Get the free Directive 95-11: Exempt Sales of Machinery, Materials, Tools and Fuel to Corporation...

Show details

This document discusses the sales tax exemption for machinery, materials, tools, and fuel purchased by corporations for use during government-mandated testing phases prior to product manufacture.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign directive 95-11 exempt sales

Edit your directive 95-11 exempt sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your directive 95-11 exempt sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit directive 95-11 exempt sales online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit directive 95-11 exempt sales. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

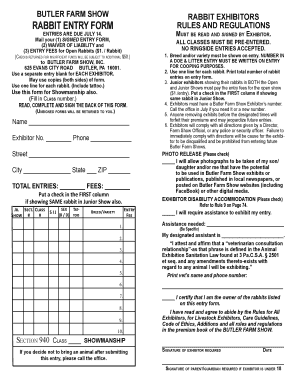

How to fill out directive 95-11 exempt sales

How to fill out Directive 95-11: Exempt Sales of Machinery, Materials, Tools and Fuel to Corporations During Government Mandated Testing Phase of Operations

01

Obtain a copy of Directive 95-11 from the relevant government agency.

02

Review the eligibility criteria outlined in the directive to ensure your corporation qualifies.

03

Gather necessary documentation including proof of governmental testing mandate, and detailed descriptions of the machinery, materials, tools, and fuel to be purchased.

04

Complete the application form provided in Directive 95-11, ensuring all required information is filled out accurately.

05

Submit the application along with the supporting documentation to the designated office as indicated in the directive.

06

Wait for confirmation that your application has been approved before proceeding with any exempt purchases.

07

Keep a copy of all submitted documents and correspondence for your records.

08

As purchases are made, ensure that suppliers are informed about the exemption status to avoid being charged sales tax.

Who needs Directive 95-11: Exempt Sales of Machinery, Materials, Tools and Fuel to Corporations During Government Mandated Testing Phase of Operations?

01

Corporations that are mandated by the government to undergo testing phases of operations for compliance or safety reasons.

02

Businesses that require machinery, materials, tools, and fuel specifically for the purpose of completing government-mandated testing.

03

Companies seeking to minimize costs during testing phases through tax exemptions on relevant purchases.

Fill

form

: Try Risk Free

People Also Ask about

Do North Dakota sales tax exemption certificates expire?

Many states' tax exemption certificates have no expiration: Arizona (the seller chooses the period of exemption); Arkansas; Colorado (this can depend on the purpose of the exemption); Georgia; Hawaii; Idaho; Indiana; Maine; Minnesota; Mississippi; Nebraska; New Mexico; New Jersey, New York, North Carolina; North Dakota

What qualifies you to be a tax exempt individual?

You generally don't have to pay taxes if your income is less than the standard deduction or the total of your itemized deductions, if you have a certain number of dependents, if you work abroad and are below the required thresholds, or if you're a qualifying non-profit organization.

Who is exempt from sales tax in Massachusetts?

Some customers are exempt from paying sales tax under Massachusetts law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

What items are exempt from sales tax in Texas?

Grocery stores and convenience stores not only sell food products, they also sell a wide variety of other items and services – some of them taxable, and others nontaxable. For example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to Texas sales and use tax.

How do I get a sales tax exemption certificate?

Generally, to obtain a sales tax exemption certificate, an exempt institution must first have a valid sales tax account. That account number is put on a form certificate issued by that state and the certificate can be used to purchase goods tax-free.

How can I get an exemption certificate?

You can apply for a medical exemption certificate (MedEx) if you have one of the medical conditions listed here. To apply, your doctor should provide you with an application form. If you're not sure about the name of your condition, speak to your doctor.

Do Oklahoma sales tax exemption certificates expire?

Many states' tax exemption certificates have no expiration: Arizona (the seller chooses the period of exemption); Arkansas; Colorado (this can depend on the purpose of the exemption); Georgia; Hawaii; Idaho; Indiana; Maine; Minnesota; Mississippi; Nebraska; New Mexico; New Jersey, New York, North Carolina; North Dakota

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Directive 95-11: Exempt Sales of Machinery, Materials, Tools and Fuel to Corporations During Government Mandated Testing Phase of Operations?

Directive 95-11 is a regulation that provides exemptions from sales tax for machinery, materials, tools, and fuel sold to corporations during a government-mandated testing phase of operations, allowing companies to operate without the burden of additional tax during this specific period.

Who is required to file Directive 95-11: Exempt Sales of Machinery, Materials, Tools and Fuel to Corporations During Government Mandated Testing Phase of Operations?

Corporations that engage in operations mandated by the government that require the use of specific machinery, materials, tools, and fuel are required to file Directive 95-11.

How to fill out Directive 95-11: Exempt Sales of Machinery, Materials, Tools and Fuel to Corporations During Government Mandated Testing Phase of Operations?

To fill out Directive 95-11, corporations must provide details about the exempt sales, including the type of machinery, materials, tools, and fuel purchased, the purpose of the exemption, and relevant operational testing phases as mandated by the government.

What is the purpose of Directive 95-11: Exempt Sales of Machinery, Materials, Tools and Fuel to Corporations During Government Mandated Testing Phase of Operations?

The purpose of Directive 95-11 is to reduce the financial impact of sales tax on corporations during critical government-mandated testing phases, thereby facilitating smoother operations and compliance with regulatory requirements.

What information must be reported on Directive 95-11: Exempt Sales of Machinery, Materials, Tools and Fuel to Corporations During Government Mandated Testing Phase of Operations?

The information that must be reported on Directive 95-11 includes the corporation's identification details, a description of the exempted items, the specific testing phase of operations, and any other relevant information necessary to substantiate the exemption claim.

Fill out your directive 95-11 exempt sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Directive 95-11 Exempt Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.