Get the free Directive 07-3: Notice to Corporate UBIT Filers - archives lib state ma

Show details

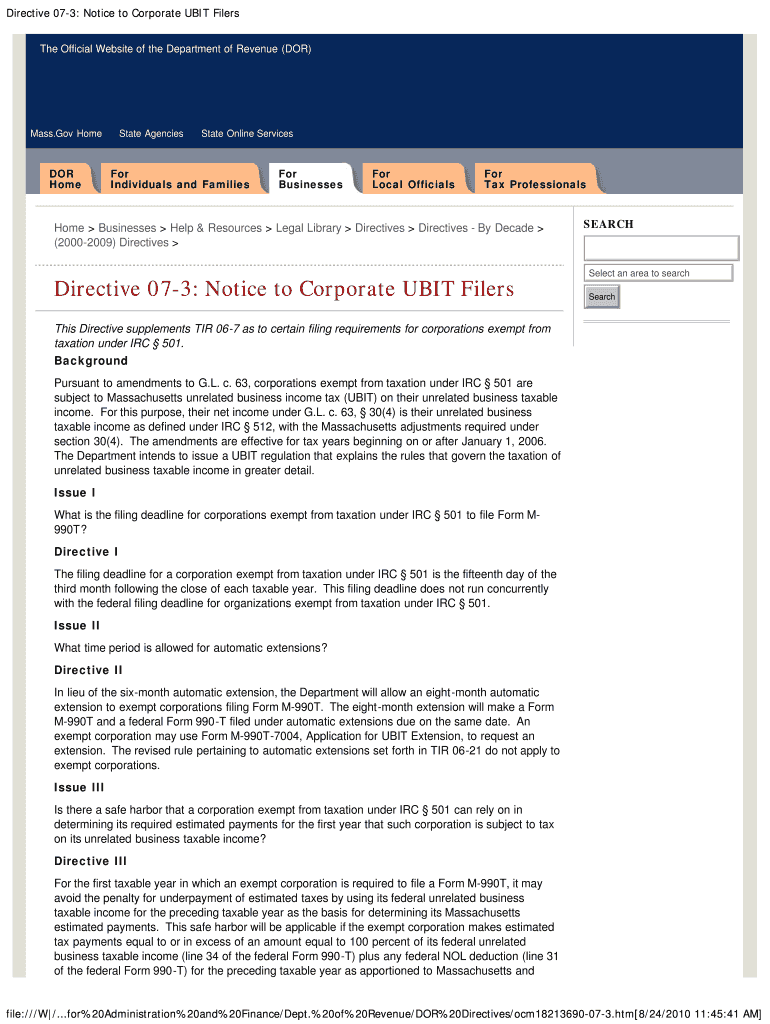

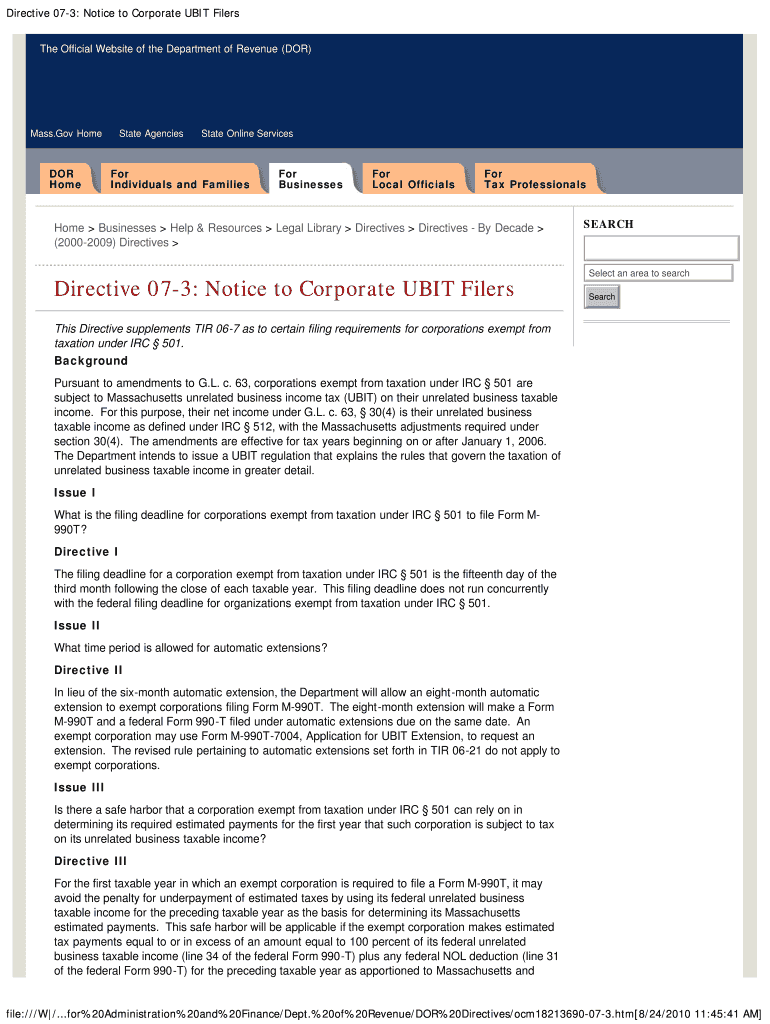

This directive provides guidance for corporations exempt from taxation under IRC § 501 regarding their filing requirements for unrelated business income tax in Massachusetts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign directive 07-3 notice to

