Get the free Manufacturing Machinery and Equipment Exemption Claim - waterfordct

Show details

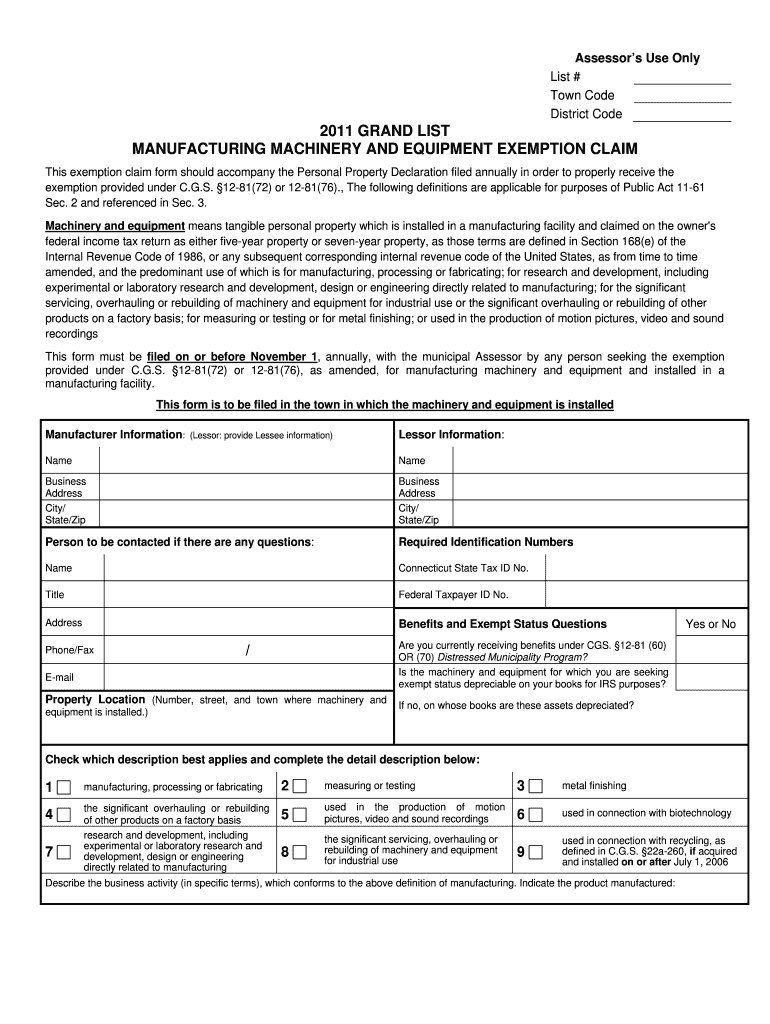

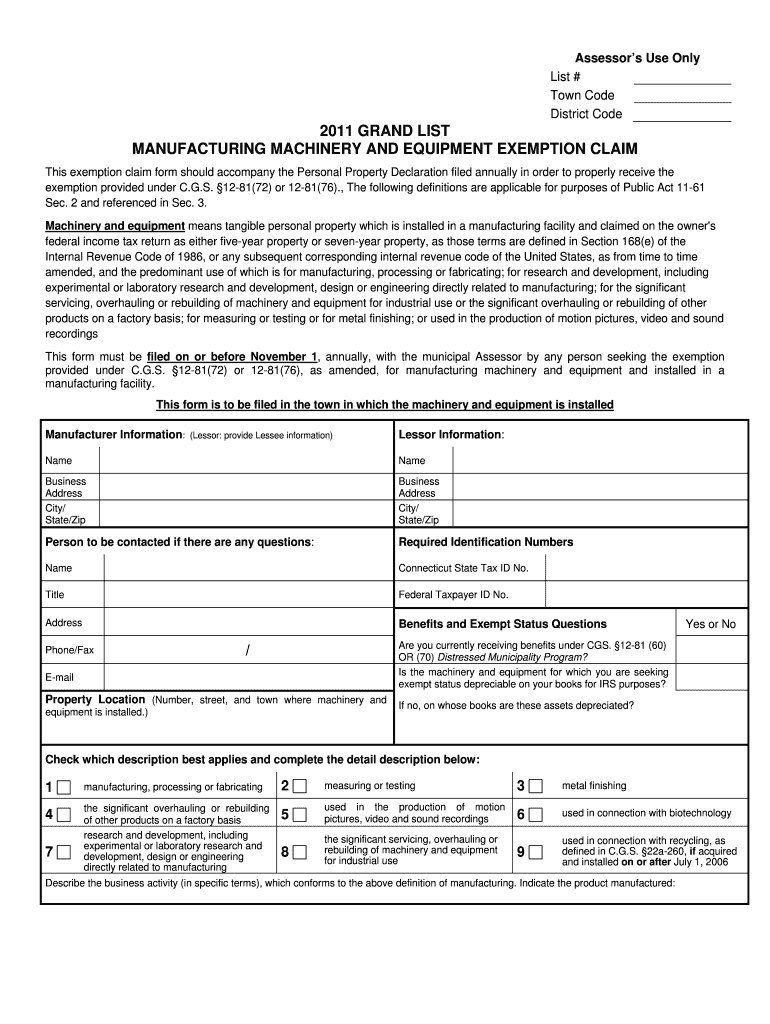

Este formulario de reclamación de exención debe acompañar la Declaración de Propiedades Personales presentada anualmente para recibir apropiadamente la exención proporcionada bajo C.G.S. §12-81(72)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manufacturing machinery and equipment

