Get the free First-Time Home Buyer Tax Credit Loan Program Term Sheet - nj

Show details

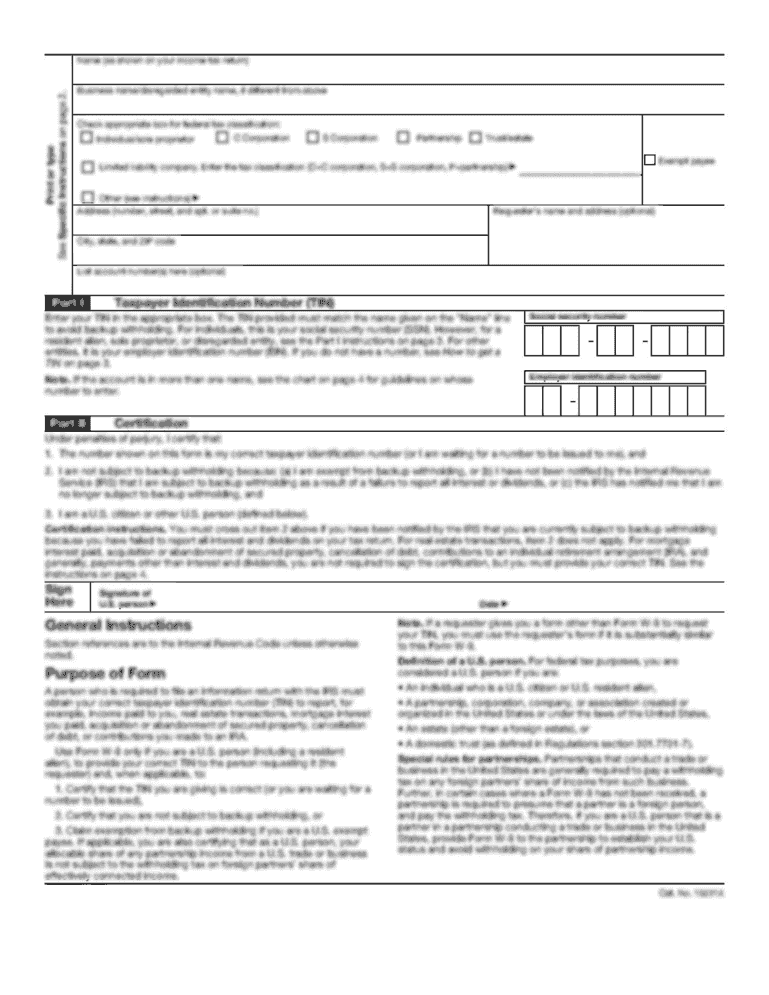

This document outlines the terms and eligibility requirements of the First-Time Home Buyer Tax Credit Loan Program (TCLP), which provides loans to first-time home buyers to cover down payment and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign first-time home buyer tax

Edit your first-time home buyer tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first-time home buyer tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit first-time home buyer tax online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit first-time home buyer tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out first-time home buyer tax

How to fill out First-Time Home Buyer Tax Credit Loan Program Term Sheet

01

Obtain the First-Time Home Buyer Tax Credit Loan Program Term Sheet from the relevant authority or website.

02

Review the eligibility criteria listed in the term sheet to ensure you qualify.

03

Fill out your personal details, including name, address, and other contact information in the designated sections.

04

Provide financial information such as your income, current debts, and employment history.

05

Detail the property you intend to purchase, including the address and sale price.

06

Include documentation that supports your financial claims, such as pay stubs, bank statements, and tax returns.

07

Review the completed term sheet for accuracy and completeness.

08

Submit the term sheet along with any required attachments as instructed in the guidelines.

Who needs First-Time Home Buyer Tax Credit Loan Program Term Sheet?

01

First-time home buyers looking to benefit from tax credits and financial assistance when purchasing a home.

02

Individuals who meet the specific criteria set forth by the program, aimed at promoting homeownership.

Fill

form

: Try Risk Free

People Also Ask about

What is the $8,000 homebuyer tax credit?

The $8000 IRS Tax Credit was part of the Housing and Economic Recovery Act of 2008 and was expanded under the American Recovery and Reinvestment Act of 2009. It provided first-time home buyers with a refundable tax credit of up to $8000, helping them offset the costs associated with purchasing a home.

Do you get a tax credit for a first time home buyer?

Tax Credit in General For first time homebuyers, there is a refundable credit equal to 10 percent of the purchase price up to a maximum of $8,000 ($4,000 if married filing separately).

What documents do I need to file taxes as a first time home buyer?

5 Documents You May Need to File Taxes as a Homeowner Form 1098: Mortgage Interest Statement. Property Tax Records. Settlement Statement (Closing Disclosure) Receipts for Energy-Efficient Improvements. HOA Dues and Records (If Applicable)

How do I qualify for first time homebuyer tax credit in the IRS?

What is the $15,000 First-Time Homebuyer Tax Credit? Must be a first-time home buyer. Must be using the first-time buyer tax credit for the first time. Must earn a modest income based on location and household size. Must purchase a modest home for the area. Must be 18 years of age or older.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is First-Time Home Buyer Tax Credit Loan Program Term Sheet?

The First-Time Home Buyer Tax Credit Loan Program Term Sheet outlines the terms and conditions under which first-time home buyers can apply for a tax credit loan, providing details about loan amounts, repayment options, and eligibility criteria.

Who is required to file First-Time Home Buyer Tax Credit Loan Program Term Sheet?

First-time home buyers who wish to take advantage of the tax credit are required to file the Term Sheet as part of their application process to ensure they meet the program's eligibility requirements.

How to fill out First-Time Home Buyer Tax Credit Loan Program Term Sheet?

To fill out the Term Sheet, applicants should provide accurate personal and financial information, including details about their new home purchase, income verification, and any other required documentation as specified by the program guidelines.

What is the purpose of First-Time Home Buyer Tax Credit Loan Program Term Sheet?

The purpose of the Term Sheet is to facilitate first-time home buyers in accessing tax credits that can alleviate the financial burden of home purchasing, thereby promoting homeownership.

What information must be reported on First-Time Home Buyer Tax Credit Loan Program Term Sheet?

The information that must be reported includes applicant personal information, income details, the purchase price of the home, loan amount requested, and any other relevant financial data required by the tax credit program.

Fill out your first-time home buyer tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

First-Time Home Buyer Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.