Edit your directive 07-3 notice to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your directive 07-3 notice to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit directive 07-3 notice to online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit directive 07-3 notice to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out directive 07-3 notice to

How to fill out Directive 07-3: Notice to Corporate UBIT Filers

01

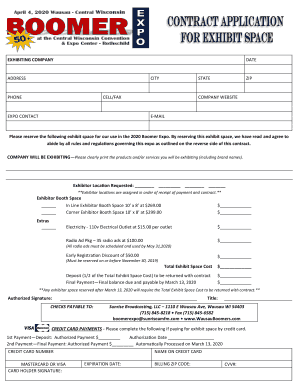

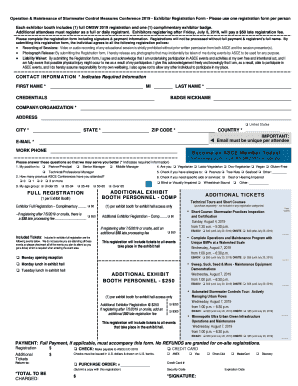

Obtain a copy of Directive 07-3: Notice to Corporate UBIT Filers.

02

Review the guidelines and instructions provided in the document.

03

Collect all necessary information regarding your corporation's unrelated business income.

04

Complete the required sections of the notice accurately.

05

Ensure that all supporting documentation is attached.

06

Double-check for any errors or omissions.

07

Submit the completed notice to the appropriate tax authority by the specified deadline.

Who needs Directive 07-3: Notice to Corporate UBIT Filers?

01

Corporations that engage in activities generating unrelated business income.

02

Tax professionals and accountants handling corporate UBIT filings.

03

Organizations seeking to understand their UBIT reporting obligations.

Fill

form

: Try Risk Free

People Also Ask about

How to avoid UBIT?

If you loan money to an entity, you won't accrue UBIT. But if you buy private equity in an entity that owns a business with debt-leverage, the tax may apply. If you buy property without leverage, you will avoid UBIT.

What is the meaning of Ubti in tax?

What is UBTI? Unrelated business taxable income is income earned by a tax-exempt entity, such as an IRA, that is not related to the exempt purpose of the tax-exempt entity. The exempt purpose of an IRA is to provide for the retirement of the IRA holder.

What is considered unrelated business taxable income?

Unrelated business income is income that is from a trade or business that is regularly carried on and that is not substantially related to the purposes that form the basis of the organization's tax-exempt status.

What is an example of unrelated business taxable income?

Understanding Unrelated Business Taxable Income (UBTI) 4 For example, income from a restaurant business that flows into an IRA is considered taxable. That's because the business activity doesn't relate to the tax-exempt purpose of providing a pension to the IRA holder.

How is UBIT calculated?

For example, if it has paid off 30% of the property while 70% remains debt-financed, only 70% of the gross UDFI is subject to UBIT. Find the difference: Subtract total deductions and exemptions from gross unrelated income. The resulting difference is your total income subject to UBIT.

What triggers UBIT in an IRA?

Unrelated Business Income Tax, or UBIT, applies to the profits of an active business owned by a tax-exempt entity such as a qualified retirement plan. For example, if an IRA invests in an unincorporated active business (such as a gas station, grocery store, etc.), the net income profit generated is subject to UBIT.

What are the exemptions for ubit?

Exemptions from UBIT include qualified corporate sponsorship payments, royalties, and convention and trade show income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Directive 07-3: Notice to Corporate UBIT Filers?

Directive 07-3: Notice to Corporate UBIT Filers is a regulatory notice issued to inform corporations of their requirement to file Unrelated Business Income Tax (UBIT) returns for activities not related to their primary nonprofit purpose.

Who is required to file Directive 07-3: Notice to Corporate UBIT Filers?

Organizations classified as tax-exempt under Internal Revenue Code Section 501(c)(3) that engage in activities generating unrelated business income are required to file Directive 07-3: Notice to Corporate UBIT Filers.

How to fill out Directive 07-3: Notice to Corporate UBIT Filers?

To fill out Directive 07-3, filers should provide the necessary identification information, describe the unrelated business activities, report the income generated from those activities, and disclose relevant expenses associated with the activities as instructed on the form.

What is the purpose of Directive 07-3: Notice to Corporate UBIT Filers?

The purpose of Directive 07-3 is to ensure compliance with tax regulations regarding unrelated business income, to assist organizations in correctly reporting income derived from non-exempt activities, and to promote transparency in financial reporting.

What information must be reported on Directive 07-3: Notice to Corporate UBIT Filers?

The information that must be reported includes the organization's identification details, a summary of unrelated business activities, total income generated from these activities, associated costs and expenses, and any deductions applicable.

Fill out your directive 07-3 notice to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Directive 07-3 Notice To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.