Edit your manufacturing machinery and equipment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manufacturing machinery and equipment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing manufacturing machinery and equipment online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit manufacturing machinery and equipment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

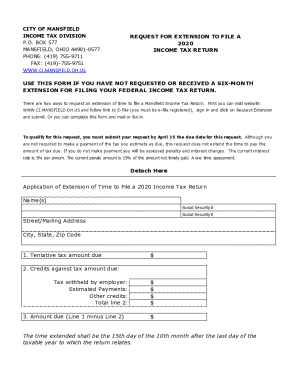

How to fill out manufacturing machinery and equipment

How to fill out Manufacturing Machinery and Equipment Exemption Claim

01

Gather necessary documentation, such as proof of purchase, invoices, and equipment specifications.

02

Complete the exemption claim form by providing your business information, including name, address, and tax identification number.

03

Clearly identify the machinery and equipment eligible for the exemption by listing each item along with its purpose and date of purchase.

04

Include any applicable supporting documents that prove the machinery and equipment are used in manufacturing processes.

05

Review the form for accuracy and ensure all required fields are filled out.

06

Submit the completed exemption claim to the appropriate tax authority by the specified deadline.

Who needs Manufacturing Machinery and Equipment Exemption Claim?

01

Businesses engaged in manufacturing processes that purchase machinery and equipment.

02

Manufacturers looking to reduce their tax burden through exemptions on specific equipment purchases.

03

Companies that meet state or local criteria for manufacturing exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Are tools for a business tax exempt?

For a tool to qualify as tax-deductible, the IRS states it must be ordinary and necessary for your business. "Ordinary" signifies that the expense is common and widely accepted in your industry, while "necessary" implies that the expense is helpful and appropriate for your trade or profession.

Is software subject to sales tax in NY?

New York broadly taxes the sale of computers and prewritten software as the sale of tangible personal property. 1 This is the case regardless of how the purchaser receives the software. For example, through a disk, electronic transmission, or remote access.

Is manufacturing equipment exempt from sales tax in California?

California is home to many innovative businesses and organizations that create jobs and contribute to the state's economy. A partial sales and use tax exemption allows certain manufacturers, researchers, and developers to pay a lower sales or use tax rate on qualifying equipment purchases and leases.

Is software taxable in TX?

In Texas, software is considered tangible personal property (TPP) for sales tax purposes and thus is subject to tax. Software means basic operating software and application software delivered electronically or via a tangible medium.

Is business equipment tax exempt?

Where use tax is concerned, manufacturers purchase many items used in making goods. Consumables, raw materials, machinery, and equipment are generally exempt, but not all states have equivalent laws on the books.

What are examples of tax exempts?

Charitable organizations. Churches and religious organizations. Private foundations. Political organizations. Other nonprofits.

Is software used in manufacturing tax exempt?

Manufacturing Exemption Typically, for software to be included in the exemption, it must control machinery used in the manufacturing process and not just provide reporting.

Is manufacturing equipment tax exempt in Minnesota?

To claim the exemption, give your vendor a completed Form ST3, Certificate of Exemption. Specify the Capital equipment exemption. To qualify for the exemption, the equipment must be used for one of the following: To manufacture, fabricate, mine, or refine products that are ultimately sold at retail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Manufacturing Machinery and Equipment Exemption Claim?

Manufacturing Machinery and Equipment Exemption Claim is a request made by manufacturers to exempt certain machinery and equipment from sales tax, recognizing that these items are essential for the manufacturing process.

Who is required to file Manufacturing Machinery and Equipment Exemption Claim?

Manufacturers who purchase machinery and equipment that qualify for exemption from sales tax are required to file the Manufacturing Machinery and Equipment Exemption Claim.

How to fill out Manufacturing Machinery and Equipment Exemption Claim?

To fill out the Manufacturing Machinery and Equipment Exemption Claim, one must provide details such as the specific machinery and equipment being claimed, the business information, and any relevant purchase records to substantiate the claim.

What is the purpose of Manufacturing Machinery and Equipment Exemption Claim?

The purpose of the Manufacturing Machinery and Equipment Exemption Claim is to provide tax relief for manufacturers, thereby encouraging investment in manufacturing operations and fostering economic growth.

What information must be reported on Manufacturing Machinery and Equipment Exemption Claim?

Information that must be reported includes the type and description of the machinery and equipment, the purchase date, the cost of the items, and the manufacturer's details, including their tax identification number.

Fill out your manufacturing machinery and equipment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manufacturing Machinery And Equipment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.