Get the free Credit Limit Request Form With Client Reference

Show details

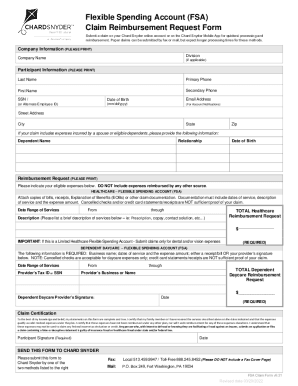

This document is used to apply for insurance coverage on new Buyers or Contractors, or to request an increase in coverage for existing Buyers or Contractors. It includes a declaration section for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit limit request form

Edit your credit limit request form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit limit request form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit limit request form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit limit request form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

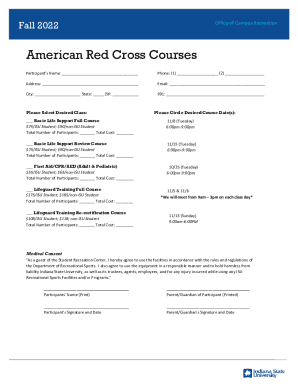

How to fill out credit limit request form

How to fill out Credit Limit Request Form With Client Reference

01

Obtain the Credit Limit Request Form from your company's financial department or website.

02

Fill in the client's name in the designated field.

03

Enter the client's account number accurately.

04

Specify the requested credit limit amount.

05

Provide any necessary justification for the requested limit increase.

06

Include the client's contact information for verification purposes.

07

Complete the form by signing and dating it in the appropriate section.

08

Submit the completed form to the finance or credit department for review.

Who needs Credit Limit Request Form With Client Reference?

01

Sales representatives who are seeking to establish or increase credit limits for their clients.

02

Financial analysts responsible for managing client accounts and credit risk.

03

Clients who wish to request a higher credit limit for their purchases or services.

Fill

form

: Try Risk Free

People Also Ask about

What is the credit application form?

A credit application is an application filed by a prospective borrower and submitted to a credit lender. A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises.

How do I write a letter requesting a credit limit increase?

A credit limit is the highest amount that a lender will allow you to borrow from a single line of revolving credit. Receiving a credit limit increase can lower your credit utilization rate, which could positively impact your credit scores.

Who fills out the credit application form?

As the name indicates, a credit application form is a form that is filled out and completed by a business or a person who wants to apply for a line of credit with a lending institution.

Why do I need to fill out a credit application?

A credit application helps prevent delinquent payments and financial loss. An accurate and up-to-date credit application is one of the best ways to minimize risk. The application also allows the company to better implement their credit policy. Prevent Bad Debt Write-Offs.

How to fill out a credit reference request?

A customer credit application form is a document that businesses and organizations use to apply for credit. It gathers important information about the applicant's financial history, creditworthiness, and ability to repay the borrowed funds.

What is a credit application for a customer?

A credit application is essential for assessing the creditworthiness of potential customers or clients, mitigating risk, establishing credit terms, and ensuring responsible lending practices. It helps businesses make informed decisions about extending credit and managing cash flow effectively.

What is a customer credit application form?

It is our view that a credit limit increase will greatly contribute to the continued success and growth of [YOUR COMPANY NAME]. Throughout our relationship with your esteemed institution, we have consistently made prompt payments, maintained an excellent credit rating, and adhered to all our credit terms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Limit Request Form With Client Reference?

The Credit Limit Request Form With Client Reference is a document used to request an increase in the credit limit extended to a client, allowing them to make larger purchases or transactions.

Who is required to file Credit Limit Request Form With Client Reference?

Typically, the form is required to be filed by businesses or individuals seeking to increase their credit limit with a financial institution or supplier.

How to fill out Credit Limit Request Form With Client Reference?

To fill out the form, provide accurate client details, current credit limit, desired credit limit, reason for the request, and any supporting financial information.

What is the purpose of Credit Limit Request Form With Client Reference?

The purpose of the form is to formally document and facilitate the review process for credit limit adjustments based on the client's financial standing and needs.

What information must be reported on Credit Limit Request Form With Client Reference?

The form must report client identification details, current credit situation, requested credit limit, justification for the increase, and any relevant financial information.

Fill out your credit limit request form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Limit Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.