Get the free Form 1099-LTC - treasurydirect

Show details

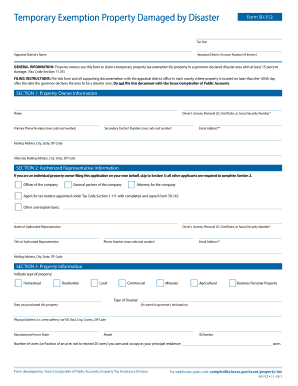

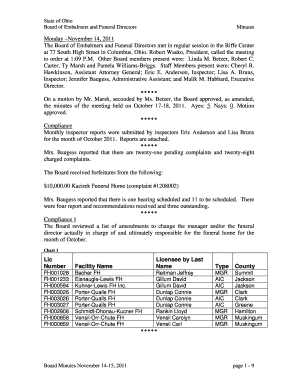

This document is used for reporting long-term care benefits and accelerated death benefits for tax purposes, requiring collection of personal and financial information from responsible entities.

We are not affiliated with any brand or entity on this form

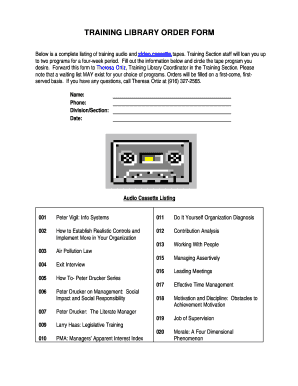

Get, Create, Make and Sign form 1099-ltc - treasurydirect

Edit your form 1099-ltc - treasurydirect form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1099-ltc - treasurydirect form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1099-ltc - treasurydirect online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 1099-ltc - treasurydirect. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1099-ltc - treasurydirect

How to fill out Form 1099-LTC

01

Obtain Form 1099-LTC from the IRS website or your tax professional.

02

Fill in the payer's details, including name, address, and taxpayer identification number (TIN).

03

Enter the recipient's details, including name, address, and TIN.

04

Report any long-term care benefits paid during the tax year in Box 1.

05

If there are any additional payments made for chronic illness, report them in Box 2.

06

Complete any other applicable boxes based on the specific payments and information.

07

Double-check all information for accuracy.

08

Submit Form 1099-LTC to the IRS by the deadline, and provide a copy to the recipient.

Who needs Form 1099-LTC?

01

Insurance companies or organizations that make payments under long-term care insurance policies.

02

Individuals who receive long-term care benefits exceeding $10 in a calendar year.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file taxes if I only have SSA-1099?

Generally, if Social Security benefits were your only income, your benefits are not taxable and you probably do not need to file a federal income tax return.

Are LTC benefits considered taxable income?

Generally, no. Tax-qualified Long-Term Care Insurance benefits come to you tax-free. Insurance companies that pay long-term care insurance benefits are required by the Internal Revenue Service (IRS) to provide claimants with a 1099 LTC.

Is my SSA-1099 taxable?

The taxable portion of Social Security benefits is never more than 85% of the net benefits the taxpayer received. In many cases, the taxable portion is less than 50%. If the taxpayer files a joint return, enter the amounts from each Form SSA-1099 and the software will compute the portion that is taxable, if any.

Do I have to report 1099-LTC on my tax return?

Do I need to report 1099-LTC on my tax return? Not necessarily. Whether or not you need to report these payments depends on the kind of benefit you received (actual costs or on a periodic basis) and how it was used.

Do I need to attach my SSA-1099 to my tax return?

When you mail a tax return you attach W-2's and 1099's that show tax withheld. If no tax was withheld from your SS, then you do not include it the SSA1099 with the Form 1040 that you are mailing.

How do I enter a 1099 LTC in Turbotax?

Go to Income, then scroll to the bottom of the section to find Less Common Income. Scroll down to Miscellaneous Income, 1099-A, 1099-C and click Start or Update. Scroll down to Long-term care account distributions (Form 1099-LTC) and click Start or Update.

What is a SSA 1099 in English?

The Social Security Benefit Statement is also known as the SSA-1099 or the SSA-1042S. It is a tax form we mail to you every January if you receive Social Security benefits.

Is a SSA-1099 the same as a W-2?

Key Takeaways. If you work as an employee, you'll receive a W-2 form from your employer that shows your tax information for the year, but if you're an independent contractor or own your own business, you'll receive 1099 forms from clients with your tax information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1099-LTC?

Form 1099-LTC is used to report payments received under a long-term care insurance contract or for accelerated death benefits.

Who is required to file Form 1099-LTC?

Insurers are required to file Form 1099-LTC if they make payments to an individual under a long-term care insurance contract or for accelerated death benefits that exceed a specified threshold.

How to fill out Form 1099-LTC?

To fill out Form 1099-LTC, provide the payer's information, recipient's information, and report the total amount of long-term care benefits paid during the year.

What is the purpose of Form 1099-LTC?

The purpose of Form 1099-LTC is to inform the IRS and recipients of long-term care benefits received during the tax year, allowing for proper tax reporting.

What information must be reported on Form 1099-LTC?

On Form 1099-LTC, you must report the total amount of long-term care benefits, the recipient's name, address, and taxpayer identification number, as well as the insurance company's information.

Fill out your form 1099-ltc - treasurydirect online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1099-Ltc - Treasurydirect is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.