Get the free Demanda del Contribuyente sobre Impuestos Locales a Inmuebles - judiciary state nj

Show details

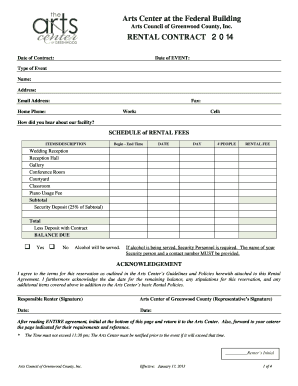

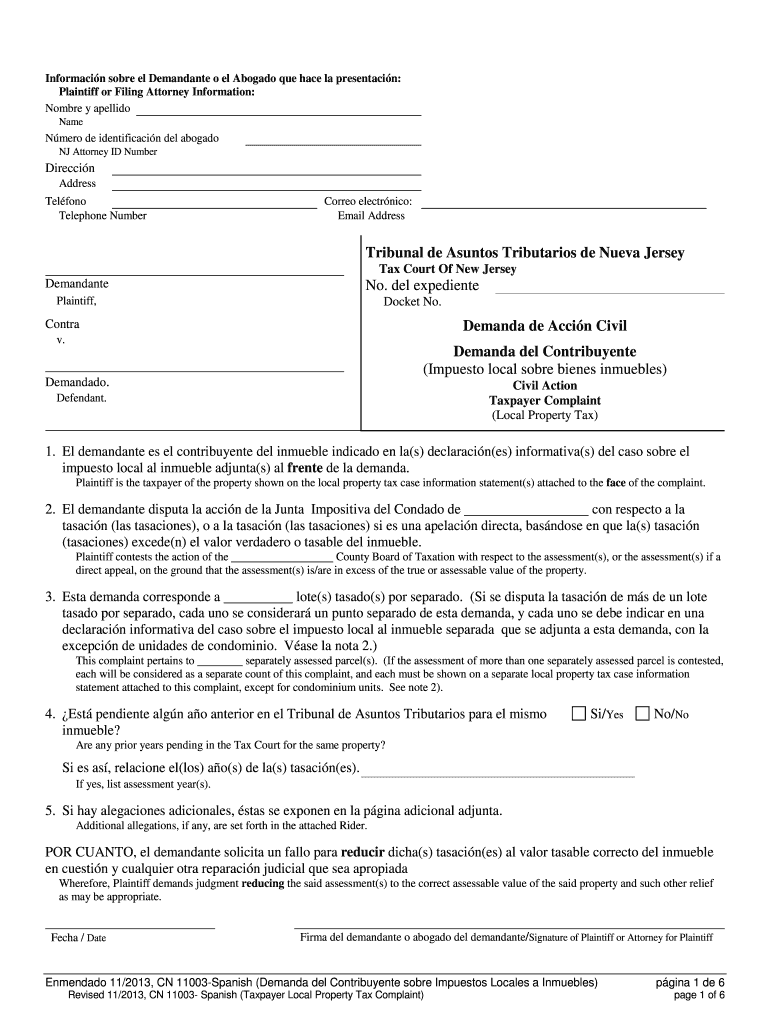

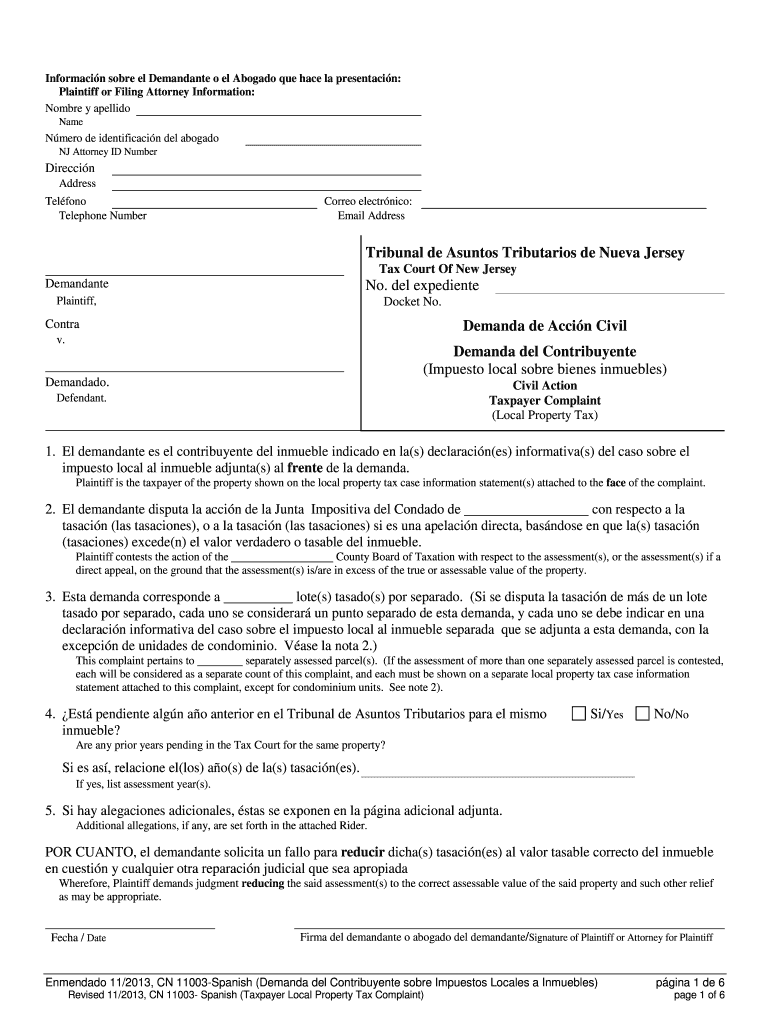

This document is used by a taxpayer to contest a local property tax assessment made by the County Board of Taxation, seeking judicial relief to reduce property assessments.

