Get the free De Minimis Distribution Request Form

Show details

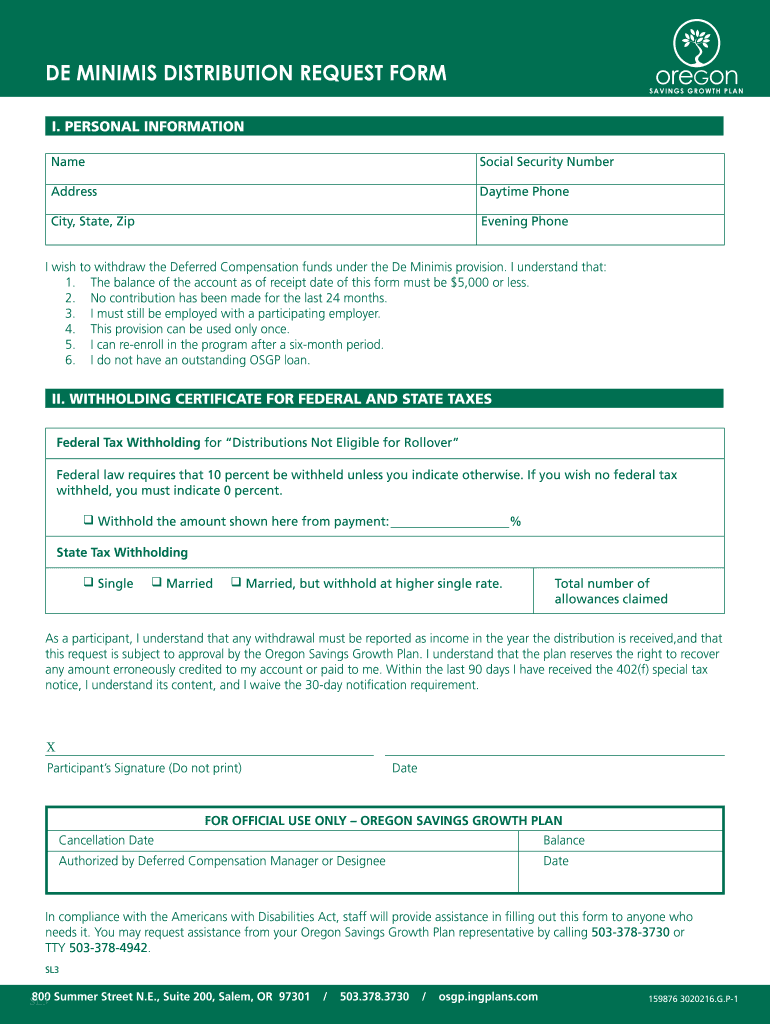

This form is used by participants to request withdrawal of Deferred Compensation funds under the De Minimis provision, along with certification of federal and state tax withholding preferences.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign de minimis distribution request

Edit your de minimis distribution request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de minimis distribution request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit de minimis distribution request online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit de minimis distribution request. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out de minimis distribution request

How to fill out De Minimis Distribution Request Form

01

Obtain the De Minimis Distribution Request Form from the appropriate financial institution or website.

02

Fill in your personal information, including name, address, and account number.

03

Indicate the reason for the distribution, such as financial hardship or other qualifying factors.

04

Specify the amount you wish to withdraw, ensuring it meets the de minimis threshold set by your plan.

05

Review any tax implications of the distribution and confirm your eligibility.

06

Sign and date the form to certify that the information is accurate.

07

Submit the completed form to your plan administrator or financial institution.

Who needs De Minimis Distribution Request Form?

01

Individuals with retirement accounts who qualify for a de minimis distribution due to a low account balance.

02

Participants in retirement plans that offer de minimis distributions for those meeting specific conditions.

Fill

form

: Try Risk Free

People Also Ask about

What does a de minimis distribution mean?

De Minimis Distribution. Internal Revenue Code (IRC) Section 411 permits plans to distribute vested account balances without the consent of. the participant if the total account balance at the time of distribution does not exceed the plan's automatic cash-out. threshold.

What is a de minimis 401a 401k forced plan distribution?

If your 401(k) or 403(b) balance has less than $1,000 vested in it when you leave, your former employer can cash out your account or roll it into an individual retirement account (IRA). This is known as a “de minimus” or “forced plan distribution” IRS rule.

Why does my 1099 say de minimis?

A transaction is de minimis if it can be determined with certainty that the total money, services, and property received or to be received is less than $600, as measured on the closing date.

What is a de minimis distribution?

De minimis means it's below the minimum threshold for tax reporting. Typically, interest, for example, won't be reported to the IRS on a 1099 if it's below $10. Fidelity is providing the de minimis 1099 for your reference, but they are not filing it with the IRS.

What does the IRS consider de minimis?

In general, a de minimis benefit is one for which, considering its value and the frequency with which it is provided, is so small as to make accounting for it unreasonable or impractical.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is De Minimis Distribution Request Form?

The De Minimis Distribution Request Form is a document used by plan participants to request a small distribution from their retirement plan that meets certain criteria, allowing them to receive funds without the usual tax implications.

Who is required to file De Minimis Distribution Request Form?

Participants in a retirement plan who have a small account balance, typically under a specified threshold (e.g., $5,000), and wish to withdraw their funds without a tax penalty may be required to file this form.

How to fill out De Minimis Distribution Request Form?

To fill out the De Minimis Distribution Request Form, participants should provide their personal information including name, account number, and contact details, select the reason for the request, and sign and date the form.

What is the purpose of De Minimis Distribution Request Form?

The purpose of the De Minimis Distribution Request Form is to facilitate the process for individuals to access small amounts of their retirement savings without incurring adverse tax consequences or penalties.

What information must be reported on De Minimis Distribution Request Form?

The information that must be reported on the De Minimis Distribution Request Form typically includes the participant's personal details, account balance, request for distribution amount, tax withholding preferences, and any required signatures.

Fill out your de minimis distribution request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De Minimis Distribution Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.