Get the free APPLICATION FINANCIAL INSTITUTION BOND

Show details

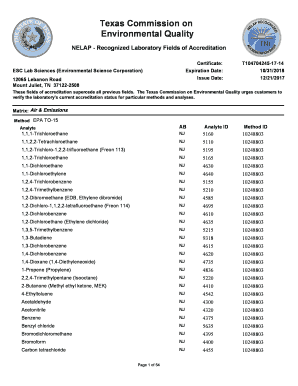

This application is for obtaining a financial institution bond, detailing the applicant's information, organizational practices, and financial statistics.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application financial institution bond

Edit your application financial institution bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application financial institution bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application financial institution bond online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application financial institution bond. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application financial institution bond

How to fill out APPLICATION FINANCIAL INSTITUTION BOND

01

Obtain the APPLICATION FINANCIAL INSTITUTION BOND form from the relevant regulatory authority or financial institution.

02

Read the instructions carefully before filling out the form to understand all requirements.

03

Fill in the applicant's name and contact information accurately at the top of the application.

04

Provide details of the financial institution including its name, address, and contact information.

05

Specify the type of bond required and the amount of coverage needed.

06

Include information about the business activities of the financial institution, specifying the nature of its operations.

07

Ensure all required signatures are obtained from authorized individuals within the institution.

08

Attach any necessary attachments or documents required by the specific regulatory authority.

09

Review the completed application for accuracy and completeness before submission.

10

Submit the application to the appropriate regulatory body either electronically or via mail, along with any required fees.

Who needs APPLICATION FINANCIAL INSTITUTION BOND?

01

Financial institutions such as banks, credit unions, and insurance companies that require surety bonds to operate legally.

02

Business owners seeking to prove their financial integrity and reliability to customers and clients.

03

Entities that are mandated by regulatory authorities to obtain a bond to secure compliance with legal and financial obligations.

Fill

form

: Try Risk Free

People Also Ask about

What are financial institution bonds?

Financial institution bond (FI bond) insurance, also known as a fidelity bond, is designed to help protect financial institutions against a variety of fraudulent risks, including losses from employee dishonesty, such as theft or forgery, as well as certain external perils.

What entities are eligible for financial institution bonds?

Financial Institution Bonds Provides coverage for financial institutions, such as banks, non-bank lenders, asset managers, and insurance companies.

What does financial institution mean on an application?

Definition: A financial institution is a company or nonprofit organization that provides financial services to customers and facilitates transactions between parties.

What is a bond financial institution?

Financial Institution Bonds Explained Financial institution bonds are a type of fidelity bonds. Their purpose is to protect your finance-related company against different illegal acts your employees may engage in on the job.

What is an institutional bond?

A: Institutional bonds are debt commitments that allow the University to make investments in large capital projects, similar to what private citizens do when they buy a home and take on a mortgage.

What is the difference between a financial institution bond and a crime policy?

Fidelity bonds specifically protect a business from losses caused by fraudulent acts committed by its employees. On the other hand, crime insurance offers broader protection against criminal activities, including those committed by employees, as well as third parties.

What is an application for bond?

A surety bond application is a form required by the surety carrier. It provides the basic information needed about the bond and the principal for the approval process. It also often serves as the legal contract between the surety carrier and the principal.

What is a financial institution bond?

Financial institution bond (FI bond) insurance, also known as a fidelity bond, is designed to help protect financial institutions against a variety of fraudulent risks, including losses from employee dishonesty, such as theft or forgery, as well as certain external perils.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FINANCIAL INSTITUTION BOND?

APPLICATION FINANCIAL INSTITUTION BOND is a type of surety bond required for financial institutions, serving as a guarantee of compliance with state regulations and protections for consumers.

Who is required to file APPLICATION FINANCIAL INSTITUTION BOND?

Financial institutions such as banks, credit unions, and other lenders are typically required to file an APPLICATION FINANCIAL INSTITUTION BOND to operate legally.

How to fill out APPLICATION FINANCIAL INSTITUTION BOND?

To fill out an APPLICATION FINANCIAL INSTITUTION BOND, applicants need to provide accurate information including their business name, physical address, type of financial services offered, and details of the bond itself such as the amount and duration.

What is the purpose of APPLICATION FINANCIAL INSTITUTION BOND?

The purpose of APPLICATION FINANCIAL INSTITUTION BOND is to protect consumers from potential misconduct or failure of the financial institution, ensuring that the institution adheres to regulatory requirements.

What information must be reported on APPLICATION FINANCIAL INSTITUTION BOND?

Information that must be reported includes the name and address of the licensee, the license or registration number, the amount of the bond, the effective date of the bond, and the surety company details.

Fill out your application financial institution bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Financial Institution Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.