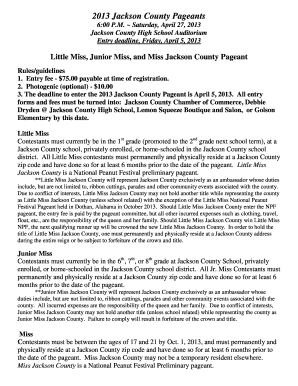

Get the free Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form - nyc

Show details

This form allows participants of the New York City Deferred Compensation Plan to elect the Deferral Acceleration for Retirement (DAR) provision, enabling increased contributions before retirement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred compensation 457 plan

Edit your deferred compensation 457 plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred compensation 457 plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

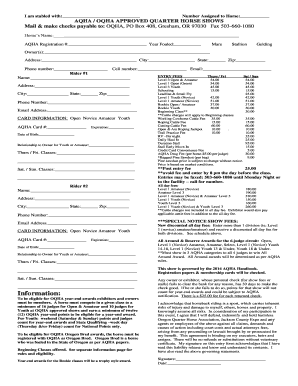

How to edit deferred compensation 457 plan online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit deferred compensation 457 plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred compensation 457 plan

How to fill out Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form

01

Obtain the Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form from your employer's HR department or the official website.

02

Review the instructions provided with the form carefully to understand the requirements and implications.

03

Fill out your personal information in the designated fields, including your name, employee ID, and contact details.

04

Specify the amount you wish to defer and the timeframe of the deferral.

05

Indicate the reason for the acceleration request, making sure to provide any necessary supporting documentation.

06

Review the form for accuracy and completeness.

07

Sign and date the form to certify that all provided information is true and accurate.

08

Submit the completed form to your HR department or the designated plan administrator by the specified deadline.

Who needs Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form?

01

Employees who are participating in a Deferred Compensation 457 Plan and are considering accelerating their deferral for retirement.

02

Individuals who are planning their retirement finances and need to adjust their deferral amounts.

Fill

form

: Try Risk Free

People Also Ask about

At what age can you withdraw from a 457 deferred compensation plan?

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

Do I need to report 457 on my taxes?

Therefore, annual deferrals under a ' 457(b) plan are not subject to income tax withholding at the time of the deferral. However, a participant's annual deferrals during the taxable year under a ' 457(b) plan are reported on Form W-2, Wage and Tax Statement, in the manner described in the instructions to that form.

How does a 457 deferred compensation plan work?

Cons of 457(b) plans: Fewer investing options than 401(k)s (Not as common today) Only available to certain employees employed by state or local governments or qualifying nonprofits. Employer contributions count toward the annual limit. Non-governmental 457(b) plans are riskier.

What is deferred compensation on an IRS transcript?

An eligible deferred compensation plan under IRC Section 457(b) is an agreement or arrangement (which may be an individual employment agreement) under which the payment of compensation is deferred (whether by salary reduction or by nonelective employer contribution).

What is a 457 deferred compensation retirement plan?

The CalPERS 457 Plan is a voluntary deferred retirement savings plan that allows you to defer any amount, subject to annual limits, from your paycheck on a pre-tax and/or Roth after-tax basis. Roth contributions, and their earnings, can benefit from the power of tax-deferred compounding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form?

The Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form is a document used by employees participating in a 457 deferred compensation plan to request an acceleration of their deferred compensation payments, typically to be received before retirement.

Who is required to file Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form?

Employees who are enrolled in a Deferred Compensation 457 Plan and who wish to accelerate their deferral payouts before reaching retirement age are required to file the Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form.

How to fill out Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form?

To fill out the DAR Form, one needs to provide personal details such as name and employee ID, specify the amount of deferred compensation to be accelerated, select the timing for the distribution, and sign the form. It's important to review the instructions provided with the form for detailed guidance.

What is the purpose of Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form?

The purpose of the DAR Form is to allow eligible participants in a 457 deferred compensation plan to request an earlier distribution of their deferred benefits, enabling them to access their funds sooner under specific circumstances.

What information must be reported on Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form?

The information that must be reported on the DAR Form includes the participant's name, employee ID, amount of deferred compensation being requested for acceleration, the proposed date for the distribution, and any necessary signatures.

Fill out your deferred compensation 457 plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Compensation 457 Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.