Get the free Fiduciary Liability Coverage Application

Show details

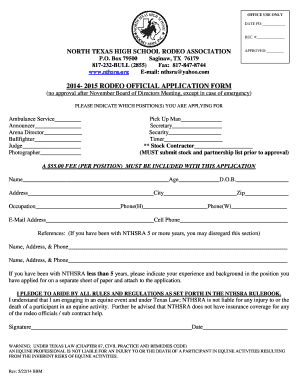

This document serves as an application for fiduciary liability coverage, detailing the applicant's organizational and financial information, plan data, and prior claims for insurance underwriting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiduciary liability coverage application

Edit your fiduciary liability coverage application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiduciary liability coverage application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiduciary liability coverage application online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fiduciary liability coverage application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiduciary liability coverage application

How to fill out Fiduciary Liability Coverage Application

01

Begin by providing your organization's legal name and address.

02

List the names and titles of all fiduciaries managing the plan.

03

Include details about the employee benefit plans for which coverage is sought.

04

Disclose any prior claims or litigation related to fiduciary responsibilities.

05

Indicate whether there have been any changes to the fiduciaries or the plan.

06

Complete the financial information section regarding the plan's size and funding.

07

Review all sections for accuracy and completeness.

08

Sign and date the application.

Who needs Fiduciary Liability Coverage Application?

01

Any organization that offers employee benefit plans, such as retirement or health plans.

02

Fiduciaries managing retirement plans, health plans, and other employee benefit programs.

03

Non-profit organizations, corporations, and governmental entities with employee benefit plans.

04

Companies looking to protect themselves from potential litigation related to their fiduciary duties.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a fidelity bond and fiduciary insurance?

An ERISA fidelity bond is required by law to cover plan losses as a result of fraud. Fiduciary liability insurance is not required, but it may be a good idea to help protect plan fiduciaries. The Department of Labor (DOL), under ERISA Sec.

What is fiduciary liability coverage?

As you may be aware, Employee Retirement Income Security Act (ERISA) fidelity bonds and fiduciary liability insurance are not the same. Both serve to mitigate risk for fiduciaries, and are critical aspects of an employee benefits plan. The difference between the two lies in the risks that they cover.

What is another name for fidelity bond insurance?

In addition to being referred to as a fidelity bond, Employee Dishonesty Insurance is sometimes also referred to as: Financial Institution Bond. Commercial Crime Policy.

Is liability insurance the same as a bond?

Both surety bonds and liability insurance are critical tools for managing risk and ensuring financial stability. While surety bonds guarantee that your business will meet its contractual obligations, liability insurance protects it from the unpredictable nature of accidents, lawsuits, and claims.

What is another name for fiduciary liability insurance?

Fiduciary liability insurance (and management liability insurance) is targeted at protecting businesses' and employers' assets against fiduciary-related claims of mismanagement of a company's employee benefit plans. It is not required by the Employee Retirement Income Security Act (ERISA) or any federal statute.

How much does fiduciary liability insurance cost?

A fiduciary insurance policy protects employers and their plan fiduciaries from fiduciary-related claims for the alleged mismanagement of plan assets or failure to follow ERISA rules in the control or management of plan assets and payment of benefits. The coverage is not required but is highly recommended.

Is fiduciary liability coverage the same as a fidelity bond?

What does fiduciary liability insurance cost? Fiduciary liability insurance costs vary by company size, plan assets and more. Most companies can get a fiduciary liability plan for $500 to $2,500 per year, with up to $10 million in coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fiduciary Liability Coverage Application?

A Fiduciary Liability Coverage Application is a document used by organizations seeking insurance coverage to protect themselves against claims arising from fiduciary responsibilities related to employee benefit plans.

Who is required to file Fiduciary Liability Coverage Application?

Typically, organizations that manage employee benefit plans, such as pension plans or health insurance plans, and wish to obtain fiduciary liability insurance are required to file this application.

How to fill out Fiduciary Liability Coverage Application?

To fill out the application, an organization should provide information about its fiduciary responsibilities, employee benefit plans, any past claims or lawsuits, and the governance structure of the organization.

What is the purpose of Fiduciary Liability Coverage Application?

The purpose of the application is to provide insurers with the necessary information to assess the risk and determine the appropriate coverage and premiums for fiduciary liability insurance.

What information must be reported on Fiduciary Liability Coverage Application?

The application typically requires information such as the types of employee benefit plans managed, the number of employees covered, details of plan fiduciaries, historical claims data, and any litigation history related to fiduciary responsibilities.

Fill out your fiduciary liability coverage application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiduciary Liability Coverage Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.