We are not affiliated with any brand or entity on this form

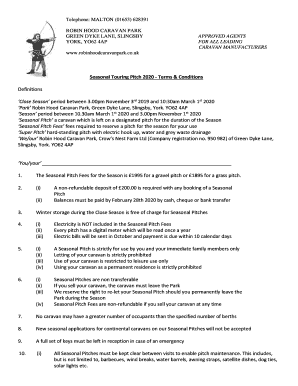

Get, Create, Make and Sign demanda del contribuyente sobre

Edit your demanda del contribuyente sobre form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your demanda del contribuyente sobre form via URL. You can also download, print, or export forms to your preferred cloud storage service.

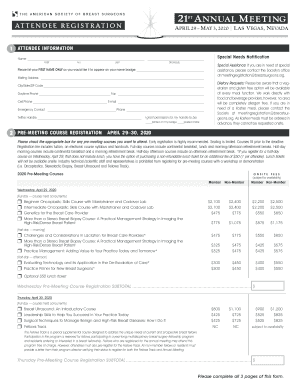

How to edit demanda del contribuyente sobre online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit demanda del contribuyente sobre. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out demanda del contribuyente sobre

How to fill out Demanda del Contribuyente sobre Impuestos Locales a Inmuebles

01

Begin by obtaining the official form of Demanda del Contribuyente sobre Impuestos Locales a Inmuebles.

02

Fill out your personal information, including your full name, address, and identification number.

03

Indicate the property for which you are challenging local taxes, specifying its location and description.

04

Clearly state your reason for disputing the tax amount, providing any supporting evidence or documentation.

05

Detail any previous communications or actions taken regarding this tax dispute.

06

Sign and date the form at the designated areas.

07

Make copies of the completed form and any supporting documents for your records.

08

Submit the completed form to the appropriate local tax authority office, ensuring you meet any deadlines.

Who needs Demanda del Contribuyente sobre Impuestos Locales a Inmuebles?

01

Property owners who believe they are being overtaxed or are disputing local property tax assessments.

02

Individuals or businesses seeking a formal review of local taxes on real estate.

03

Anyone who has received an assessment notice from local tax authorities and wishes to contest it.

Fill

form

: Try Risk Free

People Also Ask about

¿Quién cobra los impuestos locales?

Los impuestos locales son impuestos sobre la renta que cobran los gobiernos locales . A diferencia de los impuestos federales y estatales sobre la renta, los impuestos locales generalmente se aplican a quienes viven o trabajan en la localidad.

¿Qué es una exención de impuestos a la propiedad?

Condiciones de calificación Usted es elegible para esta exención si, debido a una enfermedad o discapacidad mental o física de largo plazo, usted: no ha vivido en su residencia única o principal durante 12 meses o más . o no ha podido vivir en su residencia única o principal durante menos de 12 meses y es poco probable que regrese a su

¿Quién está exento de pagar impuestos sobre la propiedad en los EE.UU?

Las exenciones comunes del impuesto predial incluyen veteranos, veteranos discapacitados, vivienda familiar, mayores de 65 años y más . Dependiendo de su lugar de residencia, podría solicitar varias exenciones del impuesto predial. No todos los veteranos ni propietarios de vivienda califican para estas exenciones. Las exenciones pueden variar según el condado y el estado.

¿Cómo se llama el impuesto predial en Estados Unidos?

Los impuestos prediales (¨property tax¨ en inglés) son aquellos que el dueño de una propiedad debe pagar al condado. La cantidad de estos impuestos depende de muchos factores, siendo los más importantes la ubicación y el valor de la vivienda o terreno.

¿Quién está exento de pagar impuestos en Estados Unidos?

Ingresos mínimos para estar exento de declarar impuestos Personas solteras menores de 65 años: si sus ingresos anuales fueron menores a US$14.600, no es necesario que presenten una declaración.

¿Quién suele estar exento del impuesto sobre la propiedad?

Una exención de impuestos a la propiedad brinda alivio de los impuestos a la propiedad a personas y grupos elegibles, incluidas organizaciones religiosas, entidades gubernamentales, personas mayores, veteranos y propietarios de viviendas con discapacidades .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Demanda del Contribuyente sobre Impuestos Locales a Inmuebles?

Demanda del Contribuyente sobre Impuestos Locales a Inmuebles is a legal claim filed by property taxpayers to contest or appeal decisions made by local tax authorities regarding property taxes.

Who is required to file Demanda del Contribuyente sobre Impuestos Locales a Inmuebles?

Property owners or taxpayers who disagree with the local government's assessment or taxation related to their properties are required to file this demand.

How to fill out Demanda del Contribuyente sobre Impuestos Locales a Inmuebles?

To fill out the Demanda, taxpayers typically need to provide personal identification information, property details, the basis of their dispute, and any evidence supporting their claim.

What is the purpose of Demanda del Contribuyente sobre Impuestos Locales a Inmuebles?

The purpose is to allow taxpayers to formally challenge the assessments or decisions made by local tax authorities, ensuring a fair review process.

What information must be reported on Demanda del Contribuyente sobre Impuestos Locales a Inmuebles?

The demand must report the taxpayer's identification details, property address, tax assessment information, the nature of the contestation, and any supporting documents.

Fill out your demanda del contribuyente sobre online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Demanda Del Contribuyente Sobre is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.