Get the free Basic Life Insurance Enrollment Form - wvde state wv

Show details

This form is used by employees to enroll for basic life insurance coverage through the Public Employees Insurance Agency (PEIA) in West Virginia, including beneficiary designations and tobacco usage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign basic life insurance enrollment

Edit your basic life insurance enrollment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your basic life insurance enrollment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing basic life insurance enrollment online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit basic life insurance enrollment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out basic life insurance enrollment

How to fill out Basic Life Insurance Enrollment Form

01

Obtain the Basic Life Insurance Enrollment Form from your employer or insurance provider.

02

Fill in your personal information including name, address, date of birth, and Social Security number.

03

Indicate your employment details such as job title, department, and hire date.

04

Provide the requested coverage amount and beneficiary information, including the beneficiary's name, relationship, and contact details.

05

Review the eligibility criteria and confirm your understanding by signing and dating the form.

06

Submit the completed form to your HR department or designated insurance representative by the specified deadline.

Who needs Basic Life Insurance Enrollment Form?

01

Individuals looking to secure financial protection for their beneficiaries in the event of their death.

02

Employees who are offered basic life insurance as part of their employee benefits package.

03

New hires who are enrolling in employer-sponsored life insurance for the first time.

04

Those who want to ensure their loved ones are financially supported in case of unexpected circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is basic life enrollment?

Basic life insurance is commonly offered by employers, providing coverage for a specific period of the policyholder's lifetime. Coverage amount is based on the policyholder's salary; beneficiaries receive the death benefit if the policyholder passes away.

How to fill out a life insurance beneficiary form?

Life Insurance can be defined as a contract between an insurance policy holder and an insurance company, where the insurer promises to pay a sum of money in exchange for a premium, upon the death of an insured person or after a set period.

Should you enroll in basic life insurance?

Basic life insurance is often cost-effective, especially for younger and healthier individuals, and does not require medical underwriting. However, basic coverage may be limited, and evaluating your financial needs and considering supplemental policies if necessary is essential.

What is the most basic form of life insurance?

Term life insurance is the most basic and usually the most affordable. Policies can be purchased for a specified period of time. If you die within the time period defined in your policy, the insurance company will pay your beneficiaries the face value of your policy.

What is the difference between basic life and whole life insurance?

Term life is more affordable but lasts only for a set period of time. On the other hand, whole life insurance tends to have higher premiums but never expires. Knowing the differences between term and whole life insurance will help you choose a policy that works best for you and your lifestyle.

What does the basic term life insurance mean?

It's a contract: At its most basic level, a term life policy is an agreement between the person who owns the policy (the owner) and an insurance company: The owner agrees to pay a premium for a specific term (usually between 10 and 30 years); in return, the insurance company promises to pay a specific death benefit to

What does basic life mean in insurance?

Basic life insurance is typically a form of term life insurance, offering coverage for a specified period, often ranging from 10 to 30 years. It provides a death benefit, a lump-sum payment to beneficiaries if the insured passes away during the term. This coverage is usually limited and often employer-provided.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Basic Life Insurance Enrollment Form?

The Basic Life Insurance Enrollment Form is a document used to enroll individuals in a basic life insurance plan offered by an employer or insurance provider.

Who is required to file Basic Life Insurance Enrollment Form?

Generally, employees who wish to enroll in basic life insurance coverage provided by their employer are required to file the Basic Life Insurance Enrollment Form.

How to fill out Basic Life Insurance Enrollment Form?

To fill out the Basic Life Insurance Enrollment Form, individuals should provide personal information such as name, address, date of birth, and select coverage options as required by the form.

What is the purpose of Basic Life Insurance Enrollment Form?

The purpose of the Basic Life Insurance Enrollment Form is to officially enroll employees in a basic life insurance policy and to gather necessary information for the insurance provider.

What information must be reported on Basic Life Insurance Enrollment Form?

The information that must be reported on the Basic Life Insurance Enrollment Form typically includes the participant's personal details, beneficiary information, and any specific coverage amounts selected.

Fill out your basic life insurance enrollment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Basic Life Insurance Enrollment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

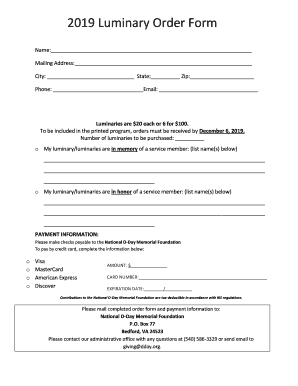

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.