Get the free Rules of the Neighborhood Revitalization Tax Credit Program - nj

Show details

This document outlines the regulations governing the Neighborhood Revitalization Tax Credit Program designed to foster the revitalization of low and moderate-income neighborhoods in New Jersey through

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rules of form neighborhood

Edit your rules of form neighborhood form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rules of form neighborhood form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rules of form neighborhood online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rules of form neighborhood. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

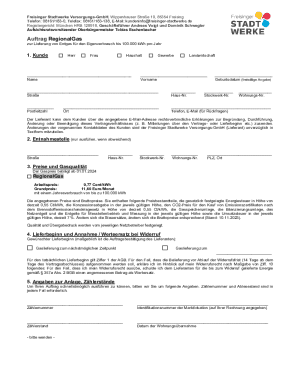

How to fill out rules of form neighborhood

How to fill out Rules of the Neighborhood Revitalization Tax Credit Program

01

Obtain the application form for the Neighborhood Revitalization Tax Credit Program from the relevant authority or website.

02

Read the guidelines carefully to understand eligibility criteria and requirements.

03

Fill in your personal information accurately, including your name, address, and contact details.

04

Provide a detailed description of your project and its intended impact on neighborhood revitalization.

05

List the specific expenses you are claiming for the tax credit, ensuring they meet program guidelines.

06

Gather and attach any necessary documentation that supports your application, such as invoices or project plans.

07

Review your application for completeness and accuracy before submitting.

08

Submit the completed application by the deadline specified in the program guidelines.

Who needs Rules of the Neighborhood Revitalization Tax Credit Program?

01

Individuals or businesses looking to invest in neighborhood revitalization projects.

02

Non-profit organizations involved in community development.

03

Local governments seeking to encourage development in designated areas.

Fill

form

: Try Risk Free

People Also Ask about

What is the $1500 tax credit in NJ?

Homeowners with household incomes below $150,000 will receive a $1,500 property tax rebate, and homeowners with a household income between $150,000 and $250,000 will receive a $1,000 rebate.

How much is the new homeowner tax credit?

The First-Time Homebuyer Tax Credit Act is a bill that gives eligible first-time home buyers up to $15,000 in federal income tax credits. The bill was first introduced in the 117th Congress (2021-2022) and then again in the 118th Congress (2023-2024).

How much does the low income housing tax credit cost?

An LIHTC housing project must rent to tenants whose average income is below the area's median income, and this commitment must be maintained for a period of 15 years. The tax credit costs the U.S. government an estimated $13.5 billion every year.

What is the neighborhood revitalization tax credit program in New Jersey?

The Neighborhood Revitalization Tax Credit Program (NRTC) is designed to foster the revitalization of New Jersey's distressed neighborhoods. NRTC offers business entities a 100 percent tax credit against various New Jersey state taxes.

What is the New Jersey Rd tax credit?

Qualified Research Activities Generally all of the federal rules and methods for the federal corporate in- come tax R&D Credit apply when computing the New Jersey R&D Cred- it. However, the New Jersey credit is fixed at 10%. The expenses are for research in New Jersey.

What is the revitalization tax credit in Prince George's County?

Revitalization Tax Credits are designed to encourage revitalization in existing communities. The county offers eligible projects relief from taxes on any incremental value that they add as a result of making certain real property improvements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rules of the Neighborhood Revitalization Tax Credit Program?

The Rules of the Neighborhood Revitalization Tax Credit Program provide guidelines for the administration and application of tax credits aimed at promoting the revitalization of designated neighborhoods through various improvements and enhancements.

Who is required to file Rules of the Neighborhood Revitalization Tax Credit Program?

Entities or individuals who are applying for tax credits under the Neighborhood Revitalization Tax Credit Program must file the relevant forms as specified in the program rules. This typically includes developers, property owners, and organizations involved in revitalization projects within eligible areas.

How to fill out Rules of the Neighborhood Revitalization Tax Credit Program?

To fill out the Rules of the Neighborhood Revitalization Tax Credit Program, applicants must complete the designated forms by providing necessary project details, financial information, and relevant supporting documentation as outlined in the instructions accompanying the forms.

What is the purpose of Rules of the Neighborhood Revitalization Tax Credit Program?

The purpose of the Rules of the Neighborhood Revitalization Tax Credit Program is to incentivize economic development and community improvement in underdeveloped or distressed neighborhoods by providing tax credits to qualifying projects that enhance the area's overall quality of life.

What information must be reported on Rules of the Neighborhood Revitalization Tax Credit Program?

Applicants must report information including the nature of the project, total development costs, anticipated benefits, project timelines, and compliance with eligibility criteria defined by the program. Additional financial documentation may also be required.

Fill out your rules of form neighborhood online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rules Of Form Neighborhood is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.