WV WV/NRER 2008 free printable template

Show details

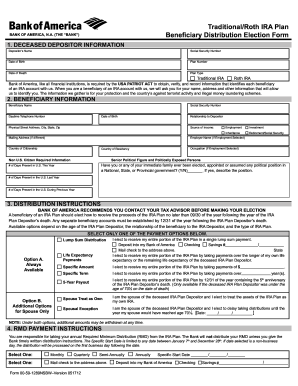

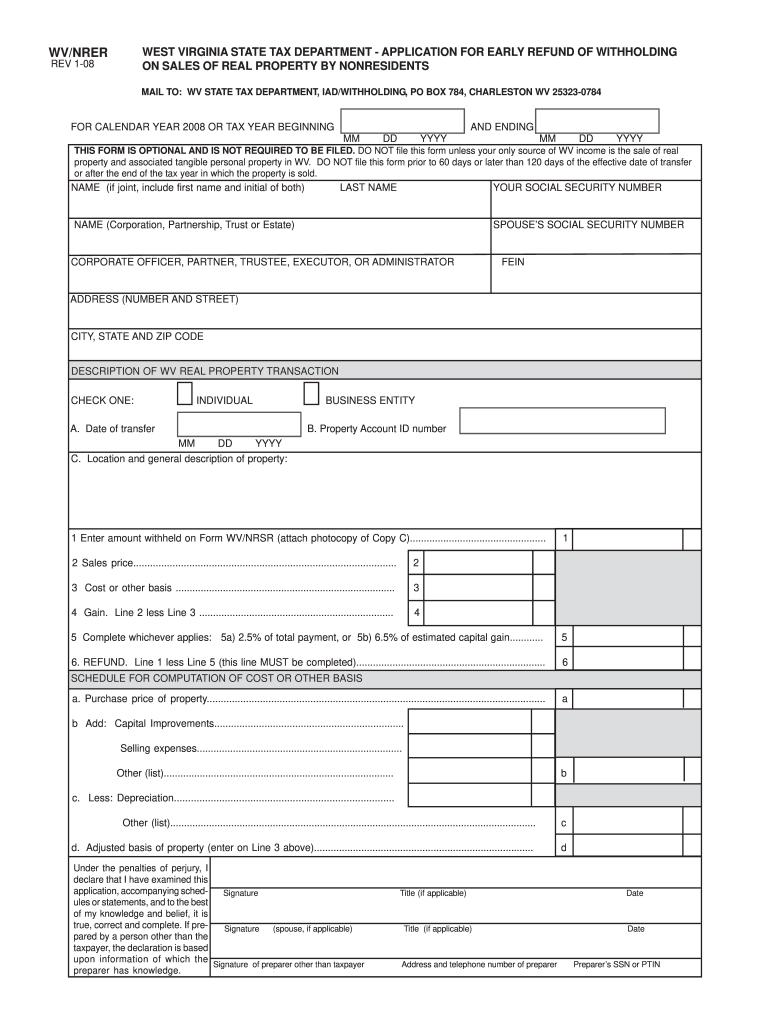

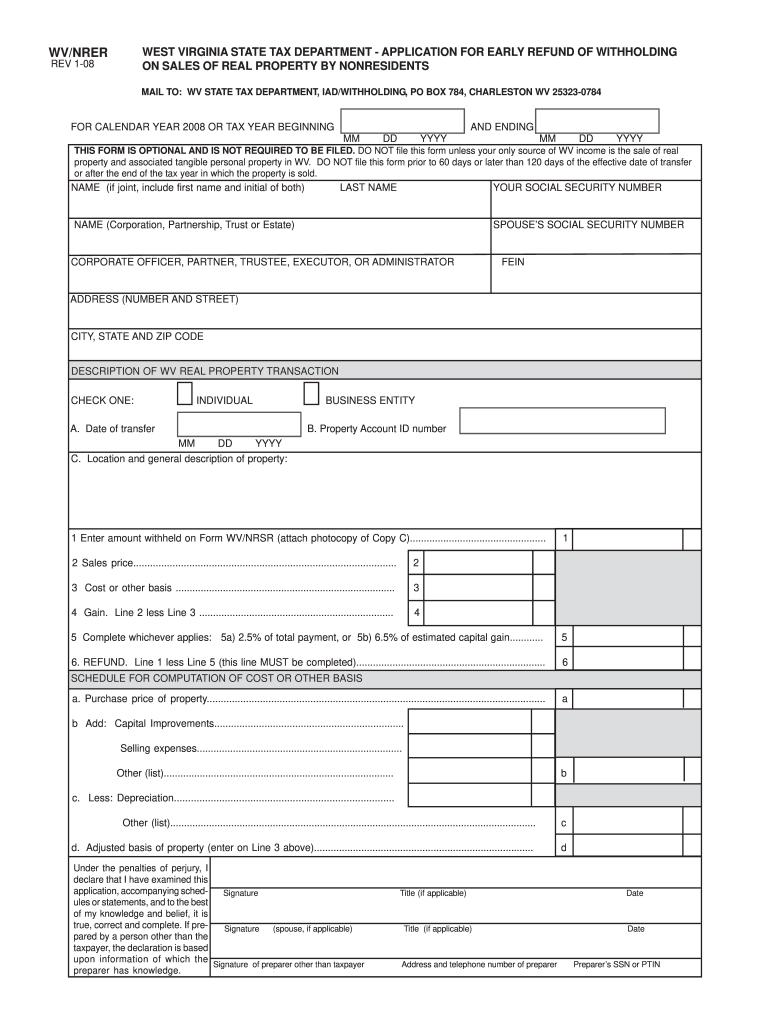

WEST VIRGINIA STATE TAX DEPARTMENT APPLICATION FOR EARLY REFUND OF WITHHOLDING ON SALES OF REAL PROPERTY BY NONRESIDENTS WV/NER REV 1-08 MAIL TO: WV STATE TAX DEPARTMENT, IAD/WITHHOLDING, PO BOX 784,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WV WVNRER

Edit your WV WVNRER form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WV WVNRER form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WV WVNRER online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WV WVNRER. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV WV/NRER Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WV WVNRER

How to fill out WV WV/NRER

01

Obtain the WV WV/NRER form from the appropriate agency or website.

02

Fill in your personal information at the top of the form, including name, address, and contact details.

03

Provide specific details regarding the employment or activity related to the request.

04

Complete any required sections regarding income or financial information.

05

Check all information for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form according to the instructions provided, either electronically or via mail.

Who needs WV WV/NRER?

01

Individuals applying for certain state benefits or assistance in West Virginia.

02

Those needing to report employment information for tax or legal purposes.

03

Residents who require documentation for verifications related to financial assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

How do you check if all my taxes were filed?

Check your federal tax return status Check your tax refund status using the IRS Where's My Refund tool. Sign in to view your IRS online account information. Call the IRS. Look for email or status updates from your e-filing website or software.

What is the WV income tax rate?

How does West Virginia's tax code compare? West Virginia has a graduated individual income tax, with rates ranging from 3.00 percent to 6.50 percent. There are also jurisdictions that collect local income taxes. West Virginia has a flat 6.50 percent corporate income tax rate and permits local gross receipts taxes.

What is the non resident withholding tax in West Virginia?

The withholding tax rate is 6.5% of distributions of West Virginia source income (whether actual or deemed distributions).

