Get the free Acceptance of Student Loans - medschool vcu

Show details

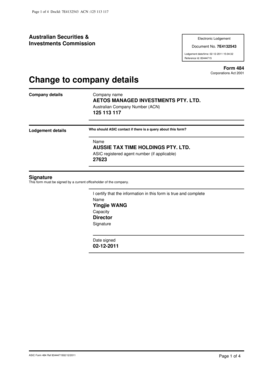

A form for students to indicate the amount of federal student loans they wish to accept for the academic year, including guidelines on loan eligibility and reporting external scholarships.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign acceptance of student loans

Edit your acceptance of student loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your acceptance of student loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit acceptance of student loans online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit acceptance of student loans. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out acceptance of student loans

How to fill out Acceptance of Student Loans

01

Start by collecting all necessary personal information, including your name, address, social security number, and school details.

02

Review the loan amounts you are being offered and ensure they align with your financial needs.

03

Read through the terms and conditions of the student loans to fully understand your commitments.

04

Sign the acceptance form, indicating which loans you wish to accept or reject.

05

Provide your signature and date on the document where required.

06

Submit the completed acceptance form to your school's financial aid office by the specified deadline.

Who needs Acceptance of Student Loans?

01

Students who have been approved for federal or private student loans to help finance their education.

02

Individuals who are enrolled or planning to enroll in a college or university and require financial assistance.

03

Students who have received a financial aid package that includes student loans as part of their funding.

Fill

form

: Try Risk Free

People Also Ask about

When taking out student loans What is the signed agreement?

A Master Promissory Note (MPN) is an agreement between you and the government to repay your debt. You agree to only use loan funds for authorized academic expenses when you sign an MPN.

How does MPN work?

The most probable number (MPN) is a statistical method used to estimate the viable numbers of bacteria in a sample by inoculating broth in 10-fold dilutions and is based on the principle of extinction dilution. It is often used in estimating bacterial cells in water and food.

Does signing an MPN mean anything?

The Master Promissory Note (MPN) is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your loan(s).

Does signing the MPN mean you are accepting the loan?

Qualifying for federal student loans is often easier because they don't require a credit check. Each lender sets its own eligibility requirements, but private student loans usually require borrowers have a credit score of 670 or better, earn a minimum income and enroll in a minimum number of credit hours.

Do parents who make $120000 still qualify for FAFSA?

Any money left over is paid to you directly for other education expenses. If you get your loan money, but then you realize that you don't need the money after all, you may cancel all or part of your loan within 120 days of receiving it and no interest or fees will be charged.

Does a promissory note mean you got the loan?

A promissory note is a legally binding document in which the borrower agrees to repay the loan and any accrued interest and fees. The document also explains the terms and conditions of the loan. A signed, valid promissory note must be signed before loan funds can be disbursed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Acceptance of Student Loans?

Acceptance of Student Loans refers to the process where students acknowledge and accept the terms and conditions of the loans they are awarded for their education expenses.

Who is required to file Acceptance of Student Loans?

Students who have been awarded federal or private student loans must file an Acceptance of Student Loans to formally accept the funds for their education.

How to fill out Acceptance of Student Loans?

To fill out Acceptance of Student Loans, students typically need to complete a provided form by their school, which includes entering personal information, selecting the loan amount they wish to accept, and signing to confirm acceptance.

What is the purpose of Acceptance of Student Loans?

The purpose of Acceptance of Student Loans is to ensure that students are aware of and agree to the loan terms, including repayment obligations and interest rates, before receiving the funds.

What information must be reported on Acceptance of Student Loans?

Information that must be reported includes the student’s name, ID number, loan amounts accepted, loan types, and any conditions or terms associated with the loans.

Fill out your acceptance of student loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Acceptance Of Student Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.