Get the free Industrial Business Property Return - state wv

Show details

This document serves as a tax return for industrial property owners in West Virginia, requiring detailed reports of owned, leased, and depreciated assets, following state tax regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign industrial business property return

Edit your industrial business property return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your industrial business property return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing industrial business property return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit industrial business property return. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out industrial business property return

How to fill out Industrial Business Property Return

01

Begin by gathering all relevant information about your business property, including property addresses, types of businesses, and nature of operations.

02

Access the Industrial Business Property Return form, which is usually available from your local government or revenue agency's website.

03

Fill out the identifying information section, including your business name, address, and contact details.

04

Provide detailed descriptions of each industrial property you own or lease, listing the size, age, and type of industrial use.

05

Report the assessed value of the property, which may involve market research or consulting with a property appraiser.

06

Include any exemptions or deductions you may qualify for, such as those for environmental assessments or energy efficiency improvements.

07

Complete any required financial information, such as revenue generated from the property or expenses incurred.

08

Review your entries for accuracy and completeness before signing and dating the form.

09

Submit the completed form by the specified deadline, ensuring you have copies for your records.

Who needs Industrial Business Property Return?

01

Owners of industrial properties, including factories, warehouses, and manufacturing plants, must file this return to report property details to the local government.

02

Businesses that operate in leased industrial spaces may also need to complete the return if required by their jurisdiction.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a personal property?

Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property. Just as some loans—mortgages, for example—are secured by real property like a house, some loans are secured by personal property.

What are examples of business use property?

Business Personal Property is the assets of the business. Desks, chairs, file cabinets, computers, printers, copiers, phones, fire extinguishers, shelving, trash cans, cleaning supplies, decor, hand trucks, forklifts, and other machinery and equipment are all personal property assets and must be reported per ORS.

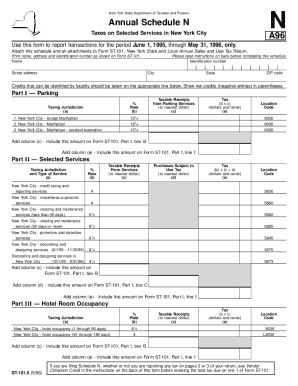

Why do commercial tenants pay property taxes?

There's a reason for that, as there are some rare circumstances when renters pay property tax instead of the landlord: Triple-Net Leases - In commercial real estate, tenants with a triple-net lease (NNN) agree to cover property taxes, insurance, and maintenance costs in addition to rent.

How do I write off my business property?

How to write off property taxes for commercial real estate Confirm that your property qualifies for a tax deduction. Gather statements and receipts to document the amounts and dates of payments. Determine the deductible portion of each expense ing to IRS limits. Complete the tax forms.

What is a business personal property tax example?

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

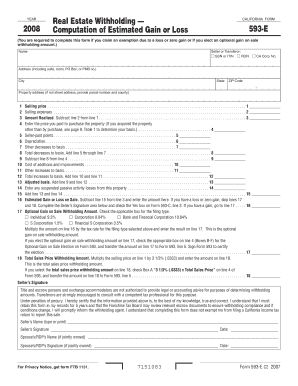

How do you report the sale of business property?

If you sold any business property last year like equipment, vehicles or livestock, you'll have to file Form 4797 to report any gains on your taxes.

What is classified as business personal property?

In general, Business Personal Property is all property owned or leased by a business except: Real Property (land, buildings and other improvements), and. Business Inventory (items held for sale)

What is the business personal property tax?

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Industrial Business Property Return?

The Industrial Business Property Return is a form used by businesses to report the value and characteristics of their industrial property to local taxing authorities for assessment purposes.

Who is required to file Industrial Business Property Return?

Businesses that own or lease industrial property, such as manufacturing plants, warehouses, and distribution centers, are required to file the Industrial Business Property Return.

How to fill out Industrial Business Property Return?

To fill out the Industrial Business Property Return, businesses need to provide details regarding the property location, type of property, year of acquisition, assessed value, and any improvements made to the property.

What is the purpose of Industrial Business Property Return?

The purpose of the Industrial Business Property Return is to ensure accurate property valuation for taxation, assist in the assessment of property taxes, and help local governments maintain updated records of industrial properties.

What information must be reported on Industrial Business Property Return?

The information that must be reported includes property identification details, ownership information, description of the property, its use, the value of the property, and any relevant improvements or alterations made.

Fill out your industrial business property return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Industrial Business Property Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.