Get the free APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE - state wv

Show details

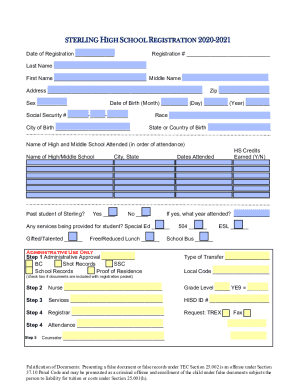

This document is an application form intended for businesses to request a refund of their business license registration fee in West Virginia, as per the state code requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for refund of

Edit your application for refund of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for refund of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for refund of online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for refund of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for refund of

How to fill out APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE

01

Obtain the APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE form from the appropriate government website or office.

02

Fill out the applicant's information, including name, address, and contact details.

03

Provide details of the business, including the business name, license number, and type of business.

04

State the reason for the refund request clearly and provide any necessary supporting documentation.

05

Calculate the amount to be refunded and ensure it matches the amount paid initially.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form along with any supporting documents to the appropriate government office, either by mail or in person.

08

Keep a copy of the submitted application for your records.

Who needs APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE?

01

Any business owner who has applied for a business license and paid the registration fee but needs to cancel or has been denied the license.

02

Individuals or organizations that have inadvertently overpaid their business license registration fees.

Fill

form

: Try Risk Free

People Also Ask about

Should I remove the registration sticker when selling a car in Texas?

No that will be the responsibility of the new owner. Upon selling your car, take the plates off of it and the registration sticker in addition to any toll tags you may have in it. This way the new owner will have to register it in their name.

Can you claim car registration fees in Texas?

Texas, Florida, and New York are examples of states where these fees are not deductible. However, other states like Arkansas allow residents to deduct vehicle registration fees, specifically the value-based ad valorem tax paid as part of vehicle registration.

How do I issue a refund on total registration?

Click the Over Paid link on your Dashboard to view a list of students that may need refunds. Refunds are reserved for students who need money returned. Click Refund to enter a refund. Scroll to the bottom and enter the amount to be refunded and a note.

How do I get a refund on my registration in Texas?

Submitting a Refund Claim The party that paid the tax in error should submit the refund claim on Form 14-202, Texas Claim for Refund of Motor Vehicle Tax, Diesel Motor Vehicle Surcharge and/or Commercial Vehicle Registration Surcharge (PDF).

What is the statute of limitations on Texas franchise tax refund?

The statute of limitations for assessment of additional franchise tax, as well as for filing franchise tax refund claims, is generally four years from the date the tax becomes due and payable, but the starting date for that four-year period can vary depending on whether a taxable entity requests an extension for filing

How do I claim my Texas sales tax refund?

To request a refund from the Comptroller's office, you must: submit a claim in writing that states fully and in detail each reason or ground on which the claim is founded. Download Form 00-957-Texas Claim for Refund (PDF); identify the period during which the claimed overpayment was made; and.

What is the assignment of right to refund form in Texas?

Form 00-985 may also be used to assign the right to refund from a permitted purchaser (assignor) to another (assignee), assuming the assignor has the right to assign the refund. An assignor is a person who transfers rights, property or benefits to another.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE?

The APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE is a formal request submitted by a business to recover fees paid for a business license that is no longer needed or has been overpaid.

Who is required to file APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE?

Any business entity or individual that has paid a business license registration fee and believes they are eligible for a refund due to specific circumstances, such as overpayment or cancellation of the license, is required to file this application.

How to fill out APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE?

To fill out the APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE, obtain the application form from the relevant governing body, provide required personal and business details, state the reason for the refund, attach supporting documents, and submit it according to the provided instructions.

What is the purpose of APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE?

The purpose of the APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE is to facilitate the process for businesses to recover fees that were mistakenly paid, are no longer applicable, or were paid in excess.

What information must be reported on APPLICATION FOR REFUND OF BUSINESS LICENSE REGISTRATION FEE?

The application must include the business name, contact information, license number, date of payment, amount paid, reason for the refund request, and any relevant documentation that supports the claim.

Fill out your application for refund of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Refund Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.