Get the free 2008 HPD Low-Income Housing Tax Credit Application - nyc

Show details

This document outlines the documentation requirements for participants in the NYSERDA Multifamily Performance Program and Enterprise Green Communities program related to the Low-Income Housing Tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2008 hpd low-income housing

Edit your 2008 hpd low-income housing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2008 hpd low-income housing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2008 hpd low-income housing online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2008 hpd low-income housing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2008 hpd low-income housing

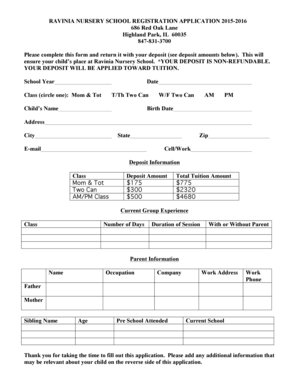

How to fill out 2008 HPD Low-Income Housing Tax Credit Application

01

Gather all necessary documentation, including proof of income, identification, and tax returns.

02

Download the 2008 HPD Low-Income Housing Tax Credit Application form from the official website.

03

Carefully read the instructions provided with the application form.

04

Fill out the applicant information section with accurate personal details.

05

Complete the income section by providing detailed information on all sources of income.

06

Fill out the housing information section to describe your current living situation.

07

Review and attach the required supporting documentation for income verification.

08

Sign and date the application form where indicated.

09

Make copies of the completed application and all documents for your records.

10

Submit the application via the specified method (mail or online submission) before the deadline.

Who needs 2008 HPD Low-Income Housing Tax Credit Application?

01

Low-income individuals or families seeking affordable housing options.

02

Developers or owners of rental properties looking to receive tax credits for creating low-income housing.

03

Investors interested in financing low-income housing projects.

Fill

form

: Try Risk Free

People Also Ask about

What is the NYS low income housing tax credit program?

SLIHC provides a dollar-for-dollar reduction in state taxes to investors in qualified low-income housing which meet the requirements of Article 2-A of the Public Housing Law.

What is the 50% test for low income housing tax credit?

The test is to verify that 50% or more of the tax-exempt bond proceeds are used to finance the aggregate basis of any building and the land on which the building is located. Failure to meet the 50% Test is catastrophic to a low-income housing tax credit project.

What is the limit for the low income housing tax credit?

Low-income tenants can be charged a maximum rent of 30% of the maximum eligible income, which is 60% of the area's median income adjusted for household size as determined by HUD. There are no limits on the rents that can be charged to tenants who are not low income but live in the same project.

What is the housing Assistance tax Act 2008?

The bill would provide a refundable tax credit that is equivalent to an interest-free loan equal to 10 percent of the purchase of a home (up to $7,500) by first-time home buyers. The provision applies to homes purchased on or after April 9, 2008 and before July 1, 2009.

What is the housing tax credit for 2008?

Homebuyers who purchased a home in 2008, 2009 or 2010 may be able to take advantage of the first-time homebuyer credit. An $8,000 tax credit is available to first-time homebuyers who purchase homes before May 1, 2010 (and close on the home by June 30, 2010).

What is the housing Assistance Act of 2008?

Housing Assistance Tax Act of 2008 Included a first-time home buyer refundable tax credit for purchases on or after April 9, 2008 and before July 1, 2009 equal to 10 percent of the purchase price of a principal residence, up to $7,500.

What did the Housing and Economic Recovery Act of 2008 do?

The Housing and Economic Recovery Act (HERA) of 2008 was a piece of financial reform legislation passed by Congress in response to the subprime mortgage crisis. HERA allowed the Federal Housing Administration (FHA) to guarantee up to $300 billion in new 30-year fixed-rate mortgages for subprime borrowers.

What is the housing Assistance tax Act of 2008?

The bill would provide a refundable tax credit that is equivalent to an interest-free loan equal to 10 percent of the purchase of a home (up to $7,500) by first-time home buyers. The provision applies to homes purchased on or after April 9, 2008 and before July 1, 2009.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

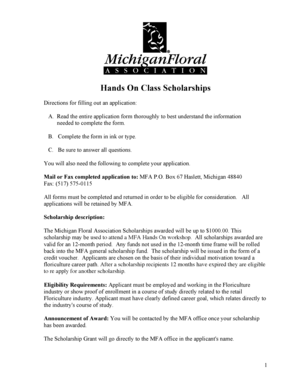

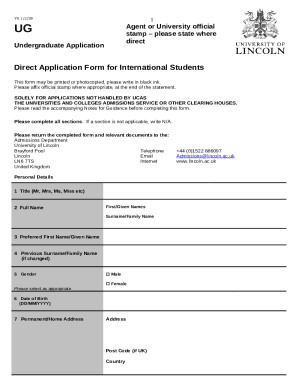

What is 2008 HPD Low-Income Housing Tax Credit Application?

The 2008 HPD Low-Income Housing Tax Credit Application is a form that developers and organizations use to apply for low-income housing tax credits provided by the New York City Department of Housing Preservation and Development (HPD) to incentivize the development of affordable rental housing.

Who is required to file 2008 HPD Low-Income Housing Tax Credit Application?

Entities such as developers, non-profit organizations, and other businesses seeking to obtain low-income housing tax credits for affordable housing projects are required to file the 2008 HPD Low-Income Housing Tax Credit Application.

How to fill out 2008 HPD Low-Income Housing Tax Credit Application?

To fill out the 2008 HPD Low-Income Housing Tax Credit Application, applicants must follow the instructions provided in the application guide, ensure all required documentation is included, accurately complete all sections regarding project details and financial projections, and submit it before the specified deadline.

What is the purpose of 2008 HPD Low-Income Housing Tax Credit Application?

The purpose of the 2008 HPD Low-Income Housing Tax Credit Application is to allocate tax credits to eligible developers who commit to creating and maintaining affordable housing for low-income individuals and families, ultimately increasing the availability of affordable housing in New York City.

What information must be reported on 2008 HPD Low-Income Housing Tax Credit Application?

The 2008 HPD Low-Income Housing Tax Credit Application requires reporting information such as the project name, location, the number of units, the financial details of the project, compliance plans for affordable housing obligations, and supporting documentation demonstrating the project's eligibility and feasibility.

Fill out your 2008 hpd low-income housing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2008 Hpd Low-Income Housing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.