Get the free OPENING AN ESTATE - WITHOUT A WILL - courts state nh

Show details

This document provides necessary forms and instructions for initiating an estate administration case in New Hampshire for individuals who have passed away without a will.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign opening an estate

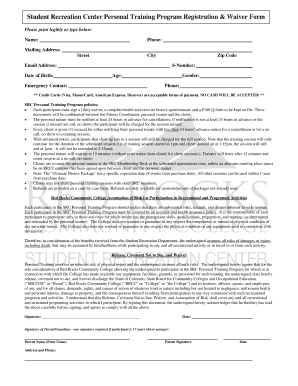

Edit your opening an estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your opening an estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit opening an estate online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit opening an estate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

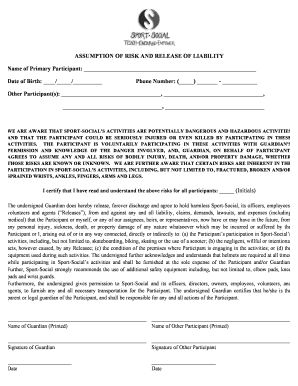

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

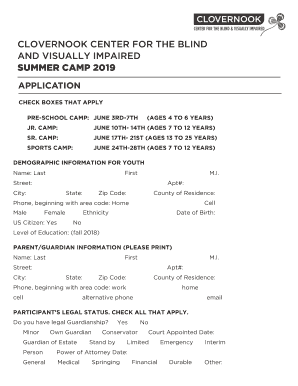

How to fill out opening an estate

How to fill out OPENING AN ESTATE - WITHOUT A WILL

01

Identify the deceased person and gather necessary information such as full name, date of death, and last known address.

02

Determine the heirs and their relationship to the deceased, as they will inherit the estate.

03

Obtain a death certificate as it is often required for the estate opening process.

04

File a petition for probate in the appropriate court. This may require filling out specific forms and paying a filing fee.

05

Notify all interested parties, including heirs and potential claimants against the estate, about the probate proceedings.

06

Appoint an administrator for the estate, as there is no will to designate an executor.

07

Inventory the deceased's assets and liabilities, including property, bank accounts, and debts.

08

Manage the estate's ongoing expenses and settle debts as necessary during the probate process.

09

Distribute the remaining assets to the heirs according to state intestacy laws, which dictate how assets are divided without a will.

10

Complete and file the final accounting with the probate court to conclude the probate process.

Who needs OPENING AN ESTATE - WITHOUT A WILL?

01

Anyone whose loved one has passed away without leaving a will.

02

Heirs who want to claim their inheritance legally.

03

Individuals seeking to settle the estate of a deceased person for whom they were not designated in a will.

04

Family members or dependents of the deceased who may be entitled to inherit under state intestacy laws.

Fill

form

: Try Risk Free

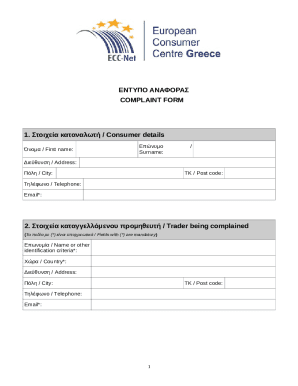

People Also Ask about

How to open an estate account without a will?

Banks typically require legal documentation, such as a death certificate and court-issued letters of administration, to open one. This type of account helps separate the estate's funds from personal finances, streamlining the probate process and ensuring transactions are properly documented.

Who is considered the next of kin in NJ?

Who is considered next of kin? We require spouse and children to be listed. IF decedent has a child who predeceased him or her and that child produced grandchildren, the those grandchildren must be listed. IF there is NO spouse or children, you would list the decedent's parents.

Do you inherit anything if you have no will in NJ?

If you lack a spouse or children, your parents inherit everything. Without a spouse, children, or parents, your siblings inherit everything. A spouse inherits everything if no children, parents, or siblings are present. If you have children but no spouse, the children inherit everything.

What is the order of inheritance in New Jersey?

Spouse inherits the first 25% (not less than $50,000 or more than $200,000) and three-quarters of the remaining estate. Surviving parents inherit the balance. Parents inherit everything. Siblings inherit everything.

Can an executor decide who gets what if there is no will?

The answer would be the decedent's heirs, who may consist of their surviving spouse, children, grandchildren, parents, siblings, and nieces and nephews, among others. To put it simply, even when there is no will, the administrator does not have the authority to decide who gets what.

How to become administrator of an estate without a will?

If you'd like to file as the executor of an estate with no will, we've outlined 6 steps for you to follow: Find out your place in line. Obtain waivers from other family members. Contact the court. File your administration petition. Go to the probate hearing. Get a probate bond.

Who inherits in NJ if there is no will?

The answer would be the decedent's heirs, who may consist of their surviving spouse, children, grandchildren, parents, siblings, and nieces and nephews, among others. To put it simply, even when there is no will, the administrator does not have the authority to decide who gets what.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OPENING AN ESTATE - WITHOUT A WILL?

Opening an estate without a will refers to the legal process of administering the estate of a deceased person who did not leave a will, ensuring that their assets are distributed according to state laws.

Who is required to file OPENING AN ESTATE - WITHOUT A WILL?

Typically, a close relative or heir of the deceased, such as a spouse, child, or sibling, is required to file for opening an estate without a will.

How to fill out OPENING AN ESTATE - WITHOUT A WILL?

To fill out the necessary forms for opening an estate without a will, you must provide details about the deceased, their assets, debts, and beneficiaries, and submit the completed forms to the appropriate probate court.

What is the purpose of OPENING AN ESTATE - WITHOUT A WILL?

The purpose of opening an estate without a will is to legally settle the deceased's financial affairs, distribute their assets according to the law, and address any debts owed by the deceased.

What information must be reported on OPENING AN ESTATE - WITHOUT A WILL?

Information that must be reported includes the name and date of death of the deceased, a list of their assets and liabilities, details of heirs or beneficiaries, and any relevant financial documents.

Fill out your opening an estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Opening An Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.