prescribed regulations.

What is the purpose of Federal Credit Union Loans, 1948?

The purpose of Federal Credit Union Loans, 1948 is to provide a framework that ensures credit unions operate safely, serve their members effectively, and adhere to federal laws that govern lending practices.

What information must be reported on Federal Credit Union Loans, 1948?

Information that must be reported includes the types of loans issued, interest rates, the number of loans, member demographics, and compliance with federal lending requirements.

Fill out your federal credit union loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Credit Union Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.