Get the free APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION - state tn

Show details

This document serves as an application for businesses wishing to register for franchise and excise tax in Tennessee, requiring detailed business and owner information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for franchise excise

Edit your application for franchise excise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for franchise excise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for franchise excise online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for franchise excise. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

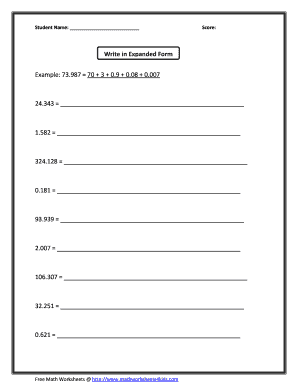

How to fill out application for franchise excise

How to fill out APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION

01

Obtain the APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION form from the relevant tax authority website or office.

02

Fill in the applicant's personal information, including name, address, and contact details.

03

Provide business details such as the business name, type, and address.

04

Indicate the nature of the business for which the excise tax registration is being applied.

05

Complete the financial information section as required, including estimated revenues and expenses.

06

Sign and date the application to certify that the information provided is accurate.

07

Submit the completed application form to the appropriate local or state tax office, either in person or via mail.

08

Keep a copy of the submitted application and any confirmation received for your records.

Who needs APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION?

01

All businesses intending to sell goods or services that require excise tax compliance.

02

Franchise owners looking to legally operate within a specific jurisdiction.

03

Anyone engaging in taxable activities that fall under local or state excise tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the Fae 170 form in Tennessee?

Who needs a form FAE 170? Form FAE 170 is created for small business owners to report franchise and excise tax and income to the Department of Revenue. This form in particular is designed for entrepreneurs in the State of Tennessee.

How to make a payment on tntap account?

To make a payment while logged in to your TNTAP account: Log in to TNTAP. Select the account to apply the payment. Click “Make a Payment” link in the “I Want To” section. Choose ACH Debit or Credit Card and fill in the information requested. Click “Submit” to complete the payment.

Where do I pay excise tax?

Often, the retailer, manufacturer or importer must pay the excise tax to the IRS and file the Form 720.

How to pay Tennessee franchise and excise tax online?

Pay while logged into TNTAP: Log into TNTAP. Select your FAE Account and Period, then select the “Make a Payment” link in the “I Want To” section. Choose ACH Debit or Credit Card, and then fill in the information requested. Once completed, click the “Submit” button.

Does an LLC pay franchise and excise tax in Tennessee?

If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

Does a single member LLC pay franchise and excise tax in Tennessee?

A SMLLC will not be disregarded if its single member is not classified as a corporation for federal tax purposes. In such cases, the SMLLC will be treated as a separate entity for franchise and excise tax purposes, and it must file its own separate franchise and excise tax return.

How do I register for TN franchise and excise tax?

You can register for franchise & excise tax online using the Tennessee Taxpayer Access Point (TNTAP). After your account is established, then complete the Consolidated Net Worth Election application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION?

APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION is a formal document that businesses must submit to the appropriate government authority to register for franchise taxes or excise taxes, which are taxes imposed on specific goods and services, and can also apply to the gross income of businesses.

Who is required to file APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION?

Any business entity that engages in activities subject to franchise or excise taxes is required to file this application, which can include corporations, partnerships, and sole proprietorships depending on the jurisdiction.

How to fill out APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION?

To fill out the application, one must typically gather all relevant business information, such as the business name, address, tax identification number, and details regarding the type of business activities, and then complete the specific sections of the application form as directed by the governing tax authority.

What is the purpose of APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION?

The purpose of the application is to formally notify tax authorities of a business's existence and activities that are subject to franchise or excise taxes, allowing the government to assess and collect the appropriate taxes.

What information must be reported on APPLICATION FOR FRANCHISE, EXCISE TAX REGISTRATION?

The application generally requires information such as the business name, address, type of ownership, contact information, description of business activities, and possibly financial projections or past tax information, depending on local regulations.

Fill out your application for franchise excise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Franchise Excise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.