Get the free Foreign Professional Limited Liability Company Annual Report - sec state ma

Show details

Annual report required for foreign professional limited liability companies operating in Massachusetts, detailing company information, members, and compliance with state regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign professional limited liability

Edit your foreign professional limited liability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign professional limited liability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foreign professional limited liability online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit foreign professional limited liability. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

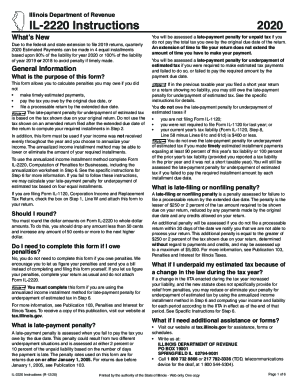

How to fill out foreign professional limited liability

How to fill out Foreign Professional Limited Liability Company Annual Report

01

Gather essential information about your Foreign Professional Limited Liability Company (FPLLC), including your entity name, principal office address, and business registration number.

02

Review the previous year's Annual Report to ensure consistency and accuracy in the information.

03

Fill out the required sections, which typically include management details, business activities, and registered agent information.

04

Provide any updates regarding ownership or changes in company structure since the last report.

05

Ensure compliance with state-specific requirements regarding signature and notary, if applicable.

06

Calculate any applicable fees and prepare payment for submission.

07

Submit the completed Annual Report along with the payment to the designated state authority by the deadline.

Who needs Foreign Professional Limited Liability Company Annual Report?

01

All Foreign Professional Limited Liability Companies operating in the state must file an Annual Report to maintain good standing and legal compliance.

Fill

form

: Try Risk Free

People Also Ask about

What annual reports are needed for LLC?

While state policies vary, almost all LLCs have to file an LLC annual report with their state of operation. Annual reports are short documents that provide updated information about your business, including the name and address of the LLC, the people who run it, and its registered agent.

Do I need to register my LLC in Massachusetts?

To start an LLC, you'll file a Certificate of Organization with the Secretary of the Commonwealth. The filing fee for the Certificate is $500. An LLC only legally exists after the state approves its certificate of organization, which provides a public record of its name and contact information.

Can a US LLC be owned by a foreign company?

More In File Each state may use different regulations, you should check with your state if you are interested in starting a Limited Liability Company. Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities.

Do I have to register a foreign LLC in Massachusetts?

Except as listed herein, a foreign LLC which owns registered land must file with the Massachusetts Secretary of State. It is not required that a foreign LLC, LLP, or LP which is not the owner, but is a member, partner, manager etc. in a tiered signature chain, be registered in Massachusetts.

How do I get a company's annual report?

The US Securities and Exchange Commission (SEC) database of corporate filings. Contains annual reports, press releases, and other public documents for most public companies in the US. Note that annual reports are "10-K" forms for the SEC.

How much does it cost to register a foreign entity in Massachusetts?

Corporations Division Filing Fees Domestic Profit and Professional Corporations Foreign and Foreign Professional Corporations Registration in Massachusetts $400.00 ($375 if filed by fax) Certificate of Amendment $100.00 Certificate of Withdrawal $100.00138 more rows

Do I need to register as a foreign LLC in Massachusetts?

Except as listed herein, a foreign LLC which owns registered land must file with the Massachusetts Secretary of State. It is not required that a foreign LLC, LLP, or LP which is not the owner, but is a member, partner, manager etc. in a tiered signature chain, be registered in Massachusetts.

What is foreign limited liability company LLC?

It's a limited liability company doing business in other states. For example, if your state of origin is New Jersey, you would form a Foreign LLC to do business in Massachusetts. Most states require the formation of a Foreign LLC if you operate within their borders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Foreign Professional Limited Liability Company Annual Report?

The Foreign Professional Limited Liability Company Annual Report is a document that foreign professional LLCs must submit to the state to provide updates on their business operations and compliance with state laws. It typically includes information about the company's structure, ownership, and financial status.

Who is required to file Foreign Professional Limited Liability Company Annual Report?

Foreign professional limited liability companies that are registered to conduct business in a particular state are required to file the Annual Report. This includes all foreign LLCs that provide professional services in the state.

How to fill out Foreign Professional Limited Liability Company Annual Report?

To fill out the Foreign Professional Limited Liability Company Annual Report, you need to gather the required information about the company, including its name, registration details, and the names of members or managers. You can then complete the form, which is usually available online or through the appropriate state agency.

What is the purpose of Foreign Professional Limited Liability Company Annual Report?

The purpose of the Foreign Professional Limited Liability Company Annual Report is to maintain the company's good standing with the state, provide transparency regarding business operations, and ensure compliance with relevant legal requirements.

What information must be reported on Foreign Professional Limited Liability Company Annual Report?

The information that must be reported on the Foreign Professional Limited Liability Company Annual Report typically includes the company's name, state of formation, principal office address, registered agent information, and names of members or managers, as well as any business changes that have occurred over the reporting period.

Fill out your foreign professional limited liability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Professional Limited Liability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.