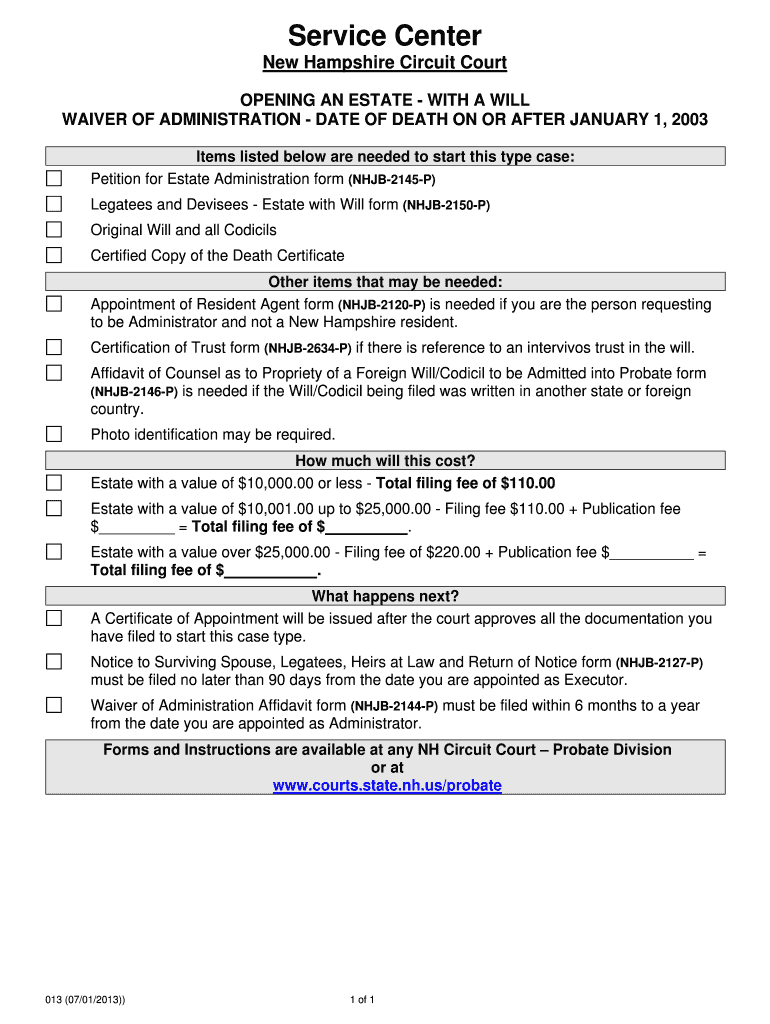

Get the free WAIVER OF ADMINISTRATION - DATE OF DEATH ON OR AFTER JANUARY 1, 2003 - courts state nh

Show details

This document provides instructions and requirements for opening an estate in New Hampshire when a will is present, including necessary forms, filing fees, and procedural steps.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign waiver of administration

Edit your waiver of administration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your waiver of administration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit waiver of administration online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit waiver of administration. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out waiver of administration

How to fill out WAIVER OF ADMINISTRATION - DATE OF DEATH ON OR AFTER JANUARY 1, 2003

01

Obtain the WAIVER OF ADMINISTRATION form from your local court or online from a government website.

02

Fill in the decedent's full name and date of death on the form.

03

List the names and addresses of all beneficiaries or interested parties.

04

Sign the form in the presence of a notary public if required.

05

Submit the completed form to the appropriate probate court along with any required filing fee.

Who needs WAIVER OF ADMINISTRATION - DATE OF DEATH ON OR AFTER JANUARY 1, 2003?

01

Individuals who are named beneficiaries in an estate where the decedent died on or after January 1, 2003.

02

Heirs of the decedent who wish to waive the formal administration of the estate.

03

Parties interested in settling the estate without a full probate process.

Fill

form

: Try Risk Free

People Also Ask about

How do you know when an estate is settled?

Some key indicators an estate has been settled include: All taxes and debts have been paid. Assets have been distributed. Closure documents have been filed. There are no pending claims or disputes.

What is the difference between letters testamentary and administration?

Intestacy: Dying without a will In New Hampshire in the absence of a will, a surviving spouse inherits the entire estate unless the decedent and the spouse share descendants, in which case the spouse inherits the first $250,000 of the estate plus half the balance.

What happens when the administrator of an estate dies?

If the executor dies during the probate process, a successor executor can step in to finish the estate settlement. That assumes, however, that the testator was forward-thinking enough to name one or more successor executors to prevent the estate from being left without one.

What is the purpose of the administrative letter?

In summary, the primary difference between Letters of Administration and Letters Testamentary in California lies in whether there is a valid will. Letters of Administration are issued when there is no will, and an administrator is appointed to handle the estate ing to intestacy laws.

What happens after a Letter of Administration after death?

Identifying and securing assets: The administrator must locate and safeguard all assets belonging to the deceased, including property, bank accounts, investments, and personal belongings. It's now their responsibility to ensure these are properly managed.

What to do when you get letters of administration after death?

Once you have letters of administration and are appointed administrator, you can take action to pay off the estate's debts, sell property to liquidate assets and distribute assets to all eligible heirs.

What is the purpose of a letter of administration?

A Letter of Administration is a legal document that grants authority to an individual or individuals to manage the financial affairs and assets of someone who has died without a will. This document is issued by the court when there is no executor named in the decedent's will if one exists.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WAIVER OF ADMINISTRATION - DATE OF DEATH ON OR AFTER JANUARY 1, 2003?

WAIVER OF ADMINISTRATION is a legal document that allows heirs or beneficiaries to bypass the formal probate process for the estate of a deceased individual who died on or after January 1, 2003, effectively enabling the distribution of the estate without appointing an administrator.

Who is required to file WAIVER OF ADMINISTRATION - DATE OF DEATH ON OR AFTER JANUARY 1, 2003?

Heirs or beneficiaries of the deceased individual are typically required to file the WAIVER OF ADMINISTRATION, indicating their agreement to waive the appointment of a personal representative for the settlement of the estate.

How to fill out WAIVER OF ADMINISTRATION - DATE OF DEATH ON OR AFTER JANUARY 1, 2003?

To fill out the WAIVER OF ADMINISTRATION, you must provide information such as the deceased's name, date of death, and details about the heirs or beneficiaries. Each eligible heir must sign the document, indicating their consent to waive formal administration.

What is the purpose of WAIVER OF ADMINISTRATION - DATE OF DEATH ON OR AFTER JANUARY 1, 2003?

The purpose of the WAIVER OF ADMINISTRATION is to simplify the estate settlement process, allowing heirs to quickly and efficiently distribute the deceased's assets without the delays and costs associated with probate.

What information must be reported on WAIVER OF ADMINISTRATION - DATE OF DEATH ON OR AFTER JANUARY 1, 2003?

The information that must be reported includes the deceased individual's full name, date of death, details of the heirs or beneficiaries, a declaration of the estate's value, and each signer’s acknowledgment of waiving the need for an administrator.

Fill out your waiver of administration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Waiver Of Administration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.