Get the free 26 U.S.C. §42 -- FEDERAL LOW INCOME HOUSING TAX CREDIT PROGRAM NEW JERSEY -- 2003 CO...

Show details

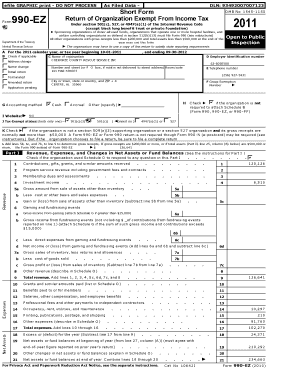

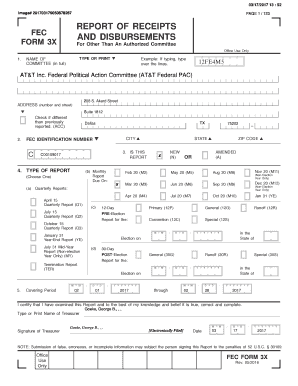

This document outlines the rankings and allocations for the Federal Low Income Housing Tax Credit Program in New Jersey, detailing various housing projects, their sponsors, units, financial requests,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 26 usc 42

Edit your 26 usc 42 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 26 usc 42 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 26 usc 42 online

To use the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 26 usc 42. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 26 usc 42

How to fill out 26 U.S.C. §42 -- FEDERAL LOW INCOME HOUSING TAX CREDIT PROGRAM NEW JERSEY -- 2003 COMPETITIVE CYCLES

01

Gather all necessary documentation related to the property, including ownership, financing, and development plans.

02

Review the eligibility requirements for the Federal Low Income Housing Tax Credit (LIHTC) under 26 U.S.C. §42 to ensure compliance.

03

Complete IRS Form 8586, which is the form specifically for claiming the LIHTC.

04

Prepare a comprehensive low-income housing plan outlining the target population and rent structure.

05

Submit all documentation, including the completed Form 8586 and your housing plan, to the New Jersey Housing and Mortgage Finance Agency.

06

Ensure timely submission before the application deadline for the 2003 competitive cycle.

07

Follow up with the agency for any necessary additional information or clarifications.

08

Once approved, maintain compliance with program regulations throughout the tax credit period.

Who needs 26 U.S.C. §42 -- FEDERAL LOW INCOME HOUSING TAX CREDIT PROGRAM NEW JERSEY -- 2003 COMPETITIVE CYCLES?

01

Developers or builders of affordable housing projects seeking financial incentives.

02

Non-profit organizations focused on providing low-income housing solutions.

03

Investors interested in tax benefits associated with low-income housing investments.

04

State and local governments looking to increase the availability of affordable housing.

05

Low-income families needing affordable rental housing options.

Fill

form

: Try Risk Free

People Also Ask about

What is Section 42 tax credit compliance?

What is Compliance? Compliance means that you fit all the guidelines necessary to live in a Section 42 apartment. Who determines the maximum income levels? Income levels are determined by the Department of Housing and Urban Development (HUD) for each county or metropolitan statistical area.

What are the benefits of section 42?

In Section 42 housing, rent isn't based on your income but is set at an affordable level for people in the area. Even if your income increases, your rent stays unchanged during your lease. This stability is a significant benefit for tenants who might otherwise face rent increases in non-subsidized housing.

What is Section 42 of the income tax?

Section 42 of the Income Tax Act 58 of 1962 (Act) deals with asset-for-share transactions. It provides roll-over relief for persons wishing to transfer assets to a company in exchange for an issue of shares. But how many shares must the transferee company issue in exchange for an asset or assets?

How does section 42 work in Minnesota?

Renters living in Low Income Housing Tax Credit (LIHTC - Section 42) units pay a fixed rent amount. The rent amounts are often similar to other market rate units in the area. However, the LIHTC buildings often have much nicer amenities than market rate units renting for a similar price.

What is the 50% test for low-income housing tax credit?

The test is to verify that 50% or more of the tax-exempt bond proceeds are used to finance the aggregate basis of any building and the land on which the building is located. Failure to meet the 50% Test is catastrophic to a low-income housing tax credit project.

What is the 26 US Code 42?

26 U.S. Code § 42 - Low-income housing credit. the qualified basis of each qualified low-income building. in the case of any building to which subsection (h)(4)(B) applies, the month in which the tax-exempt obligations are issued.

What is Section 42 of the low income tax credit?

2085 (1986 Act) created the low-income housing credit under § 42 of the Code. Section 42(a) provides that the amount of the low-income housing credit for any taxable year in the credit period is an amount equal to the applicable percentage of the qualified basis of each qualified low-income building.

What is the section 42 of the low-income tax credit?

2085 (1986 Act) created the low-income housing credit under § 42 of the Code. Section 42(a) provides that the amount of the low-income housing credit for any taxable year in the credit period is an amount equal to the applicable percentage of the qualified basis of each qualified low-income building.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 26 U.S.C. §42 -- FEDERAL LOW INCOME HOUSING TAX CREDIT PROGRAM NEW JERSEY -- 2003 COMPETITIVE CYCLES?

26 U.S.C. §42 establishes the Federal Low Income Housing Tax Credit (LIHTC) Program, which incentivizes the development of affordable rental housing for low-income individuals in New Jersey and across the United States. The 2003 Competitive Cycles refer to the specific rounds or periods in which allocations of these tax credits were made available to developers in New Jersey.

Who is required to file 26 U.S.C. §42 -- FEDERAL LOW INCOME HOUSING TAX CREDIT PROGRAM NEW JERSEY -- 2003 COMPETITIVE CYCLES?

Developers and property owners seeking to obtain tax credits for the construction or rehabilitation of low-income housing properties in New Jersey are required to file under 26 U.S.C. §42. This includes those applying for credits during the 2003 Competitive Cycles.

How to fill out 26 U.S.C. §42 -- FEDERAL LOW INCOME HOUSING TAX CREDIT PROGRAM NEW JERSEY -- 2003 COMPETITIVE CYCLES?

To fill out the forms for 26 U.S.C. §42, applicants must prepare and submit a comprehensive application including project details, financial information, and evidence of compliance with federal and state requirements for low-income housing. Specific forms and guidance can be obtained from the New Jersey Housing and Mortgage Finance Agency.

What is the purpose of 26 U.S.C. §42 -- FEDERAL LOW INCOME HOUSING TAX CREDIT PROGRAM NEW JERSEY -- 2003 COMPETITIVE CYCLES?

The purpose of 26 U.S.C. §42 is to encourage the construction and rehabilitation of affordable housing for low-income individuals by providing federal tax credits to property owners and investors. The 2003 Competitive Cycles aimed to meet the increasing demand for affordable housing in New Jersey.

What information must be reported on 26 U.S.C. §42 -- FEDERAL LOW INCOME HOUSING TAX CREDIT PROGRAM NEW JERSEY -- 2003 COMPETITIVE CYCLES?

Applicants are required to report detailed information including property location, the number of units designated for low-income residents, rent calculations, compliance with income restrictions, and project financing. Ongoing compliance with report requirements during the credit period is also necessary.

Fill out your 26 usc 42 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

26 Usc 42 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.