How can I check the status of my taxes online?

Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund.

How do I pay my West Virginia state taxes?

You can use the Pay Personal Income Tax link on the MyTaxes Website. website to begin remitting payments electronically using the ACH Debit method. Credit Cards – All major credit cards accepted. You can visit the Credit Card Payments page for more information.

Who must file a West Virginia income tax return?

If you are domiciled in West Virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to West Virginia.

Does West Virginia have a state withholding form?

Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages.

Does West Virginia tax retirement income?

West Virginia is tax-friendly toward retirees. Social Security income is partially taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 4.50%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WV WVNRER to be eSigned by others?

Once your WV WVNRER is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete WV WVNRER online?

pdfFiller has made it easy to fill out and sign WV WVNRER. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit WV WVNRER straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing WV WVNRER right away.

What is WV WV/NRER?

WV WV/NRER is a tax form used in West Virginia for reporting income earned by non-residents and certain specific types of income earned by residents.

Who is required to file WV WV/NRER?

Individuals who have income sourced from West Virginia but do not reside in the state are typically required to file the WV WV/NRER form.

How to fill out WV WV/NRER?

To fill out the WV WV/NRER, taxpayers must complete all required sections by providing their personal information, income details, and applicable deductions and credits.

What is the purpose of WV WV/NRER?

The purpose of the WV WV/NRER is to ensure that individuals who earn income from West Virginia sources pay the appropriate state taxes on that income.

What information must be reported on WV WV/NRER?

Taxpayers must report personal identification information, details of income earned in West Virginia, deductions, credits, and any other relevant financial information.

Fill out your WV WVNRER online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WV WVNRER is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.